When a business seeks significant funding, large secured business loans often emerge as a viable option. These loans, secured by assets like real estate, equipment, or inventory, can provide substantial capital crucial for expansion, acquisition, or operational stability. However, the decision to take on such a loan should not be made lightly.

Business owners must understand the implications of using their assets as collateral, assess the long-term impact on their financial health, and navigate the terms that will shape their repayment schedule. This involves a deep dive into how different types of collateral can affect loan terms, the financial analysis needed to justify the debt, and the strategies to negotiate favorable conditions that support business growth without over-leveraging.

Continue reading for 3 key considerations for business owners seeking large secured business loans. If you’re ready to explore the options you qualify for, complete our easy application to get started with a Business Finance Advisor.

Understanding Collateral Requirements

Collateral acts as a safety net for lenders, giving them a fallback in case the borrower fails to meet the repayment terms. For borrowers, understanding the nuances of collateral requirements is important to secure the needed funds, protect their business assets, and ensure favorable loan conditions.

Definition of Collateral

Collateral refers to tangible or intangible assets that a borrower offers to secure a loan. Should the borrower default, the lender has the right to seize the collateral to recover the outstanding debt. This security allows lenders to offer larger sums of money, often at lower interest rates, compared to unsecured loans, which require robust financial qualifications to achieve higher funding amounts.

Types of Collateral

The most commonly accepted types of collateral include:

| Collateral Type | Description | Valuation Process |

| Real Estate | This includes commercial properties, land, office buildings, and sometimes residential properties owned by business owners. Lenders often prefer real estate due to its substantial value and relatively stable market.

Still, it’s important for borrowers to consider the potential impact of tying up real estate, especially if it’s integral to the operation or expansion of the business. |

Involves assessing the property’s current market value, location, condition, and potential for future value increase.

Appraisals are conducted by licensed professionals who consider recent sales of similar properties, revenue generation capabilities (for commercial properties), and overall market trends in the area. |

| Equipment | This can encompass a wide range of machinery, from manufacturing equipment to vehicles used for business operations. Lenders typically require a detailed list of the equipment, including purchase dates and conditions. | The value of machinery or vehicles is determined based on the current market value, age, wear and tear, and the remaining useful life of the equipment. Specialized equipment might require an industry expert’s valuation to accurately assess its worth and marketability.

Depreciation plays a significant role in equipment valuation, as most machinery loses value over time due to usage and technological advancements. |

| Inventory | For retail or manufacturing businesses, inventory, such as raw materials or finished goods, can be used as collateral. | Valuing inventory involves assessing the current wholesale value of the stock, its condition, and the speed at which it can be sold (liquidity). Inventory that is perishable or subject to rapid technological obsolescence can be riskier to use as collateral.

Lenders often apply a discount to the inventory’s value to account for these risks, which is known as the net orderly liquidation value. |

| Accounts Receivable | Unpaid invoices or sales agreements can serve as collateral, providing lenders with assurance based on pending payments due to the business.

Typically, only receivables due within 90 days are considered, and they may be discounted based on the lender’s assessment of their collectibility. |

Evaluated based on the age of the receivables, the creditworthiness of the debtors, and historical collection rates. Older receivables are typically discounted more heavily as the probability of collecting decreases over time.

Lenders may also consider the diversity of the receivables; a broad base of customers typically presents less risk than a concentration of large amounts due from a few customers. |

| Intellectual Property | For technology or creative businesses, intellectual property (IP) such as patents, copyrights, and trademarks can be used as collateral. | Valuing IP is complex and highly subjective, often requiring specialized valuation experts who can assess potential earnings from patents, trademarks, copyrights, or brand recognition.

Factors such as market potential, existing royalties, legal protections, and the competitive landscape are considered. |

| Future Cash Flows | For businesses with strong, predictable cash flow, projected earnings can be pledged as collateral. This is more common in industries with long-term contracts or stable revenue streams, such as service providers with recurring income. | Lenders will evaluate the reliability of these projections based on past performance, market conditions, and the company’s operational strength. |

Each type of collateral comes with its own set of risks and considerations. For instance, real estate typically maintains or appreciates in value, making it a strong choice for securing large loans. However, using crucial operational assets like machinery could risk business operations if the loan cannot be serviced as planned.

Risks Involved

While offering assets as collateral can unlock larger loan amounts and better rates, it also introduces significant risks:

- Asset Seizure: The most direct risk of using collateral to secure a loan is the possibility of asset seizure. If the business fails to meet the repayment terms, the lender has the legal right to seize the collateral assets. This can be particularly disruptive if the collateral includes critical operational assets or property essential to the business’s core functions. Losing such assets could cripple the business’s ability to operate and generate revenue.

