Buying new equipment is a big deal for any business. And since large purchases can create complications that affect cash flow, many business owners and operators choose to finance that fancy new equipment rather than try to pay for it all at once, upfront.

The typical duration for financing equipment varies widely – after all, the loan terms for new machinery will likely differ from a state-of-the-art computer system. That said, most equipment financing options, by and large, range from one to five years, with varying interest rates and repayment options.

Today, we’ll look at how long you can finance equipment in some common industries, how to choose the best loan – and how to get the best terms for your business on said loan.

Table of Contents

- What Is the Average Term of an Equipment Loan?

- What Factors Impact Loan Duration?

- How Do Equipment Financing Loan Periods Vary by Industry?

- How Does Equipment Loan Length Affect Interest Rates?

- How Does Loan Length Affect Payment Flexibility?

- How Do You Determine Your Term Length for Equipment Financing?

- How Long Does It Take to Get an Equipment Loan Approved?

- Explore Equipment Financing With National Business Capital

What Is the Average Term of an Equipment Loan?

Generally, the average term length of business equipment loans runs between two and five years (24 to 60 months), but there’s no hard and fast rule. Loan term length can vary based on several factors, but a major one is the equipment’s useful life. The idea behind this – and why loan structure may vary – is that lenders want to align the repayment schedule with the equipment’s useful life. In other words, you’d pay off the loan while the equipment is still operational and generating revenue.

So, if you’re in an industry where equipment tends to have a longer life, you may see longer loan lengths available. Construction equipment, for example, is typically robust and built for long-term use.

An excavator has a life span of 10,000 hours of operation, making a 60-month loan a reasonable investment. You’ll still be using that piece of equipment long after you’ve completed financing it.

While equipment lifespan isn’t the only factor impacting loan duration, it’s certainly a major one.

What Factors Impact Loan Duration?

Several factors influence the duration of a loan. The most important factor is the industry you’re in (and what type of equipment you want to finance), but other considerations will impact the final amount due each month.

Some common ones include:

- Equipment type: Lenders typically want the loan repaid within the equipment’s useful life – so longer-lasting equipment will likely qualify for longer loan terms.

- Lender policies: Each lender has different risk tolerance and criteria for loans. Some lenders specialize in short-term loans, while others are more willing to offer extended terms. Look for a lender that works with your industry and will be more likely to provide agreeable terms.

- Borrower qualifications: Lenders assess your business credit score, financial stability, and overall loan repayment ability. If your business has a strong credit profile and consistent revenue stream, you will be more likely to secure longer loan terms or lower interest rates.

Ultimately, the ideal loan duration balances all of the above factors to fit both the borrower’s and lender’s needs.

How Do Equipment Financing Loan Periods Vary by Industry?

Since the length of a loan term varies by the lifespan of the equipment, it stands to reason that loan terms would vary by industry – since different industries require different types of equipment.

Some of the most common industries that see equipment loans include the following:

