Our monthly construction industry trend report combines the latest industry data with our internal findings from National Business Capital’s award-winning team. With extensive experience in the construction industry since 2007, we are thrilled to share these findings and expand on them through our unique expertise.

Our goal is to provide business leaders and decision-makers with the necessary information and data to make well-informed decisions in their business endeavors.

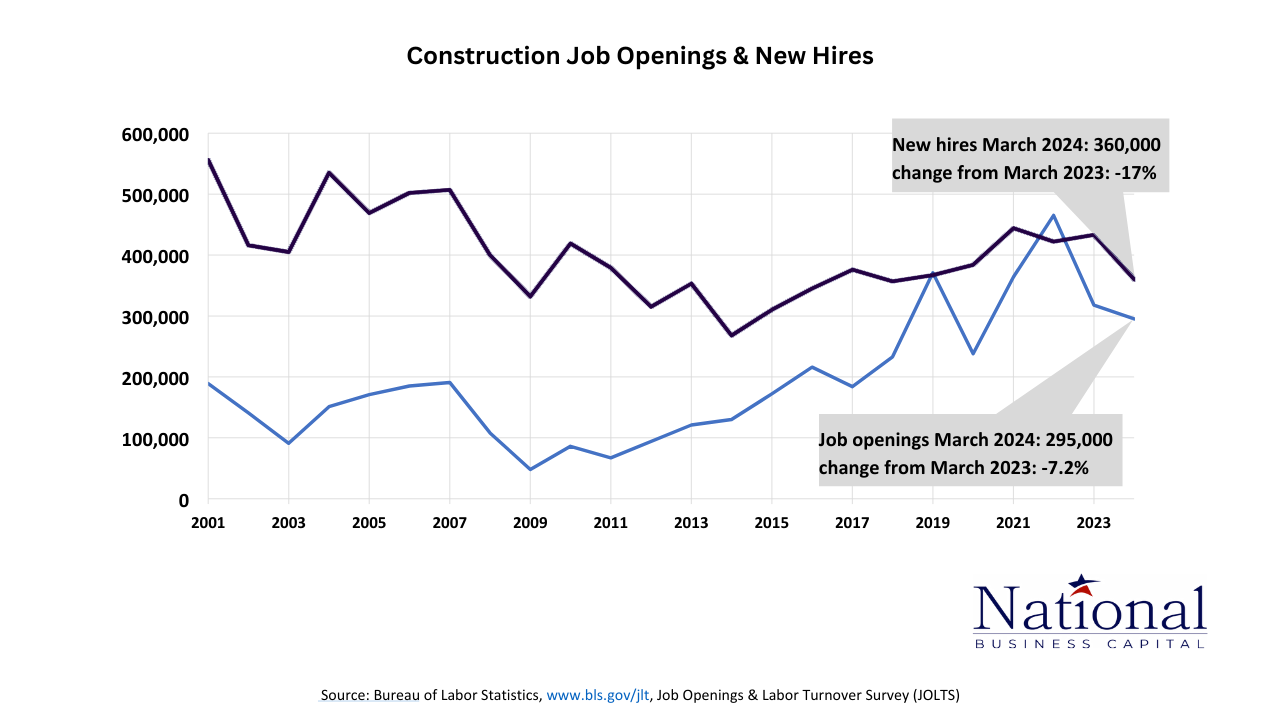

Construction Job Openings & New Hires

The relationship between construction job openings and new hires speaks to the industry’s operational capability.

May 2024 – Although the decline in hiring and job openings may suggest a contracting industry, looking at the data on a state level offers a bit more transparency.

| State | 1-Month Gain | 12-Month Gain |

| Florida | +0.1% | +3.5% |

| Michigan | +2.1% | +8.5% |

| New Jersey | +0.2% | +3.3% |

| Texas | +0.1% | +3.7% |

Source: AGC

The states that National Business Capital works most closely with in terms of volume have grown their employment from April to May, with more significant gains in employment seen in the 12-month average.

Some states, like California and Georgia, saw a 1.7% and 2.6% increase, respectively, in yearly hiring but more recently posted 1-month declines of -0.6% and -0.5%. This can be attributed to companies in the state having already filled their job openings, meaning they’re fully staffed for their 2024 workload.

