Getting steady and consistent business cash flow is not always a smooth journey. While it typically takes 30 to 45 days to convert inventory and other resources into cash flow from sales, there is no guarantee how long it will actually take.

There can be many ups and downs along the way – especially if there are seasonal sales patterns throughout the year.

This means that, quite often, companies find themselves struggling to cover operational expenses during slower periods, causing potential interruptions or issues with suppliers and partners. This is where a business operating line of credit can really bridge the gap, providing you with quick and easy access to funds when you need them the most.

In this article, we will discuss everything you need to know about getting a business operating line of credit, as well as taking the most out of it.

What is a Business Operating Line of Credit?

A business operating line of credit is a financial tool that allows companies to borrow funds up to a set limit, repay them, and borrow again as needed throughout the life of the line of credit.

Unlike traditional term loans, where a lump sum of money is provided upfront, lines of credit are revolving – meaning that the available balance replenishes as payments are made, allowing for flexibility in borrowing and repayment.

The main characteristics of a business line of credit include:

- Credit limit – the lender sets a maximum amount of funds that you can borrow at any given time. Depending on the lender, your business’ creditworthiness, and other factors, you can expect to get from a few thousand dollars to several million dollars.

- Interest – as opposed to traditional term loans, where you pay interest on the entire quantity of the loan, interest is only charged on the amount of money you’ve actually borrowed – and not on the entire credit line available.

- Repayment – you can make payments towards the borrowed amount from your business operating line of credit at any time, with minimum payment requirements often being interest-only or a small percentage of the principal.

- Draw period – this type of loan usually features a draw period during which you can access funds up to a certain limit, repay them, and then draw again as needed. This period can vary but often lasts for several years.

If you are looking to unlock the lowest rates and the highest amounts of business lines of credit, look no further than National Business Capital – with us, you can get a line amount from $100,000 up to $10 million, and get the funds as quickly as 24 hours.

What Are The Different Types of Operating Line of Credit?

If you are looking to get a business operating line of credit, it’s important to keep in mind that there are two main types that you can choose from – secured and unsecured lines of credit. Let’s take a look at some of their key differences:

Secured operating line of credit

- Collateral – requires collateral to secure the loan, such as real estate or inventory

- Interest rates – lower interest rates as risk is mitigated by the collateral

- Credit limits – can provide higher credit limits since the loan is backed by collateral

- Qualification criteria – generally easier to qualify for due to reduced risk

- Application process – may take longer due to the need to appraise the collateral

- Risks to borrower – carries the risk of losing the pledged assets upon defaulting

Unsecured operating line of credit

- Collateral – doesn’t require collateral to secure the loan

- Interest rates – higher interest rates due to higher risk for the lender

- Credit limits – associated with lower credit limits due to the lack of collateral

- Qualification criteria – requires a higher credit score since there is no collateral

- Application process – can be quicker and simple as there is no collateral appraisal

- Risks to borrower – no risk of losing collateral, but may have other financial consequences

Essentially, the difference between both types of business operating line of credit lies in the lack or presence of collateral to secure the loan. With a secured operating line of credit, the provision of collateral reduces the risk for the lender, which results in lower interest rates, higher credit limits, and less stringent qualification criteria.

With an unsecured operating line of credit, the lender doesn’t have the security of collateral in case you default on the loan, which is reflected in higher interest rates, lower credit limits, and other potentially less favorable terms.

What is a Business Operating Line of Credit Used For?

In addition to managing inconsistent cash flow, as we mentioned earlier, a business operating line of credit actually has a lot of different use cases, supporting businesses for a variety of operational purposes.

Some of them include:

• Inventory purchases

If you are expecting peak selling periods, you may want to use a business operating line of credit to buy inventory ahead of time so you can prepare for the high demand. This is especially true if your business is affected by seasonal fluctuations.

You can also take advantage of bulk buying discounts by purchasing larger quantities of inventory at lower prices. By doing this, you can reduce the Cost of Goods Sold (COGS), improving profit margins in the long run.

• Unexpected expenses

No matter how well your business is going, there always comes a point where you have to face unexpected expenses – such as emergency repairs or equipment breakdowns. A business operating line of credit provides a safety net to avoid disruptions.

This financial tool gives you instant access to capital during emergencies – since lines of credit are pre-approved, you don’t have to go through a new loan application process each time an emergency arises.

• Cash flow management

A business operating line of credit plays a pivotal role in effective cash flow management, ensuring that you are able to meet your obligations without financial strain.

It allows you to draw funds during lean periods to cover operating expenses (such as payroll and utilities), ensure working capital available to support day-to-day operations, and manage unpredictable expenses. It also helps you build a positive credit history.

• New projects

This financial tool also allows you to fund short-term projects, ensuring that you have the capital to take on new opportunities that require immediate funding – without the need to go through a lengthy loan application process each time.

• Bridging receivables gaps

As we mentioned earlier, a lot of businesses face receivable gaps between when a sale is made and when the payment is received – especially if you operate on credit terms with your customers.

Sometimes, these gaps can be longer than expected, which can put a financial strain on your company. A business operating line of credit provides you with the necessary liquidity to bridge the gap, avoiding interruptions while awaiting payments.

How Do I Qualify For a Business Operating Line of Credit?

In order to qualify for a business operating line of credit, you will have to meet certain criteria set by lenders. As we discussed earlier, this may vary depending on whether you are taking a secured or an unsecured line of credit.

