A working capital line of credit can be a powerful financing tool for covering your short-term operational needs – from day-to-day expenses such as payroll, inventory purchases, and utilities, to seasonal sales cycles and periods of low cash flow.

However, a business line of credit is only effective if you know how to use it to your advantage. When mismanaged, it can lead to higher interest payments, increased cost of borrowing, negative credit reporting, and strained cash flow.

In this article, we will take a look at some of the best ways to manage a working capital line of credit in a way that actually supports your business growth. So, let’s take a look:

What Is a Working Capital Line of Credit?

Similar to a credit card, a working capital line of credit provides a revolving line of credit that you can draw from, repay, and draw from again, up to a specified credit limit. You can access the funds at any time and as needed, without having to reapply for a new loan each time.

This type of financing is great if you want to cover your short-term needs, such as:

- Smoothing out cash flow during slow sales periods

- Bridging the gap between paying suppliers and customer payments

- Covering recurring expenses such as rent, utilities, and wages

- Purchasing inventory in bulk to get discounts

- Funding urgent repairs or replacements of valuable equipment

- Entering new markets or launching new products

Just like a regular business line of credit, interest on a working capital line of credit is charged only on the amount of credit that you’ve actually used, and not on the entire credit limit. Payments are flexible, as they can be made based on your cash flow situation.

5 Tips for Managing a Working Capital Line of Credit

Now that the consequences of mismanaging a line of credit are clear, what are some tips to avoid mismanagement and leverage this excellent financial tool to your advantage?

As a highly experienced Specialty Finance Group, this is what National Business Capital recommends when it comes to managing your working capital line of credit successfully:

1. Monitor the use of your credit line regularly

When it comes to using a working capital line of credit, always pay close attention to how much you are drawing from the credit line. This way, you can avoid borrowing more than you can repay, which can otherwise lead to financial strain for your business.

Staying aware of your spending at all times is essential to ensure that you are only using the credit line for necessary expenses. Make sure to:

- Frequently check your transactions and credit line balance

- Maintain a detailed log of all withdrawals

- Set up notifications when your balance reach a certain threshold

In addition, make sure to maintain a healthy credit utilization ratio to avoid negatively impacting your credit score. Being conscious about your use of the working capital line of credit is key to managing it effectively, and making the most out of it.

2. Make a plan for repayment

Don’t improvise the payments of your working capital line of credit; instead of making them on the go, include them in your monthly budget.

Making a plan for repayment will not only help you maintain a strong financial discipline and ensure that you are always making your payments on time, but will also help you avoid fees and penalties.

We recommend that you calculate the monthly repayment required based on your outstanding balance and interest rate, and allocate the amount in your budget. Since you will be monitoring your expenses, you can always adjust the budget as needed.

In addition, treat the payments of your working capital line of credit as a priority expense, similar to payroll and rent – they should be paid before discretionary spending.

3. Avoid long-term investments

A working capital line of credit is typically used for short-term operational expenses – such as payroll, utility, rent, as well as emergency repairs or replacements.

That’s because of its revolving nature, flexible repayment terms, and higher interest rates, which are manageable over short periods of time.

However, it is not as suitable for long-term investments because of the higher cost of borrowing, the risk of overextending your credit, as well as the periodic review requirements.

So, if you need extra funds for a long-term investment, look for more appropriate financing options instead – such as business term loans or small business loans.

4. Keep your usage below the credit limit

Another tip for managing your working capital line of credit effectively is to keep your usage well below the credit limit. This ensures that you have available funds for unexpected expenses or emergencies, giving you a financial cushion for unforeseen circumstances.

It also helps you keep your credit utilization low – lenders usually view high utilization as a sign that you are over-reliant on credit, which increases perceived risk. This can lead to higher interest rates or denial of additional credit.

Credit scoring models, such as those used by FICO and other agencies, penalize high credit utilization. A ratio above 30% can start to negatively affect your score, and the higher it goes, the more significant the impact.

5. Reassess your credit needs regularly

When it comes to managing your working capital line of credit effectively, make sure to reassess your credit needs regularly. Adjusting your credit limit ensures that you have the appropriate amount of credit to meet the constantly evolving needs of your business.

To adjust your credit limits:

- Conduct Regular Assessments – Review the financial performance of your business periodically – for example quarterly or annually.

- Provide Updated Financials – If you need to adjust the credit limit with your lender, provide recent financial statements, tax returns, and cash flow projections.

- Analyze Usage Patterns – Pay close attention to how often and how much you draw from your working capital line of credit. If you are frequently reaching your credit limit, or rarely use the available funds, it might be time to adjust.

- Make Incremental Increases – If you need a higher credit limit, request incremental increases rather than a large jump. This shows responsible credit management and builds trust with your lender.

Bonus Tip: Use Automation Tools

Automation is your ally when it comes to managing your working capital line of credit. You can set up alerts and reminders for repayment deadlines and credit usage threshold, or configure automatic payments directly.

You can also use a financial management software to track and manage your credit line.

What Are the Consequences of Mismanaging a Working Capital Line of Credit?

