Alternative Business Lending

With NBC, centralize your business financing with an intuitive platform that brings together every available financing program in one place.

Grow to Greatness

Banks have traditionally been the first consideration for small business owners in need of financial assistance. What many discover, however, is that the entrepreneurship that they possess in abundance does not translate into a sound business plan to most lenders.

Additionally, small business owners often lack a long business history, healthy FICO score, and general financial acumen. The deck is stacked against them from the beginning. Should these businesses find co-signers or meet the lender’s high expectations by other means, the wait for the loan proceeds can be as long as several months. This is not an ideal scenario for any business trying to keep its enterprise’s day-to-day operations afloat.

What Is Alternative Business Lending?

What Are Different Types of Alternative Business Financing?

What Types of Alternative Business Lending Is Best for Small Businesses?

What Are the Benefits of Alternative Business Loans?

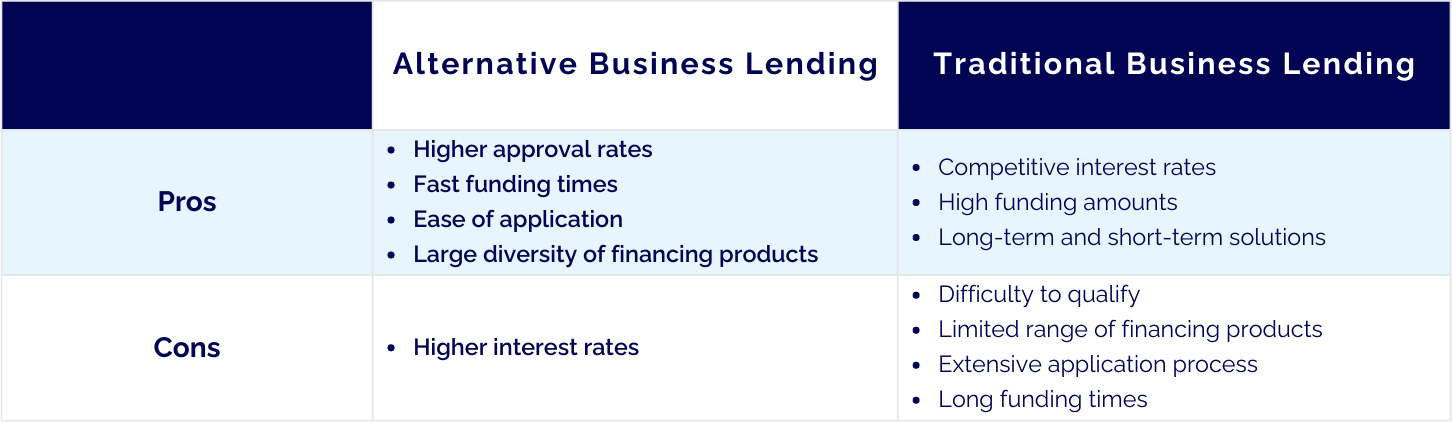

Traditional Financing vs. Alternative Business Lenders

How to Apply for Alternative Business Lending in 2022

Is Alternative Business Financing Right for Small Business?

What Is Alternative Business Lending?

What Is Alternative Business Lending?

Alternative business lending is a broad term referring to the wide range of business financing solutions and loans offered outside the scope of traditional banks. In general, alternative business lending solutions are more flexible and more accessible for businesses. Lenders in this space use technology to connect capital with borrowers at greater speed and efficiency than traditional banks.

Decades ago, if you needed a small business loan, your only option was a bank or credit union. The downside is that these lenders maintain strict requirements and low approval rates that can exclude many businesses from funding opportunities.

In many ways, alternative business lenders operate like a bank and offer similar – if not the same – kinds of business loans and financing products. You’ll find term loans, SBA loans, business lines of credit, and equipment financing. You’ll also be able to explore more nuanced options, like merchant cash advances and invoice financing.

Some alternative business lending solutions can also be structured as peer-to-peer loans or financing products. One example is crowdfunding platforms, as they allow businesses and startups to raise money from private citizens in exchange for small amounts of equity.

