Small business loans are designed to help you get the money you need to start or run your business. With funding options, like working capital loans, you’ll gain access to capital at affordable rates. As you explore your options, you’ll likely encounter two loan types: installment loans and revolving credit. So, is a small business loan an installment or revolving debt? The answer depends on your loan’s terms.

Let’s look at the differences between installment loans and revolving credit and when you should use each type of debt to finance your business.

Table of Contents

- What Is an Installment Loan?

- What Is Revolving Credit?

- Installment Loan vs. Revolving Credit: Main Differences

- When To Use an Installment Loan or Revolving Credit

- Compare and Get Help With Loan Options for Your Small Business

What Is an Installment Loan?

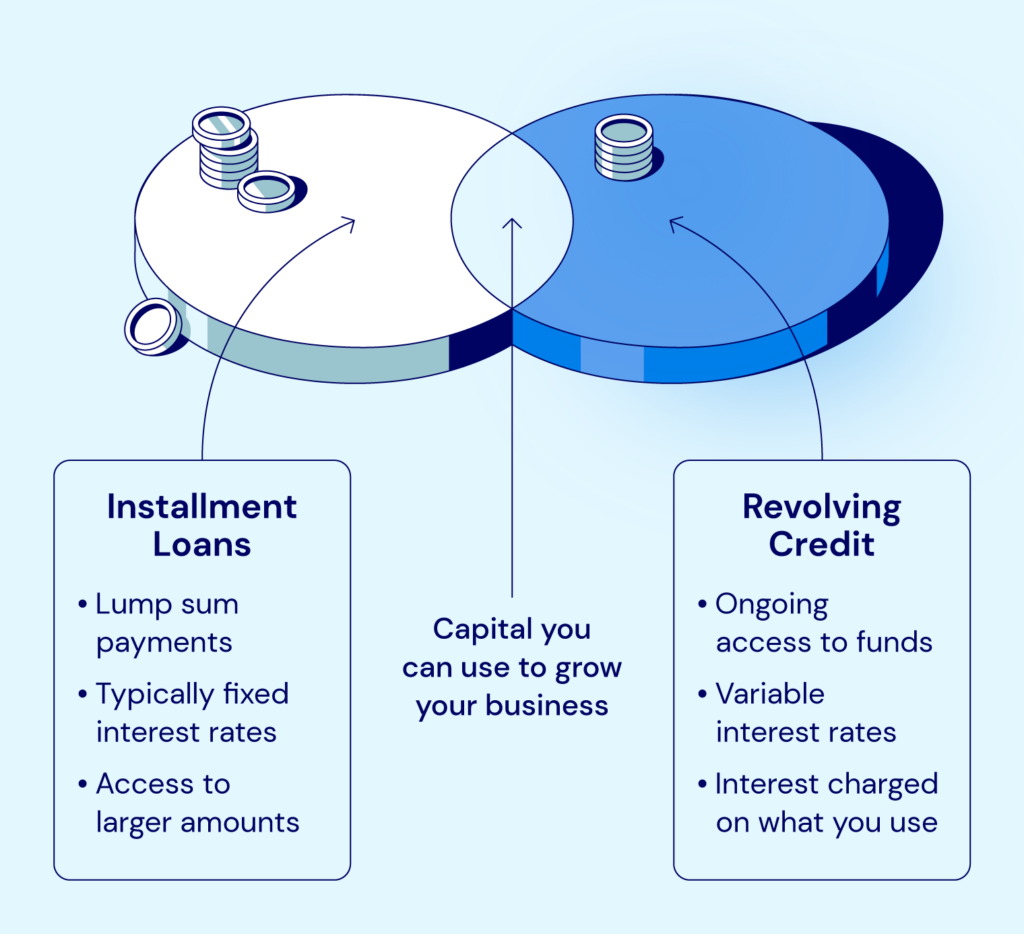

Most people consider taking out a small business loan as an installment loan. When you’re approved for and accept this type of loan, the lender sends you a lump sum payment upfront. You then pay what you borrow in installments, plus any interest accrued on the loan, until you pay the loan off in full.

Pros and Cons of Small Business Installment Loans

Installment loans offer several distinct advantages but aren’t the perfect solution for every business or every situation. Here are some of the pros and cons of using these loans.

| Installment Loan Pros | Installment Loan Cons |

|

|

What Is Revolving Credit?