As we mentioned at the beginning of the article, mismanaging a working capital line of credit can lead to significant consequences for your business, potentially affecting its operational capability and financial health. Some of them include:

- Higher Interest Payments – If you are regularly taking out money out of the working capital line of credit without repaying consistently, high-interest costs may accumulate quickly.

- Impact On Your Credit Score – Overuse of the credit line can negatively impact your business credit utilization ratio, which may lead to a lower credit score. Late or missed payments can also damage your rating.

- Strained Cash Flow – A working capital line of credit is great for providing the extra funds you need, but over-relying on it can increase your debt levels, and lead to difficulties in making timely payments – ultimately straining your cash flow.

- Operational Disruption – With a strained cash flow, you may face disruptions in your business operations, affecting payroll, inventory purchases, and other expenditures.

- Increased Financial Risk – Mismanagement can lead to defaulting on the line of credit, which can result in financial and legal consequences – including your collateral assets being seized by the lender to recover the owed amount.

- Higher Fees And Penalties – If you miss payments or pay them late as a result of mismanaging your working capital line of credit, you may incur in additional fees and penalties – increasing the overall cost of borrowing.

Qualifying for a Working Capital Line of Credit With NBC

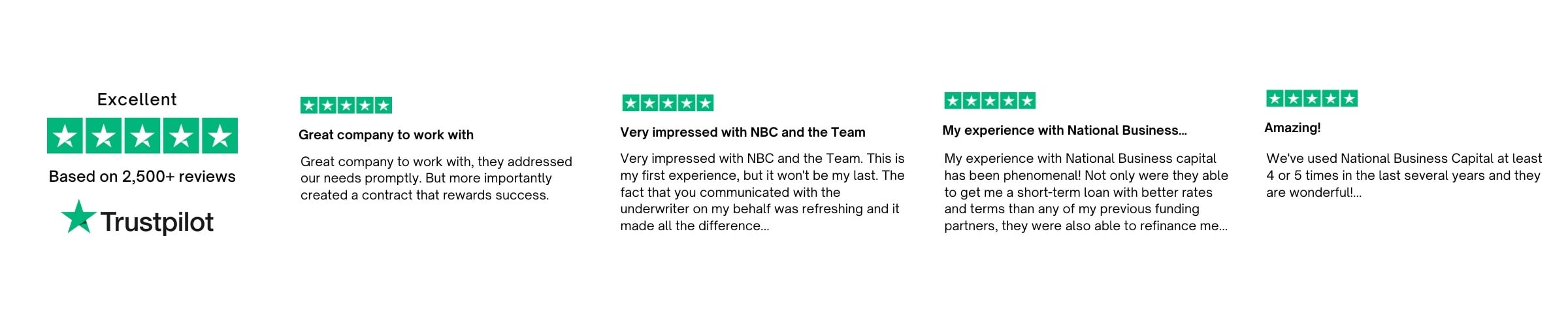

If you want to qualify for a working capital line of credit, look no further than National Business Capital. With $2+ billion financed since 2007, multiple awards, and an experienced team of Business Finance Advisors, we have everything you need to find the best financing options for your project.

Are you ready to get started? Apply here.

Frequently Asked Questions

How do I qualify for a working capital line of credit?

To qualify for a working capital line of credit, you will typically need to demonstrate solid financial health and stability. Lenders usually require a strong credit score, consistent revenue, and positive cash flow.

You’ll need to provide financial statements, tax returns, and sometimes personal financial information of the business owners. Additionally, a business plan detailing how the funds will be used and repaid can enhance your application.

Collateral might also be required, depending on the lender’s policies and the amount of credit requested.

Can I use the line of credit for any business expense?

Yes, a working capital line of credit can typically be used for a wide range of business expenses, including payroll, inventory purchases, rent, utilities, and covering cash flow gaps.

However, it’s generally intended for short-term operational needs rather than long-term investments or capital expenditures. Always check with your lender for any specific usage restrictions.

How often can I draw from the working capital line of credit?

You can draw from a working capital line of credit as often as needed, up to your approved credit limit. This flexibility allows you to access funds whenever necessary to cover short-term expenses or manage cash flow gaps.

Each draw will add to your balance, which you can repay and reuse throughout the term. Always review your lender’s specific terms and conditions.

Can I increase my credit limit over time?

Yes, you can often request an increase to your credit limit over time. To do this, you’ll typically need to demonstrate improved financial health, such as higher revenue, better cash flow, and a strong repayment history.

Lenders may require updated financial statements and re-evaluate your business’s creditworthiness.

What happens if I miss a payment on my working capital line of credit?

Missing a payment on your working capital line of credit can result in late fees, increased interest rates, and negative impacts on your credit score.

Repeated missed payments may lead to more severe consequences, such as reduced credit limits or the lender revoking your credit line. It’s crucial to communicate with your lender and address any payment issues promptly.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Joseph Camberato

Joe Camberato is the CEO and Founder of National Business Capital. Beginning in 2007 out of a spare bedroom, Joe and his team have financed $2+ billion through more than 27,000 transactions for businesses nationwide. He’s made it his calling to deliver the educational and financial resources businesses need to thrive.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.