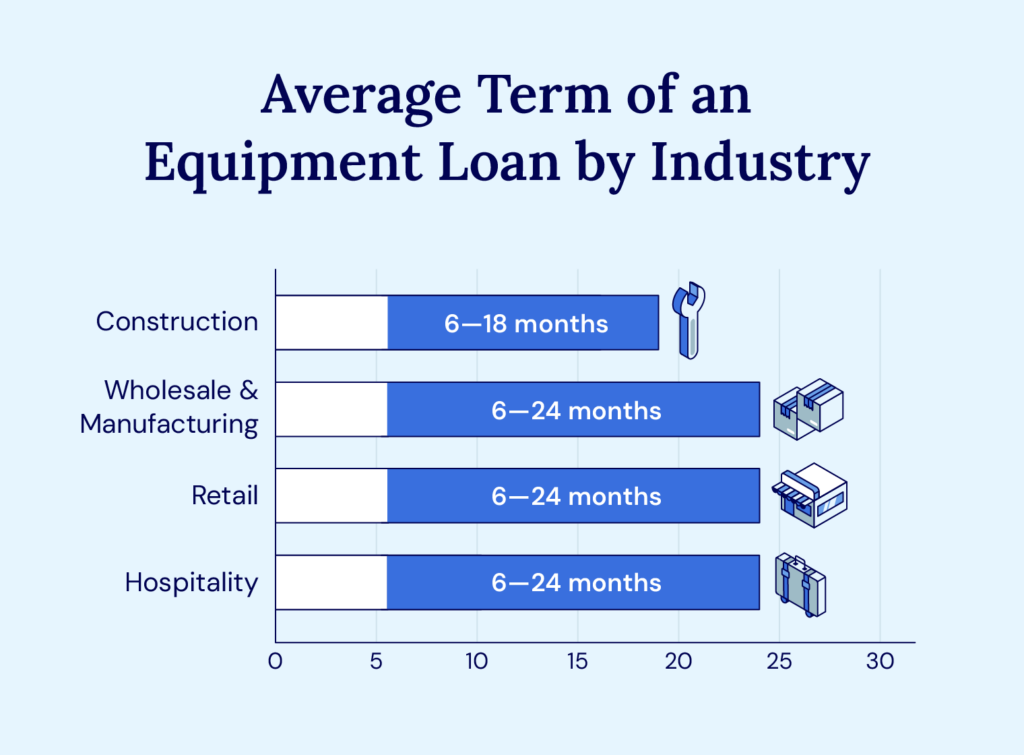

- Construction: The construction industry utilizes heavy equipment machines like excavators and bulldozers that are built to last. The terms of the accompanying heavy equipment loan are often around 6 to 18 months for equipment like this.

- Wholesale: Wholesale businesses are a different story. Owners of wholesale operations might need equipment like forklifts and warehouse management systems. These tend to have a more moderate lifespan, so loan terms usually fall between half a year and two years (6 to 24 months). This time frame aligns with the need for reliable equipment to handle large inventory volumes.

- Manufacturing: In manufacturing, machinery can be incredibly specific and expensive, and it can see a lot of wear and tear over time. Financing for manufacturing equipment can range from half a year to two years (6 to 24 months), depending mainly on the type and specificity of the equipment. This industry changes with technology – so sometimes equipment becomes outdated faster than initially thought. This can be a factor when determining terms for manufacturing equipment loans.

- Retail: Things move quickly in retail, including equipment lifespans. Common equipment like point-of-sale systems and displays can become outdated quickly, so loan terms are usually shorter, typically half a year to two years (6 to 24 months). This helps retailers stay current with technology and keep their stores looking fresh without getting locked into long-term financing.

- Hospitality: In hospitality, guest experience is paramount and often involves having the latest and greatest technology and amenities available at all times. For example, the nice espresso machine in your new hotel’s lobby won’t be the best available in two years – even if all that changed is the handle styling. This means that the life of hospitality equipment is shorter, with loan terms up to two years (6 to 24 months).

How Does Equipment Loan Length Affect Interest Rates?

The loan term – how long you have to pay it back – is a major consideration when looking at heavy equipment financing. Longer loan terms sometimes mean higher interest rates, as the lender is taking on more risk over a more extended period.

So, with an 18-month loan term for that excavator purchase we discussed earlier, you’d save interest in the long run over a longer-term loan because the loan would accumulate less interest.

A longer equipment loan term means that you will have more cash available each month since your payments will be smaller. But you will end up paying more to finance the equipment over time.

Ask yourself questions like, “Will this equipment still be valuable at the end of my loan term?” to determine whether financing for that length of time is a wise option. These are the critical things to consider when determining the best heavy equipment financing rates for your business.

How Does Loan Length Affect Payment Flexibility?