A revolving business line of credit is a type of loan that you can draw funds from more than once. Instead of receiving a lump sum payment upfront, your lender will approve you to borrow a maximum amount known as a credit limit. You can borrow capital up to that limit, and as long as you pay it off, you can keep borrowing up to that limit indefinitely.

This allows you to purchase equipment, grow your inventory, and cover other expenses when needed without applying for another loan.

Remember that the requirements for revolving lines of credit can vary from lender to lender. It’s a good idea to compare offers from multiple lenders to find the right one for your needs.

Pros and Cons of Revolving Credit

Here are a few advantages and disadvantages of business revolving lines of credit that you should be aware of.

| Revolving Credit Pros | Revolving Credit Cons |

|

|

Installment Loan vs. Revolving Credit: Main Differences

Since both installment loans and revolving business lines of credit help you gain access to capital in different ways, choosing the right tool for your needs can make all the difference. To do that, you need to understand the key differences between installment loans and revolving credit.

| Installment Loan | Revolving Credit | |

| Interest Type | Fixed or variable, depending on the loan | Variable rate based on the current market rate |

| How Lenders Distribute Funds | Lump sum payment | Funds available as needed |

| Loan Limits | One-time fixed amount received upfront | Maximum limit business owners can use repeatedly |

| Renewability | May or may not be renewable, depending on the lender | Typically renewable as long as the borrower is current on payments |

When To Use an Installment Loan or Revolving Credit

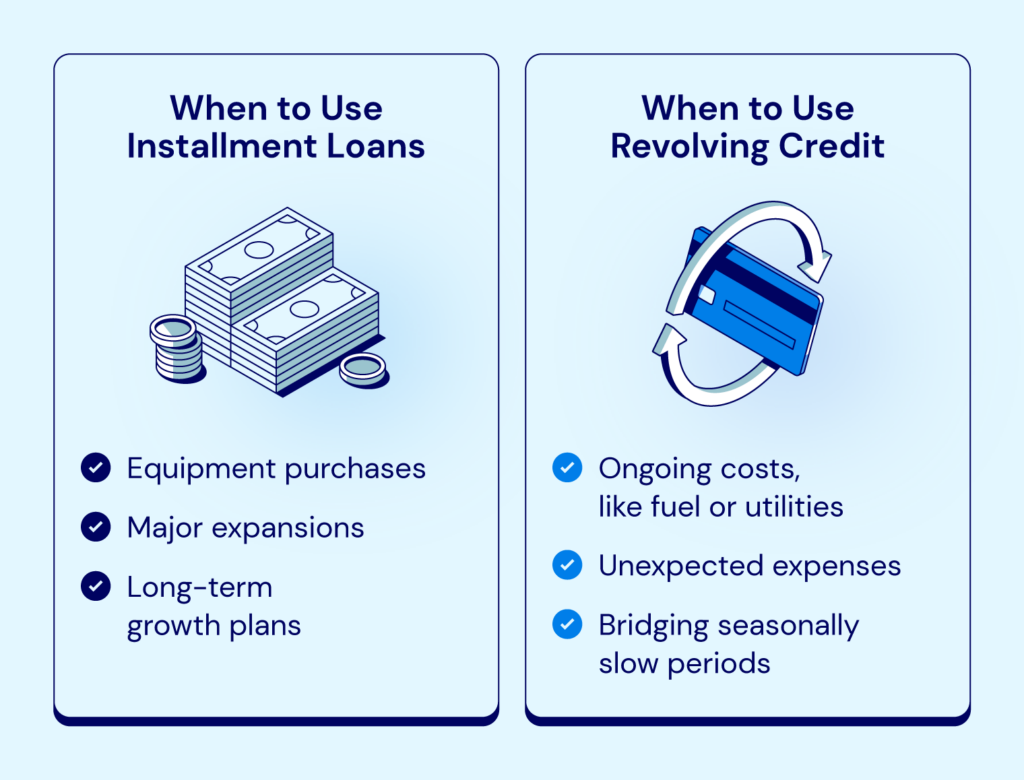

Though both installment loans and revolving lines of credit can help you grow your business, they can have different use cases. Installment loans are ideal when you need an upfront lump sum of money. This may include:

- Purchasing equipment

- Larger inventory purchases that may not immediately yield an ROI

- Remodeling your existing office

These loans give you predictable monthly payments and let you break the cost of borrowing capital up over a longer period, which could put less strain on your budget.

Revolving credit can be a good choice for business owners who need flexibility. You may want to use a business line of credit to:

- Cover expenses during slow seasons.

- Access capital on a rolling basis rather than receiving the funds upfront.

