Fragrance Manufacturer Launches Into Big Box Retailers

A rapidly growing fragrance manufacturer had an opportunity to expand its sales into big box retailers, like Walmart, Target, and Costco, but needed capital to produce inventory to meet projected new channel demands.

$10,000,000

13 Days

Major Revenue Growth

Food Producer Acquires Competitor’s Facility

An internationally recognized food producer encountered a once-in-a-lifetime opportunity to acquire a competitor's facility, but they were $10MM short of the purchase price.

$10,000,000

20 Days

10X Annual Revenue

Capitalizing on Bulk Inventory Discounts

Our client, a retailer selling premium-quality auto parts sourced from low-mileage, late-model vehicles, had an opportunity to purchase bulk inventory from overseas

$1,000,000

4 Days

75% Boost in Revenue

Meeting Critical Deadlines

Our client was assisting with the construction of a Formula 1 racetrack when cash flow constraints created an unexpected slowdown.

$750,000

1 Week

Completed Project ($5M in Profit)

Unlocking Property and Growth Potential

Our client owned a popular resort that operates year-round. On their property, they have a bridge connecting two areas that breaks every year once wintery conditions set in, costing $100,000+ annually in repair expenses.

$1.1MM

2 Weeks

Fully Accessible Property

Achieving M&A Goals

Our client, an M&A group, owned a portfolio of luxury restaurants. While constructing their 7th out of 10 locations, they encountered an unexpected slowdown in their construction process that would delay their target open date.

$4.1MM

1 Month

Mitigated Project Slowdown

Handling Larger Inventory Orders

Our client, a rapidly growing apparel wholesaler, encountered a cash flow challenge that complicated their ability to keep up with rising demand.

$11MM

1 Month

Streamlined Cash Flow; Inventory Bottleneck Mitigated

Doubling Down on Fantastic Progress

Our client was sitting on multiple large contracts from major companies – like Disney, PNC Bank, 3M, and Gamestop – and needed upfront funding to move forward.

$10MM

30 Days

$22MM to $30MM Revenue Growth

Checked Your Rate Recently? Maybe You Should…

After speaking with National Business Capital, a client discovered their bank credit line rate was 5 times higher than expected. Our team provided bridge funding to complement their bank financing when the bank refused to raise their limit despite a 37-year relationship.

$600,000

1 Week

Bridged Payment Gap & Subordinated a Bank Line

Keeping Up With Demand

A rapidly growing apparel manufacturer needed $150,000 to keep up with the high demand for their inventory.

$150,000

8 Days

Maintained Growth Momentum

Video Success Stories

CEO Joseph Camberato offers a brief overview of the fantastic opportunities we've helped clients take advantage of.

Inventory Expansion with Sub Debt

Auto Group Adding New Location

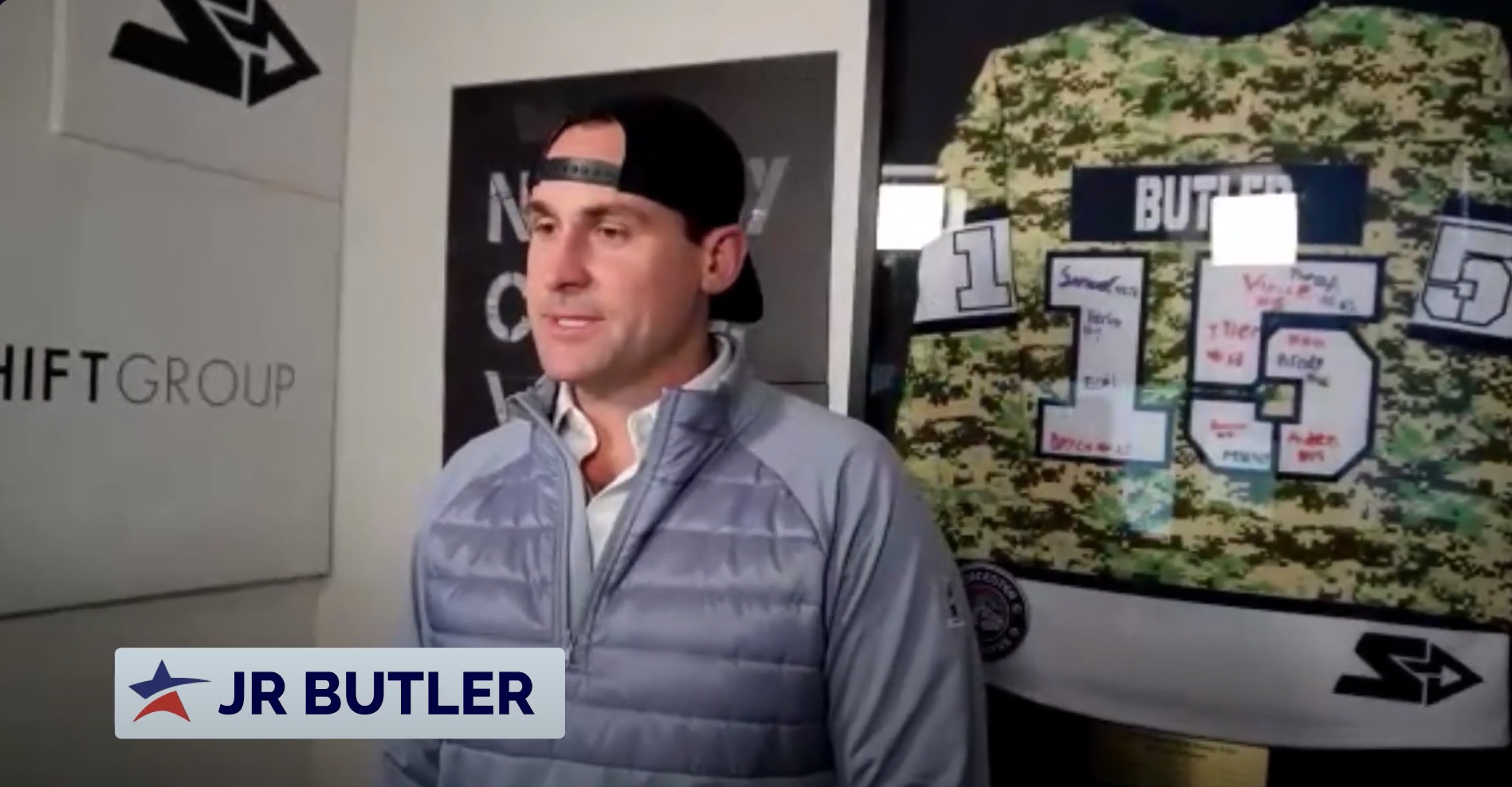

Growing a Veteran-Owned Military Service Provider

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.