In the bustling economic landscape of Chicago, businesses constantly seek flexible financing solutions to maintain growth and operational efficiency.

Business lines of credit emerge as a vital tool, offering the versatility needed to manage cash flow, address unexpected expenses, and seize new opportunities. Unlike traditional loans, a line of credit provides businesses with a revolving credit limit, allowing them to borrow, repay, and borrow again as needs arise.

They are particularly beneficial for managing seasonal fluctuations, unexpected costs, or capitalizing on time-sensitive opportunities. This flexibility makes them an invaluable resource for businesses looking to stay agile and responsive in a dynamic market.

Businesses seeking more detailed guidance on their financing options or how best to use a business line of credit should reach out to the expert Business Finance Advisors at National Business Capital. We can help you navigate the intricacies of the application process, advise you on the best options available, and help lay a foundation to scale dollar amounts and terms in the future.

Complete our easy application to get started.

Understanding Business Lines of Credit

A business line of credit is an essential financial tool for many businesses, offering flexibility and access to funds that can be used for various operational needs. Unlike traditional term loans that provide a lump sum of money upfront, a business line of credit works more like a credit card. It allows businesses to borrow up to a specified limit and only pay interest on the amount they actually use. Once repaid, the funds become available to borrow again, making it a revolving credit facility.

Definition and Basics

At its core, a business line of credit is a flexible financing solution designed to meet the short-term working capital needs of a business. Here’s a breakdown of its fundamental components:

- Credit Limit: The maximum amount a business can borrow at any given time. This limit is set by the lender based on the business’s creditworthiness and financial health.

- Interest Rates: Lines of credit typically have variable interest rates, which may fluctuate based on market conditions. The rate is usually lower than that of credit cards, making it a cost-effective borrowing option.

- Repayment Terms: Businesses are required to make minimum monthly payments, which include both principal and interest. The repayment schedule can vary, but many lines of credit require monthly interest payments, with principal repayments depending on the usage and terms agreed upon.

Key Features of a Business Line of Credit

Several features make a business line of credit an attractive option for businesses of all sizes:

- Revolving Credit: As mentioned, once the borrowed amount is repaid, the funds become available again. This continuous access to capital allows businesses to manage cash flow more effectively.

- Flexible Use: Funds from a line of credit can be used for a wide range of business needs, such as purchasing inventory, covering payroll, managing seasonal fluctuations, or financing unexpected expenses.

- Quick Access to Funds: Unlike traditional loans, where the approval process can be lengthy, lines of credit offer quicker access to funds, which is crucial for businesses needing immediate financial support.

- Lower Costs: With interest rates generally lower than those of credit cards, a business line of credit can be a more economical way to borrow money.

Benefits for Businesses

The benefits of a business line of credit are manifold, particularly for businesses operating in dynamic environments like Chicago:

- Cash Flow Management: Helps businesses manage their cash flow by providing access to funds during slow periods or when facing unexpected expenses.

- Operational Flexibility: Offers the flexibility to make strategic investments or respond quickly to market opportunities without the constraints of a lump-sum loan.

- Financial Cushion: Acts as a financial safety net, ensuring that businesses can maintain operations during lean times or unexpected downturns.

Comparison with Traditional Loans

When compared to traditional term loans, business lines of credit offer several distinct advantages:

- Flexibility in Borrowing: While term loans provide a fixed amount of capital upfront, lines of credit allow businesses to draw funds as needed, which can be more aligned with fluctuating cash flow needs.

- Cost-Effective: Because interest is only paid on the amount borrowed, lines of credit can be more cost-effective, particularly for businesses that need short-term funding.

- Renewability: The revolving nature of a line of credit means that businesses can reuse the funds without reapplying, providing ongoing access to capital.

| Criteria | Business Line of Credit | Traditional Term Loans |

| Structure | Revolving credit, borrow as needed up to the credit limit | Lump sum provided upfront |

| Interest Payment | Pay interest only on borrowed amount | Interest applies to entire loan amount |

| Flexibility | High flexibility in fund usage and repayment | May come with usage restrictions |

| Approval Process | Typically faster, less documentation required | Longer, more documentation needed |

| Repayment Terms | Depends on the lender you work with, but often more flexible than traditional loan repayments | Fixed repayment, either daily, weekly, bi-weekly, or monthly unless a specialized contract is negotiated |

Understanding how a business line of credit works and its benefits can empower Chicago businesses to make informed decisions about their financing strategies. For personalized guidance and to explore the best financing options for your business, reach out to National Business Capital.