Overall, most lenders’ criteria can be summed up into the following:

- Credit score – a personal credit score of 700 or more and a business credit score of 75 or above are generally considered good by most lenders. However, if you are applying for a secured line of credit, the collateral that you are providing can sometimes offset the credit score.

- Time in business – well-established businesses are more likely to qualify for a business operating line of credit. Usually, you will have to prove that you have been in operation for at least 1 or 2 years to ensure stability and reliability.

- Financial statements – be prepared to show all financial statements related to your current financial health and operational efficiency, from balance sheets and income statements to cash flow statements.

- Revenue and profitability – as a borrower, you will also have to prove that you have a consistent revenue stream and that your business is profitable. Some lenders have minimum revenue requirements, starting at annual revenues of $25k-$50k for smaller businesses, and up to a few million for larger companies.

- Debt-to-Income Ratio – a low debt-to-income (DTI) ratio demonstrates lenders that you can comfortably manage your existing debt obligations, along with the potential new credit line payments. While there is no universal standard, you should aim for a DTI of less than 50%.

- Collateral – if you are looking to qualify for a secured business operating line of credit, you will have to provide collateral. This can be in the form of real estate properties, inventory, equipment, accounts receivable, etc. Lenders will evaluate the value and liquidity of the collateral.

- Business plan – in addition, you may have to provide a solid and comprehensive business plan, as well as a financial forecast. This will help lenders understand your business model, the market, and how you plan to use and repay the credit.

Keep in mind that these requirements may vary by lender, so we highly recommend that you do your due diligence before applying.

Applying for a Business Operating Line of Credit

If you are planning to apply for a business operating line of credit, and you are ready to take the next step, look no further than National Business Capital. With a single application, you can get access to dozens of exclusive offers from our diverse lender platform so you can make the best decision for your business.

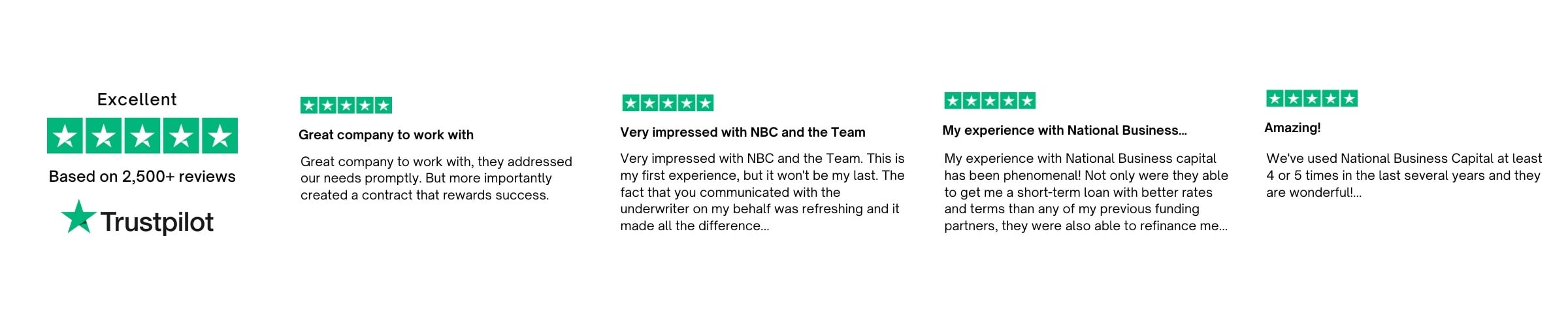

With $2+ billion financed since 2007, multiple awards, and an experienced team of Business Finance Advisors, we have everything you need to find the best financing options for your project.

Are you ready to get started? Apply here.

Frequently Asked Questions

Is it good to have a business operating line of credit and not use it?

Having a business operating line of credit and not using it can be strategically beneficial. It serves as a safety net for unexpected expenses or opportunities, ensuring financial flexibility without incurring interest until funds are drawn.

This readiness can enhance creditworthiness and provide peace of mind, allowing for swift response to business needs without the immediate cost of borrowing.

How much of a line of credit should I use?

It’s advisable to use less than 30-40% of your line of credit to maintain a healthy credit utilization ratio, which positively impacts your credit score. This approach ensures you have access to funds when needed while demonstrating responsible credit management.

Is it good to have a big operating line of credit?

Having a large operating line of credit can be advantageous, providing significant financial flexibility and security for handling unexpected expenses or capitalizing on opportunities.

However, it’s crucial to manage it wisely to avoid over-leverage and ensure the business can comfortably meet repayment obligations without straining its finances.

What happens if I default on the business operating line of credit?

Defaulting on a business operating line of credit can lead to serious consequences, including damage to your business’s credit score, legal action from the lender, and seizure of collateral if the line was secured.

It can also hinder your ability to secure future financing and may impact personal credit if you provided a personal guarantee.

How does a line of credit affect my credit score?

A line of credit can affect your credit score in several ways. Responsible use, like timely payments and maintaining low utilization, can improve your score. However, high utilization or missed payments can negatively impact it.

Can I renew or increase my business operating line of credit?

You can often renew or increase your business operating line of credit, subject to lender approval. This typically involves reviewing your business’s financial health, creditworthiness, and repayment history.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Phil Fernandes

Phil Fernandes serves as Chief Operating Officer for National Business Capital. He boasts 15 years of experience in sales and 10+ years of management experience as National’s VP of Financing/Analytics. Phil is also an excellent writer who's completed the Applied Business Analytics executive program at MIT and regularly contributes articles to National Business Capital’s blog.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.