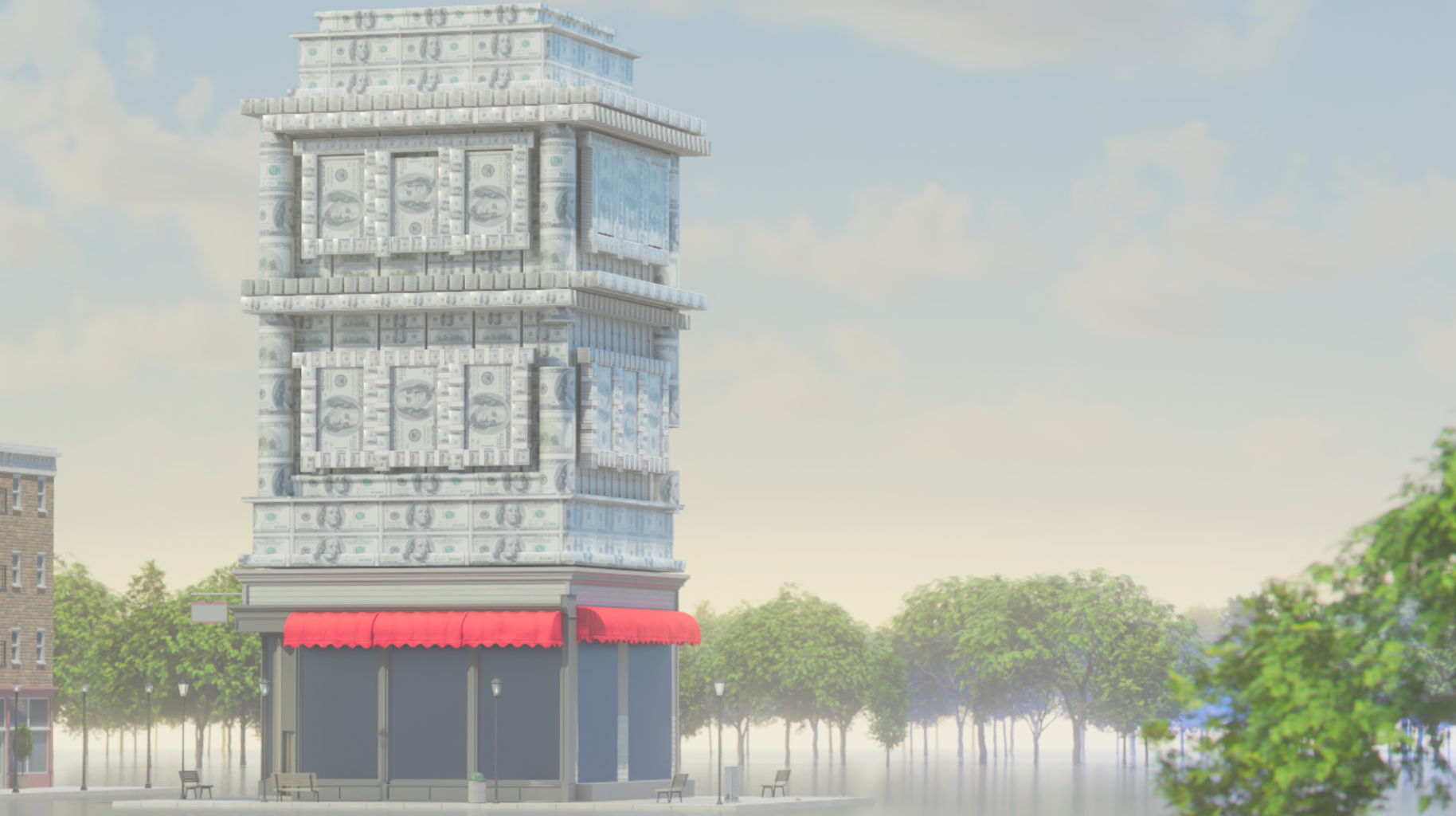

Businesses don't grow overnight, we just make it feel that way.

Get your business funding in hours – not months.

- Access Capital to Grow Faster

- No Real Estate Collateral Needed

- We Can Save You 1,896 Hours

- Speak to a Financing Expert

National Business Capital

The limits of success should never be defined by the lack of capital. Yet, in a constantly changing financing market, many entrepreneurs struggle to access the capital they depend on to fuel growth and find success. That’s why in 2007, Joe Camberato set out to create a company that lets entrepreneurs reimagine how they access capital.

With National Business Capital, experience a business lending marketplace built for entrepreneurs, by entrepreneurs.

Discover a time-saving machine that takes approval from months to hours, letting you spend less time chasing capital and more time building your business.

Leverage a network of over 75 lending partners to find the right approval for your business and secure capital without compromise. Do it all from an intuitive online platform that centralizes your business lending needs for simpler, streamlined management.

Working with NBC, gain a financing partner for the future, ensuring your business can always access the capital it needs to succeed today and tomorrow.

$2+ Billion Funded. Grow to Greatness.

How It Works

You’re only a few clicks away from the capital you need to reach your full potential.

-

1.Apply Securely Within Minutes

Move through our streamlined application within minutes and upload your business documents with zero risk.

Apply Now -

2.Review Your Offers

Compare your offers with expert advice from our team and select the best one for your specific circumstances.

-

3.Get Funded

With your money in hand, you can take advantage of opportunities and tackle challenges with confidence.

Ready to Get Started?

See success on your schedule with frictionless access to essential capital.

10 Reasons Why National Business Capital Offers the Best Small Business Financing

Paperwork |

|

|

|

Application |

|

|

|

Number of Lenders | 75+ | 1 | 1 |

Service Level | Personal Advisor | Processor | Programmatic |

Approval Process | Hours/Days | Weeks/Months | Days/Weeks |

Speed to Funding | Hours/Days | Months | Days/Weeks |

Collateral Requirements | Not Necessary | Always | Sometimes Required |

Business Profitability | Not Necessary | Last 2 Years | Sometimes Required |

Credit Score | No Minimum FICO | 680+FICO | 600+FICO |

Credit Check | Soft Pull | Hard Pull | Hard Pull |

Driving Growth for All

National empowers growth without limits for every business owner, giving them the capital and the confidence to grow to greatness.

Apply for Funding Now

Go from application to approval in hours, not months, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.