- Depreciation: Assets such as equipment and vehicles are subject to depreciation over time. This depreciation can affect the loan-to-value ratio agreed upon at the initiation of the loan. If the value of the collateral decreases significantly, the lender may require additional collateral to secure the loan, putting further strain on the business’s resources.

- Market Volatility: Assets tied to market conditions, such as real estate and inventory, can fluctuate in value due to external economic factors beyond the control of the business owner. A downturn in the market could reduce the value of the collateral, potentially leading to a situation where the loan amount surpasses the value of the secured assets (underwater loan). This can complicate financial situations, especially if refinancing or renegotiating loan terms becomes necessary.

- Opportunity Cost: Using valuable assets as collateral can also mean missing out on other opportunities to use those assets beneficially. For instance, equipment used as collateral cannot be sold or leased to raise capital for other business initiatives, limiting the business’s agility and ability to capitalize on new opportunities.

- Legal and Administrative Costs: Securing a loan with collateral involves legal fees, appraisal costs, and other administrative expenses that can add up quickly. These costs need to be factored into the total cost of the loan to evaluate its true benefit and cost-effectiveness accurately.

- Credit Score Impact: If a business fails to repay the secured loan, not only does it risk losing the asset, but it also risks damaging its credit score. A lowered credit score can affect the business’s ability to secure future financing, negotiate favorable terms, or even impact relationships with suppliers and vendors.

Understanding these risks and preparing for them through careful financial planning and risk assessment is essential for any business considering a secured loan.

Assessing the Risk vs. Reward

When contemplating a large secured business loan, it’s crucial for business owners to conduct a thorough risk versus reward analysis. This evaluation not only helps in making an informed decision but also aligns financial strategies with the broader goals of the company. Understanding both the potential benefits and the risks involved can guide businesses in making prudent choices that enhance growth without jeopardizing financial stability.

• Financial Analysis

The first step in assessing risk versus reward is a detailed financial analysis. This involves reviewing the company’s current financial health, including cash flow statements, balance sheets, and profit and loss accounts. Business owners should calculate key financial ratios such as debt-to-equity, current ratio, and quick ratio to understand the financial leverage and liquidity position before taking on more debt. This analysis helps determine whether the business can comfortably manage the loan repayments without straining its financial resources.

• Cost-Benefit Consideration

Evaluating the cost versus the benefits of the loan involves analyzing the interest rates, fees, potential penalties, and the cost of securing the loan against the tangible benefits it will bring. Benefits could include the ability to expand operations, purchase essential equipment, or simply improve the business’s cash flow. The decision should factor in how the loan will generate additional revenue and whether those revenues will sufficiently cover the cost of the loan and contribute to profit.

• Default Risks

Understanding the implications of failing to meet the loan obligations is another crucial aspect. Defaulting on a secured loan can lead to severe consequences, including losing the collateralized assets. Business owners need to consider worst-case scenarios and evaluate the feasibility of loan repayment plans under different market conditions. They should also have contingency plans in place to handle unexpected financial downturns.

• Strategic Planning

Integrating the loan into the broader business strategy is vital. The loan should serve a clear purpose in supporting the business’s long-term objectives, whether it’s for expansion, restructuring, or as a bridge in financial operations. The planned use of the loan should be part of a well-thought-out business plan that projects future cash flows and growth stimulated by the investment of the loan proceeds.

Key Terms and Conditions of Secured Business Loans

Securing a large business loan is a significant commitment, and the devil often lies in the details of the terms and conditions. This segment is dedicated to dissecting these crucial components to help business leaders navigate their loan agreements with confidence and strategic insight.

1. Cost Components: Interest Rates and Fees

Every loan carries its price tag, primarily defined through interest rates and associated fees:

- Interest Rates: These could be fixed, offering predictability over payments, or variable, which might fluctuate based on market trends, affecting monthly payment amounts. Understanding the implications of these rates on long-term financial planning is essential for managing debt effectively.

- Fees: Comprehensive understanding is vital—ranging from origination fees, processing charges to penalties for early repayment. Such fees can significantly influence the total cost of the loan. Application fees, late payment fees, and other miscellaneous charges should also be considered as they can accumulate and impact the overall financial burden on the business.

2. Scheduling Payments: Repayment Terms Analysis

Aligning repayment terms with the company’s cash flow is crucial:

- Payment Schedules: Options might include regular monthly payments or more tailored plans like balloon payments or interest-only periods, which can offer breathing space for businesses expecting future revenue growth.

- Term Length: Longer loans can reduce monthly payments but increase the total interest paid over the life of the loan. It’s crucial to balance the repayment term with the company’s financial projections and cash flow capabilities to ensure sustainability.