- Create an emergency fund to hedge against unpredictable profits.

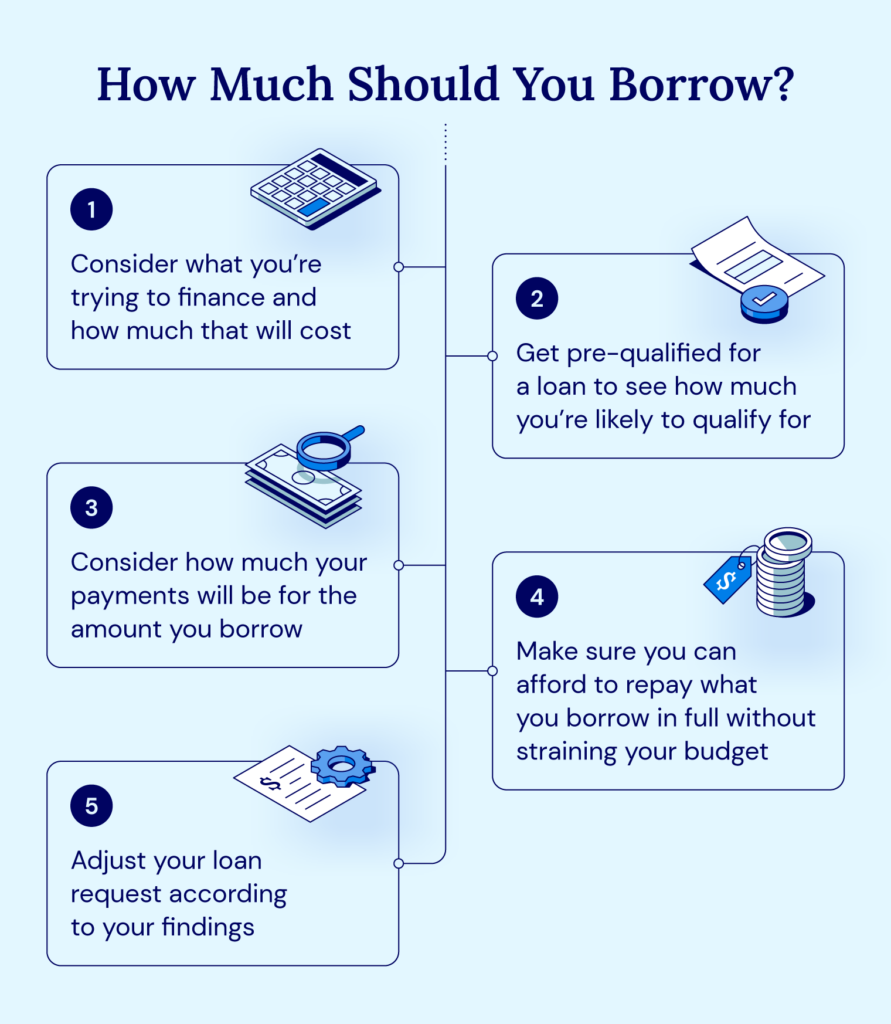

Keep in mind that many business owners choose to use a combination of installment loans and revolving credit. Before you decide, consider the amount you’ll need, how often you’ll need to access capital, and how much you can afford to repay.

Compare and Get Help With Loan Options for Your Small Business

Understanding whether a small business loan is installment or revolving debt is just the starting point. You’ll still need to choose a lender and apply for a loan or business line of credit that supports your business’s goals.

National Business Capital is here to help you find the right financing options for your needs, whether you’re considering an installment loan or revolving credit.

If you’re ready to grow your business and want to explore your options, our team is here to help. Apply now and speak with an experienced Business Finance Advisor to learn more about the loans and lines of credit you may qualify for.

Frequently Asked Questions

Are SBA Loans Revolving?

What Types of Business Loans Are Revolving Loans?

Business lines of credit and credit cards are considered revolving loans. You’re able to borrow up to the credit limit, pay off all or a portion of the balance, and borrow money again without having to renew the loan.

Who Offers Installment Loans and Revolving Loans?

You can apply for installment loans and revolving loans through financial institutions, like banks and credit unions as well as private lenders who specialize in helping small businesses get the financing they need.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Joseph Camberato

Joe Camberato is the CEO and Founder of National Business Capital. Beginning in 2007 out of a spare bedroom, Joe and his team have financed $2+ billion through more than 27,000 transactions for businesses nationwide. He’s made it his calling to deliver the educational and financial resources businesses need to thrive.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.