While banks have extensive application processes, lengthy funding times, and strict requirements, alternative business lending offers greater flexibility and accessibility.

Banks will typically want to see at least two years of business history on top of solid credit and revenue requirements. Additionally, many bank loans are only offered in exchange for collateral – which may not be an option for every business owner.

Alternative business lending is much more adaptable and tailored to an individual business’s needs. You can find a diversified range of products for a wider range of qualifications. However, generally speaking, alternative business lending products tend to come with higher interest rates than those offered by banks.

What Are Different Types of Alternative Business Financing?

What Are Different Types of Alternative Business Financing?

You’ll find alternative business lenders offer many of the same products as banks – but with more flexibility and higher approval rates. Overall, you have a large range of options at your disposal. Here’s a glance at some of the most well-known:

1. Business line of credit

Business lines of credit are structured similarly to credit cards, except the latter comes with higher funding limits and lower interest rates. Business lines of credit are very flexible, allowing you to use the funds for almost all types of business expenses.

There’s also no pressure to use the entire amount right off the bat. You can withdraw as you need, and you’ll only need to pay interest on what you borrow.

2. Term loans

Term loans are the first thing that comes to mind when people envision small business loans. These loans are structured with an upfront, lump-sum payment with regular installments over a set period of time. Term loans feature fixed interest rates and can have funding amounts ranging from $100,000 to $10 million.

3. Merchant cash advance

Merchant cash advances are known for their accessibility and fast funding times, but this product doesn’t work as a traditional loan. Instead, it’s an advance on your business’s future sales.

You’ll receive a lump-sum upfront which you’ll repay via a percentage of your business’s daily credit card sales. Merchant cash advances are designed to be short-term solutions and your payments will fluctuate depending on your business’s performance.

4. SBA loans

Small Business Administration (SBA) loans are government-backed loans with special benefits for small businesses. These loans feature low-interest rates, high funding amounts, and lengthy terms. They can be used to cover just about any type of business expense, including operating costs, real estate purchases, and equipment financing.

SBA loans are available through participating lenders, which include traditional banks and alternative business lenders as well.

5. Equipment financing

Equipment financing allows entrepreneurs to afford expensive equipment and pay for it on a manageable schedule. You can start using the asset immediately once you’ve gone through the process, and you may also qualify for tax benefits, like Section 179, which allows you to deduct nearly the entire value of equipment from the current year’s tax return.

Equipment financing increases your purchasing power, preserves cash flow, and allows you to keep up with your competition without a sizable upfront investment. You can finance traditional equipment, like trucks and construction machinery, as well as technological equipment, like CRM software and computers.

What Types of Alternative Business Lending Is Best for Small Businesses?

What Types of Alternative Business Lending Is Best for Small Businesses?

Take a look at how different alternative business lending solutions compare and cater to different needs:

Business line of credit

Flexibility is important. You want to be able to withdraw funds as you need. Maybe you don’t know exactly how much a project would cost, or you want to keep an extra reserve of cash on hand to cover working capital expenses. You’re looking for a lower-cost alternative to credit cards with higher funding amounts.

Term loans

You know exactly how much you’ll need to complete a project and satisfy your funding needs. You want to lock in a certain interest rate, and a regular repayment schedule is a good fit. You like knowing the exact amount of your payments each month so you can effectively plan ahead.

Merchant cash advance

You’re looking for a short-term, immediate financing solution. You need cash now, and you’re willing and able to forgo a portion of your business’s future daily credit card sales in exchange. You don’t mind making flexible payments that vary according to your business’s performance. Maybe you’re a younger business, or your credit history is lacking in some way.

SBA loans

You want to receive the best interest rate possible, and you have the credentials to do so. SBA loans tend to have the strictest requirements, and you’ll need to have at least a credit score of 680 for starters.

Equipment financing

You need to buy new or used equipment. Or maybe you’re looking to make repairs and upgrades on existing equipment. You need help financing a vehicle, heavy machinery, restaurant gear, or even office supplies. You rely on some type of equipment to conduct operations, or you’re a startup that needs materials to jumpstart your business.