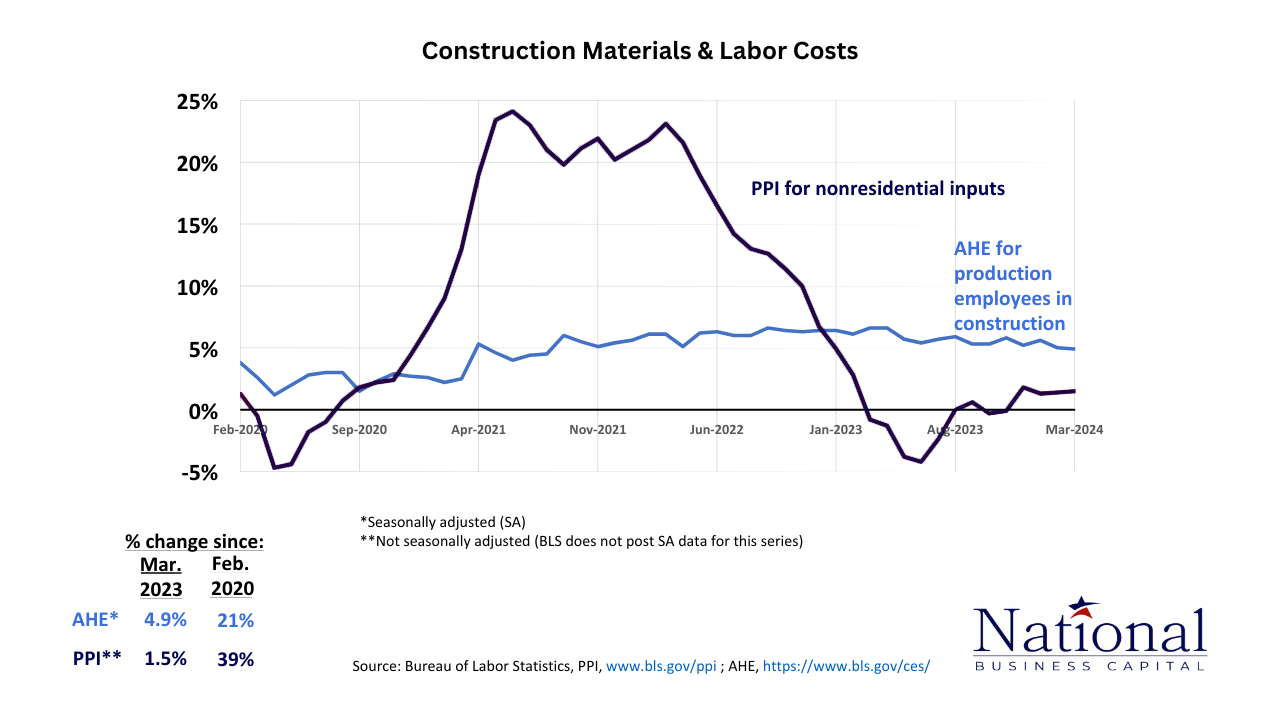

Construction Materials & Labor Costs

The producer price index (PPI) shows how the prices that domestic producers pay for their goods change over time, on average. Compared to the average hourly earnings (AHE), a representation of the average hourly wage for construction workers, you gain a birds-eye view of labor and material trends.

May 2024 – Last month’s trend continues. A slight upward trend in PPI highlights a rise in material costs, whereas a slightly downward trend in AHE foreshadows a rise in bid pricing in the near future.