3. Legal Boundaries: Understanding Obligations and Restrictions

Legal terms within loan agreements outline the borrower’s obligations and the lender’s rights:

- Covenants: These are conditions set by the lender that the borrower must adhere to, ranging from maintaining certain financial ratios to restrictions on further debt accrual. Violating these covenants can lead to severe penalties or the loan being called due immediately.

- Default Terms: These terms specify the conditions under which the lender can declare the loan in default and the consequences thereof, which could include seizing collateral. Understanding the triggers for default is critical to avoid unexpected financial complications.

4. Negotiation: Tailoring Terms to Fit Business Needs

There’s nothing wrong with pushing back on an offer to see if there’s room for improvement on terms, rates, etc.

- Flexible Terms: Businesses should negotiate terms that allow for financial flexibility, such as favorable prepayment conditions or adjustable repayment schedules, to adapt to changing financial circumstances.

- Collateral Leverage: Negotiating the type and amount of collateral required can also be crucial, especially if the business needs to preserve certain assets for operational continuity. Sometimes, offering additional collateral can result in more favorable loan terms, including lower interest rates or more lenient repayment schedules.

How Secured Loans Play Into Your Long-Term Business Objectives

The implications of secured loans extend far beyond the immediate financial relief. Financing of this caliber is instrumental in shaping a company’s future, influencing everything from daily operations to strategic growth.

Here are a few strategies to keep in mind when considering the long-term impact of your secured financing.

Aligning Loans with Business Objectives

The process of integrating large secured loans into a company’s financial strategy requires a clear understanding of both short-term needs and long-term goals:

- Capital Investment: Utilize loans to fund capital-intensive projects that have long-term payoff potentials, such as expanding production capacity or acquiring new technology.

- Strategic Acquisitions: Loans can facilitate mergers or acquisitions, allowing businesses to strategically position themselves within the market and expand their operational horizons.

- Sustainability Projects: Investing in sustainability projects can be advantageous, with secured loans providing the necessary capital to implement green technologies or processes that reduce costs and enhance brand reputation over time.

Debt Management Strategies

Effective debt management is crucial for maintaining financial health and leveraging secured loans to the company’s advantage:

- Debt Structuring: Consider structuring debt to match cash flow patterns. This might involve negotiating for seasonal payment schedules or longer amortization periods to ease cash flow during lean periods.

- Refinancing Opportunities: Keep an eye on refinancing opportunities that can lower interest rates or improve terms. This proactive approach can significantly reduce the cost burden and align debt obligations more closely with business growth cycles.

- Balance Sheet Management: Use strategic debt management to improve the balance sheet, potentially making the business more attractive to investors and other financial stakeholders.

Leveraging Loans for Growth and Expansion

Secured loans are often pivotal in supporting business scaling efforts:

- Infrastructure Development: Allocate funds from secured loans towards building or upgrading physical infrastructure to support expanded operations or to enter new markets.

- R&D Investment: Channel resources into research and development to innovate and stay competitive. Secured loans can provide the upfront cash needed to push through significant breakthroughs or product developments.

Maintaining Future Financial Health

Ensuring that the utilization of secured loans does not adversely affect the business in the future involves several strategic considerations:

- Regular Financial Reviews: Conduct regular reviews of financial status and loan impacts, adjusting strategies as necessary to avoid over-leveraging.

- Risk Management: Implement risk management practices to foresee and mitigate potential financial disruptions that could affect loan repayments.

- Growth Sustainability: Always assess the sustainability of growth funded through secured loans, ensuring it does not lead to volatile business cycles or financial strain.

Tools and Practices for Financial Health

Utilizing analytical tools and financial models can help in making informed decisions:

- Cash Flow Forecasting: Use advanced modeling techniques to forecast future cash flows and assess the impact of loan repayments on financial health.

- Performance Metrics: Monitor key performance indicators (KPIs) related to debt, such as debt-to-equity ratio and interest coverage ratio, to ensure they remain within healthy boundaries.

Explore Large Secured Business Loans with National Business Capital

Understanding the key considerations for securing large business loans – collateral specifics, balancing risks with rewards, and the intricacies of loan terms – sets the stage for effective financial management and risk protection. These elements are important for business owners looking to leverage loans to complement their cash flow and fuel growth.