Related: How to secure a $1M business line of credit

Benefits of Business Lines of Credit for Chicago Enterprises

Maintaining financial flexibility is essential for a company’s longevity. Business lines of credit offer unique advantages that cater specifically to the needs of Chicago-based businesses, helping them manage cash flow, capitalize on growth opportunities, and navigate the challenges of a bustling urban market.

Flexibility for Seasonal Demands

Chicago’s diverse economic landscape means that many businesses face significant seasonal variations in demand. For example, retail businesses often experience a surge during the holiday season, while landscaping companies see increased activity in the spring and summer. A business line of credit provides the flexibility needed to manage these fluctuations effectively:

- Inventory Management: Retailers can use a line of credit to purchase additional inventory ahead of busy periods, ensuring they have enough stock to meet increased customer demand.

- Operational Expenses: Service-based businesses can cover operating expenses during slower months, maintaining stability until demand picks up again.

- Hiring Seasonal Staff: Lines of credit can also fund the hiring of temporary or seasonal staff, allowing businesses to scale their workforce in line with demand without impacting cash flow.

Supporting Business Growth

Business lines of credit are invaluable for supporting growth initiatives. Whether it’s expanding operations, launching new products, or entering new markets, having access to flexible funding can be a game-changer for Chicago businesses:

- Quick Capital Access: Unlike traditional loans, which may take weeks or months to process, lines of credit offer quick access to funds. This speed is crucial for businesses looking to seize time-sensitive opportunities.

- Scalable Funding: As a business grows, its financing needs evolve. Lines of credit provide scalable funding that can increase with the business, ensuring ongoing support for growth initiatives.

- Marketing and Development: Funds from a line of credit can be used for marketing campaigns or product development, helping businesses to attract new customers and innovate their offerings.

Adapting to Market Changes

Chicago’s market is known for its rapid changes and competitive nature. Business lines of credit help companies stay adaptable and responsive to these changes:

- Emergency Funds: Having a line of credit ensures that businesses have access to emergency funds, helping them manage unexpected costs such as equipment repairs or sudden market downturns.

- Capitalizing on Opportunities: When new opportunities arise, such as a prime location becoming available or a sudden market demand for a new service, businesses with a line of credit can act quickly to take advantage.

- Financial Cushion: A line of credit acts as a financial cushion, providing peace of mind and financial security in an unpredictable market.

Business lines of credit offer a range of benefits tailored to the unique needs of Chicago businesses. From managing seasonal demands to supporting growth and adapting to market changes, this flexible financing option provides the financial agility needed to thrive in a competitive environment.

How to Apply for a Business Line of Credit in Chicago

From understanding the eligibility requirements to choosing the right lender, securing a business line of credit in Chicago involves several key steps.

Understanding Eligibility Requirements

Before applying for a business line of credit, it’s crucial to ensure that your business meets the typical eligibility criteria set by lenders. These requirements often include:

- Credit Score: Most lenders require a minimum personal credit score of 600-650. A higher score improves your chances of approval and may result in better terms.

- Business History: Lenders generally prefer businesses that have been operational for at least one to two years. Startups may face more stringent criteria or may need to provide additional documentation.

- Revenue: Demonstrating a consistent revenue stream is essential. Lenders often set minimum annual revenue requirements, which can vary widely depending on the lender and the amount of credit requested.

- Financial Documentation: Be prepared to provide detailed financial records, including profit and loss statements, balance sheets, and recent bank statements.

Choosing the Right Lender

Chicago businesses have a variety of lending options, each with its own advantages and potential drawbacks. Here’s an overview of the main types of lenders:

- Banks: Large national banks often offer competitive interest rates and higher credit limits. However, their application processes can be lengthy and require extensive documentation, and they may also require collateral along with a deposit relationship to extend an approval.

- Credit Unions: These smaller, local institutions may offer more personalized service and faster decision-making. They often have a better understanding of local market conditions but may offer lower credit limits. Considering their size, they’re also more at risk of market downturns.

- Non-Bank Lenders: Online lenders provide a fast and convenient application process with quicker access to funds. They typically have more lenient eligibility requirements but may charge higher interest rates.

Step-by-Step Guide to the Application Process

Here’s what to expect from the process:

- Prepare Your Documentation: Gather all necessary financial documents and ensure they are up-to-date. Accurate and detailed records can significantly enhance your application.