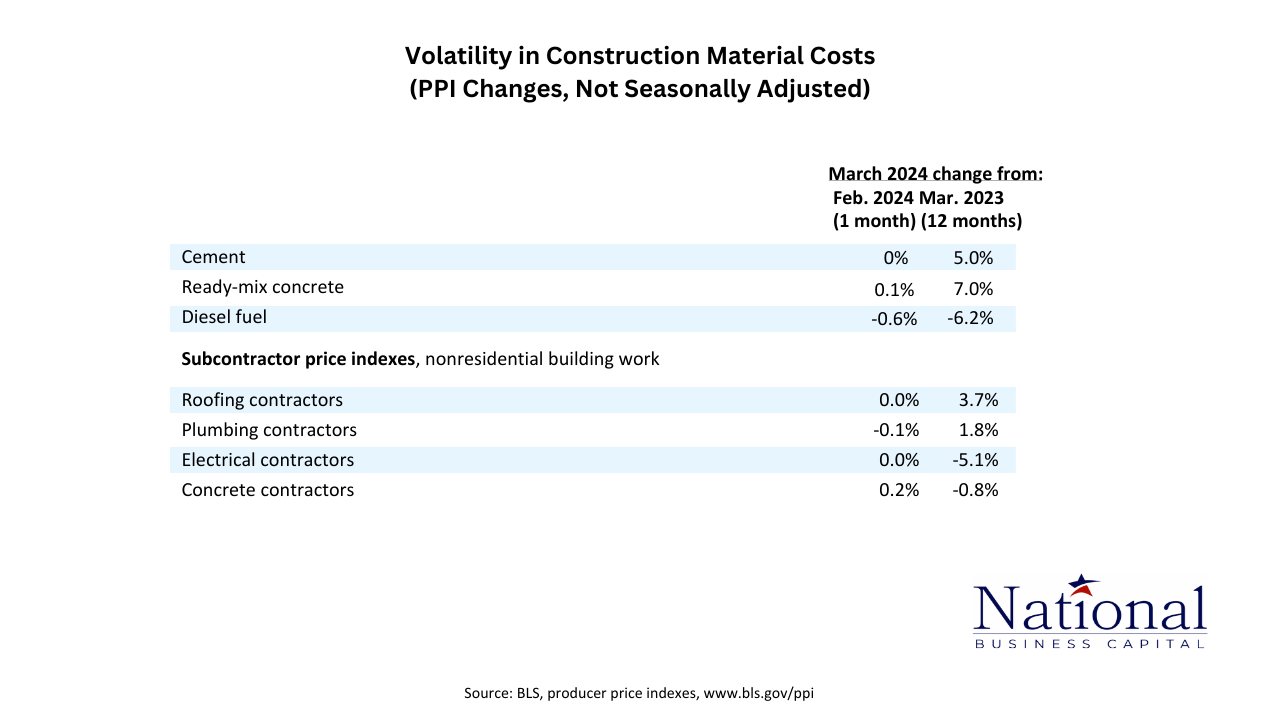

Volatility in Construction Material Costs (PPI Changes, Not Seasonally Adjusted)

Even minor fluctuations in material pricing have major implications for the construction industry. A lower cost of goods allows construction businesses to increase their ROI, whereas a higher cost of goods can erode profitability and, ultimately, deter growth and innovation.

May 2024 – Despite the overall upward trend in material costs, these 3 staples remain relatively constant month over month. However, a select few material costs are actually falling, mainly steel.

Material Cost Trends

| Material | % Price Change Since Jan 2024 |

| Iron and Steel Scrap | -11.9% |

| Steel Mill Products | -9.8% |

| Steel Pipe and Tube | -11.9% |

| Aluminum Mill Shapes | -4.4% |

| Fabricated Structural Metal (for Bridges) | -4.9% |

Source: AGC

Nippon Steel, Japan’s largest steelmaker, purchased U.S. Steel in a groundbreaking merger back in April 2024. Their move has caused ripples in the global market, which has likely influenced the price of steel.

Nonetheless, in a volatile market, it’s recommended that construction companies take advantage of this discount immediately, as similar prices may not be seen anytime soon.