What Are the Benefits of Alternative Business Loans?

What Are the Benefits of Alternative Business Loans?

Alternative business loans were initially developed to fill in the gaps where traditional bank loans fall short. Nowadays, alternative business loans play an increasingly important role in the business financing landscape. Many entrepreneurs are drawn to the unique benefits they have to offer:

Flexibility

You’ll find enormous flexibility and a wide variety of funding solutions when you work with an alternative business lender rather than a bank. Alternative lenders offer many of the same financing products as banks, but they’re more likely to adapt them to your funding needs.

Plus, you’ll also have a whole new set of funding solutions at your disposal, such as merchant cash advances, invoice financing, and more. You could even explore crowdfunding solutions.

Accessibility

With strict requirements, it’s no wonder that small business loan approval rates at banks stand at a mere 14.5%. Alternative lenders, on the other hand, are much more lenient across all major requirements – especially when it comes to your time in business and credit score.

Startups and businesses rejected by traditional benefits are especially poised to benefit from alternative business lenders. They have a better chance of accessing the funds they need to jumpstart, operate, and grow.

Fast funding times

Alternative business lenders work at lightning speed to review your application and get back to you with a decision. While banks are notorious for taking up to weeks or months, alternative lenders can get you your funds in days. In many cases, businesses are even able to qualify for next-day funding.

Ease of application

Most alternative business lenders use technology to optimize the application process. Many feature online portals where you can seamlessly submit your documents.

Overall, alternative lenders don’t require as many documents as traditional banks. It’s not uncommon for an application with an alternative business lender to take only several minutes. From there, you should be able to track your progress through an online portal.

Traditional Financing vs. Alternative Business Lenders

How to Apply for Alternative Business Lending in 2022

How to Apply for Alternative Business Lending in 2022

Looking to apply for alternative business lending but don’t know where to start? Here’s a breakdown of how the process works:

Step 1: Decide on a lender

There are many different alternative business lenders to choose from. Ideally, you want to select the company that has a solid reputation and offers the kinds of financing products you are looking for. If you don’t know where to look for a lender or can’t decide between a couple of options, you may be better off working with a financing marketplace, like National.

This way, you’ll gain an overview of different lenders as well as various financing offers. You’ll be matched based on your qualifications and financing needs, and you’ll have complete liberty to select the most optimal fit.

Step 2: Gather your documents

Alternative business lenders don’t require as many documents as traditional banks. But you will need to provide the basics. This typically includes:

- Business tax returns

- Business licenses and registrations

- Bank statements

- Information on how you plan to use the funds

Most alternative business lenders have an online portal where you can upload your documents.

Step 3: Apply

Once you’ve gathered and submitted all your documents, you should be on your way to receiving a decision. Most alternative business lenders will allow you to track and monitor your application through your online portal. You should receive a decision in a few days – if not hours!

Sounds simple enough? Start your application with National to review your customized business financing offers from over 75 different lenders simultaneously.

Is Alternative Business Financing Right for Small Business?

Is Alternative Business Financing Right for Small Business?

Remember: Traditional lenders must follow guidelines imposed by regulatory agencies. They’ll focus on the small business owner’s credit history and other important business metrics, including their annual revenue and number of employees. Their process is rather strict, but alternative financing for small businesses looks at your operation differently.

National considers these metrics as well, but we also look at the overall business landscape and use additional indicators to determine a small business’s overall “health”, projected future performance, and a broad array of non-traditional data sources. By looking at the big picture, this means that we are able to approve over 90% of the loan applications we receive, many from small businesses.

So, if you are seeking working capital for your company and are researching firms that offer alternative financing for small business, look no further. Establishing an ongoing financial relationship with National is an investment in your future. If you’re looking for a partner in growth that’s just as devoted to your business’ success as you are, contact our award-winning team today.

How Much Do You Need?

Go from application to approval in hours, not months, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.