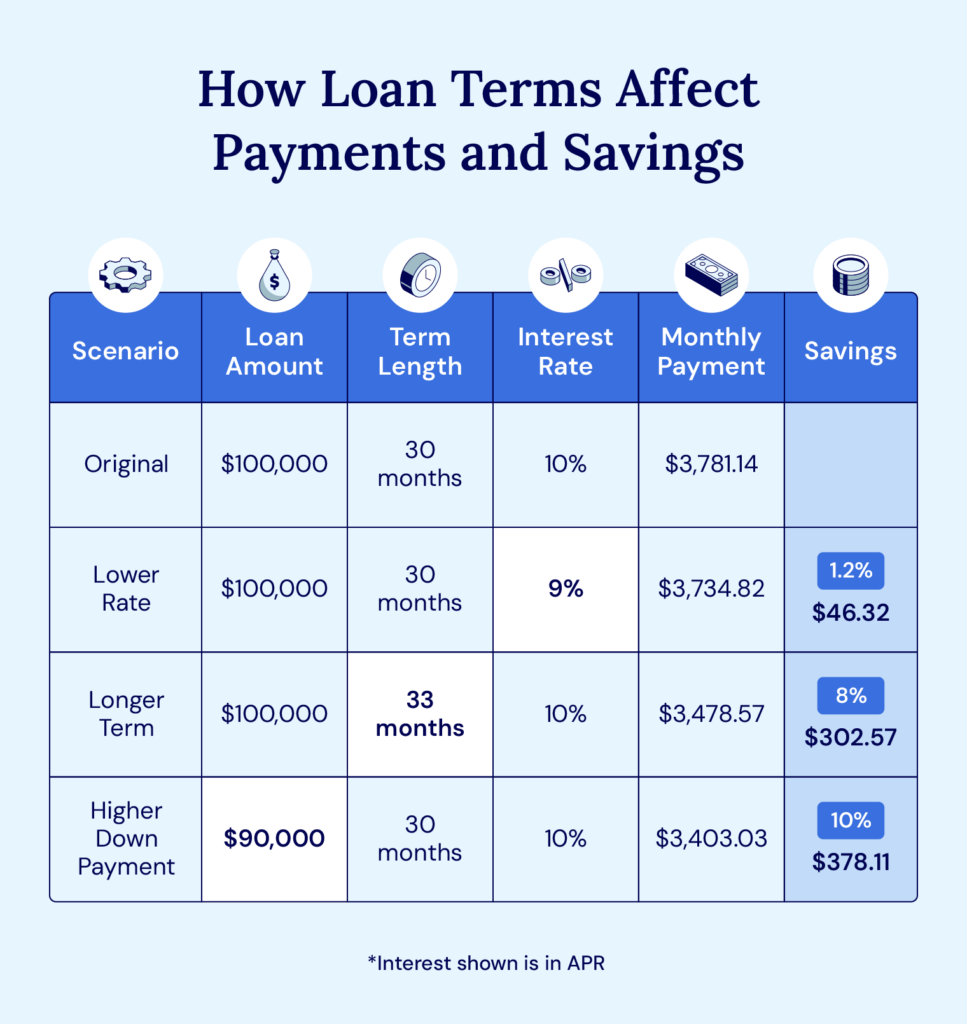

Loan term length has a huge impact on payment flexibility – and that’s an understatement. Stretching out your loan term even a little can make a big difference in the amount you pay the lender each month.

For example, going from 30 to 33 months on a $100,000 loan with a 10% interest rate drops your monthly payment by over $300. That’s a big chunk of working capital back in your business accounts each month.

The trade-off, of course, is that you’ll both pay more interest and have a higher interest rate on the loan. In the example above, if you went the other direction and shortened the same $100,000 loan at 10% interest from a 33-month to a 30-month loan, you would save approximately $1,350 by choosing the shorter-term loan. However, if you have plenty of cash on hand, you might not be too concerned about this.

How Do You Determine Your Term Length for Equipment Financing?

Choosing the right loan term for your equipment financing is a balancing act. You have to consider your cash flow, the equipment’s life span, how quickly the equipment will start bringing in revenue, and even resale value.

If you’re in a fast-paced industry like retail or hospitality, the technological elements of the equipment will be a big consideration, too – how fast will this equipment reach the point of obsolescence?

It’s a lot to consider, and what you can get approved for may not indicate whether you should finance that piece of equipment. In fact, as National Business Capital Advisor Brian Travers points out:

“If a client is approved for a lot, it may not be in their best interest to take the entire amount.”

How Long Does It Take to Get an Equipment Loan Approved?

Commercial equipment financing and small business equipment loan approval times may vary widely. Some traditional banks can take weeks to review applications depending on the lender’s processes, the loan’s complexity, and the application’s completeness.

Private capital lenders with streamlined technology-driven processes, like National Business Capital, can review applications much faster than traditional banks. You might get approval on an equipment loan in just a few days.

When choosing a company to finance your equipment, ask the right equipment financing questions to make sure they understand your business and the kind of equipment you’ll need. An understanding lender will go a long way toward helping you get the right terms on the loan you want to secure.

Explore Equipment Financing With National Business Capital

Investing in the right equipment at the right time can be the difference between success and struggle in your business venture. More efficient processes, lower costs, and a real boost in productivity – that’s the power of investing wisely in the tools you need.

At National Business Capital, we understand how crucial it is to get the equipment you need when you need it. We work with businesses of all kinds, and we’ve built our financing solutions around that. We understand that one size doesn’t fit all and that every industry has different use and equipment loan rate requirements.

Our streamlined process ensures you get the loan you need with the best terms possible for you and your business. Apply now and talk to our team of expert business advisors to learn how our flexible equipment financing can help your business grow and succeed.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.