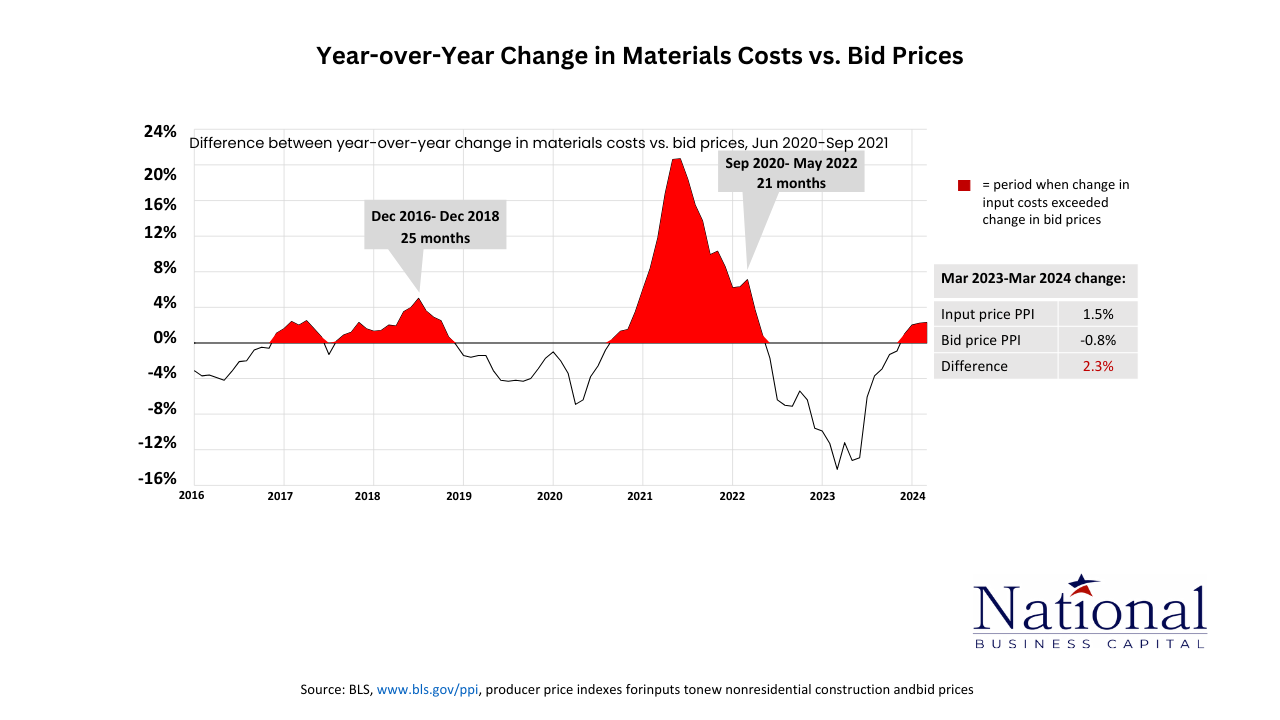

Year-over-Year Change in Materials Costs vs. Bid Prices

A “cost squeeze” occurs when the change in price of construction materials exceeds the change in bid prices. The higher price of materials “squeezes” the profitability of construction projects, which have already priced material costs into their bids.

May 2024 – Persistent inflation on key construction materials continues to challenge the industry. Construction companies must either include variable material pricing in their bids or establish a funding relationship to quickly access capital for these costs.

Similarly, it’s important for construction companies to seek the right amount of funds when applying for financing. Too little capital can leave companies strapped for cash midway through projects, whereas overborrowing can overwhelm the company financially.

At National Business Capital, our award-winning team excels at reaching the funding amount and terms that make the most sense for your operational needs.

National Business Capital’s Construction Recap (May 2024)

Each month, we’ll offer our unique viewpoint on the construction industry’s short to mid-term outlook. Our insights come from a combination of available industry statistics, internal data, and the general sentiment of the construction clients we work with daily.

- Funding Volume Increases 160% From April to May: As the northeast sheds the cold weather and joins the nation in gearing up for a busy summer season, National Business Capital’s team saw a 160% increase in funding volume from construction clients. Considering approval rates are higher than last year, it seems that construction companies are taking advantage of the opportunity to receive higher dollar amounts.

- Construction Companies Care Most About the “Amount of Funds”: National Business Capital’s application allows clients to select what’s “most important” to them: the speed, amount, or cost of their financing. From year to date, 43.8% of all construction companies applying for financing have selected that the funding amount is more important than the cost or speed of their financing.

- “Equipment” and “Expansion” Continue to Dominate Construction Companies’ Use of Funds: Another question on National Business Capital’s application concerns the intended use of funds for a client’s financing. Of all construction companies applying with National Business Capital since January 2024, 33.2% of them chose “expansion” or “equipment” as their intended use of funds.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Phil Fernandes

Phil Fernandes serves as Chief Operating Officer for National Business Capital. He boasts 15 years of experience in sales and 10+ years of management experience as National’s VP of Financing/Analytics. Phil is also an excellent writer who's completed the Applied Business Analytics executive program at MIT and regularly contributes articles to National Business Capital’s blog.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.