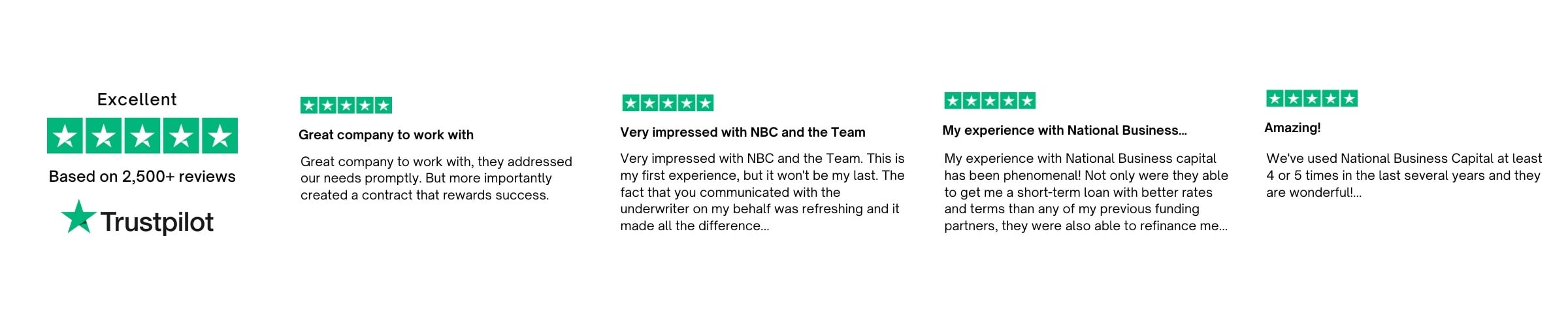

For those looking for the easiest, most convenient avenue to exploring the options their business qualifies for, consider National Business Capital and it’s award-winning team. With our streamlined, client-focused approach, you’re able to apply once, receive multiple options, and choose the offer that best fits your business goals.

Each client works with a dedicated Business Finance Advisor, who will guide them through the funding process, position their business in the best light, and serve as a point of contact for future capital needs. They become an extension of your team, so you’re always connected to the information and capital your business needs to succeed today and tomorrow.

We’re here whenever you’re ready. Complete our easy application to get started.

Frequently Asked Questions

What Qualifies as Collateral for a Large Secured Business Loan?

Collateral for a large secured business loan can include tangible and intangible assets. Common examples include commercial real estate, equipment, inventory, and accounts receivable. Lenders require that the collateral have sufficient value to cover the loan amount in case of default. It’s crucial to understand that the type of collateral accepted can vary significantly from one lender to another, and certain high-value assets, such as specialized machinery or intellectual property, might require specific appraisal processes.

How Is Collateral Valued in Secured Business Loans?

The valuation process for collateral involves an appraisal by certified professionals or a determination based on a percentage of the asset’s book value or fair market value. Lenders might use different methodologies depending on the type of collateral and the loan amount. For instance, real estate is typically appraised at current market value, whereas equipment might be valued at liquidation value or replacement cost.

What Are the Risks of Taking Out a Secured Business Loan?

The most significant risk is the possibility of losing the asset pledged as collateral if the loan is not repaid. If critical assets are lost, this could not only affect your business operations but also reduce your company’s financial flexibility. Furthermore, securing a loan with valuable assets might limit future borrowing options, as those assets cannot be used as collateral for other loans.

Can I Use Secured Business Loans for Any Business Purpose?

Generally, secured business loans offer more flexibility than unsecured loans and can be used for a variety of purposes, including working capital, expansion, purchasing equipment, or refinancing existing debts. However, some lenders might impose restrictions on the use of funds, especially if the loan is designed for specific purposes like equipment financing or real estate purchases. It’s important to discuss any potential restrictions with your lender before finalizing the loan.

What Should I Consider Before Applying for a Large Secured Business Loan?

Before applying, evaluate the necessity of the loan and the suitability of your proposed collateral. Consider the cost of borrowing, including interest rates and any associated fees. Assess the impact of the loan on your business’s cash flow and ensure you have a solid plan for repayment. Understanding the full terms and conditions of the loan, including any covenants imposed by the lender, is also crucial.

How Long Does It Take to Get Approved for a Secured Business Loan?

The approval time for a secured business loan can vary widely depending on the lender and the complexity of the loan application. It typically takes anywhere from a few days to several weeks. Factors that can influence the timeline include the valuation of collateral, completeness of the documentation provided, and the lender’s underwriting processes.

Are There Alternatives to Secured Business Loans If I Don’t Have Sufficient Collateral?

If you lack sufficient collateral, consider alternatives such as unsecured business loans, which rely on creditworthiness rather than collateral, or SBA loans, which offer favorable terms with lower collateral requirements. Another option might be seeking investors or exploring business lines of credit, which provide flexible access to funds without the need for specific collateral.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Phil Fernandes

Phil Fernandes serves as Chief Operating Officer for National Business Capital. He boasts 15 years of experience in sales and 10+ years of management experience as National’s VP of Financing/Analytics. Phil is also an excellent writer who's completed the Applied Business Analytics executive program at MIT and regularly contributes articles to National Business Capital’s blog.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.