- Choose Your Lender: Based on your business’s needs and the pros and cons of each lender type, select the lender that best suits your requirements.

- Complete the Application: Fill out the application form provided by your chosen lender. Be thorough and precise, as incomplete or inaccurate information can delay the process.

- Submit Your Application: Submit your application along with all required documentation. Some lenders may allow you to apply online, while others might require in-person submissions.

- Follow Up: After submission, stay in contact with the lender to track the progress of your application. Be prepared to provide additional information if requested.

Tips for a Successful Application

- Maintain Good Credit: Ensure both your personal and business credit scores are healthy. Pay down existing debt and correct any errors on your credit reports before applying.

- Be Transparent: Provide clear and accurate information in your application. Transparency builds trust and can improve your chances of approval.

- Showcase Business Stability: Highlight your business’s financial stability and growth potential. Strong financials and a clear business plan can make a compelling case to lenders.

By understanding the eligibility requirements, choosing the right lender, and following a structured application process, businesses can secure the funding they need to maintain operations, manage cash flow, and pursue growth opportunities.

Managing Your Line of Credit: Tips and Strategies

Once a business line of credit is secured, the next step is managing it effectively. Proper management can help maintain healthy cash flow, support business growth, and improve creditworthiness. Here are key strategies for managing a business line of credit.

Best Practices for Using a Business Line of Credit

Here are some strategies for companies to rely on as they manage their lines of credit:

- Use for Short-Term Needs: Business lines of credit are best suited for short-term financing needs such as managing cash flow fluctuations, covering unexpected expenses, or taking advantage of timely business opportunities. Avoid using them for long-term investments or significant capital expenditures.

- Monitor Your Credit Utilization: Keep track of how much of your credit line you are using. It’s generally advisable to keep your credit utilization below 30% of your available limit. High utilization rates can negatively impact your credit score and may signal financial stress to lenders.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum monthly payment. This reduces the principal faster and lowers the amount of interest you will pay over time. Regularly paying down your balance also frees up available credit for future needs.

- Avoid Over-Borrowing: Resist the temptation to borrow more than what is necessary. Over-borrowing can lead to high debt levels and financial strain. Borrow only what you need and have a clear plan for repayment.

Monitoring and Adjusting Your Line of Credit

Consistent monitoring of your company’s line of credit will be key to leveraging the tool to its full potential. Here are some tips to keep in mind:

- Regular Financial Reviews: Conduct regular reviews of your financial situation to assess the effectiveness of your line of credit usage. This helps in identifying any emerging cash flow issues and adjusting your borrowing strategy accordingly.

- Update Your Business Plan: Periodically update your business plan to reflect changes in your financial strategy and growth objectives. This keeps your financial goals aligned with your credit usage and helps in communicating your strategy to lenders if adjustments are needed.

- Negotiate Terms with Your Lender: If your business experiences significant growth or changes in financial status, consider negotiating new terms with your lender. This could include increasing your credit limit, lowering your interest rate, or adjusting repayment terms to better suit your evolving needs.

- Track Interest Rates: Stay informed about changes in interest rates, especially if your line of credit has a variable rate. Rising interest rates can increase your borrowing costs, so it’s important to plan accordingly and manage your expenses.

Common Pitfalls (and How to Avoid Them)

Familiarizing yourself with common pitfalls gives you an opportunity to avoid them. Here are a few of the most common challenges encountered by companies:

- Mixing Personal and Business Finances: Keep your business and personal finances separate. Using your business line of credit for personal expenses can complicate your financial records and create issues during tax season or financial audits.

- Ignoring Fees and Penalties: Be aware of any fees associated with your line of credit, such as maintenance fees, transaction fees, or penalties for late payments. Understanding these costs can help you avoid unnecessary charges and manage your credit more effectively.

- Failing to Plan for Repayments: Have a clear repayment plan in place before drawing on your line of credit. Consider how you will repay the borrowed amount and ensure that your cash flow can support the repayment schedule without disrupting your business operations.

- Relying Too Heavily on Credit: While a line of credit can provide valuable financial support, relying too heavily on borrowed funds can lead to financial instability. Use credit judiciously and ensure that it complements, rather than substitutes, a strong financial management strategy.

Related: What are the key requirements for an Operating Line of Credit?

Explore Line of Credit Options with National Business Capital

A business line of credit is a strong and versatile financial tool for Chicago businesses seeking to manage cash flow, respond to unexpected expenses, and capitalize on growth opportunities. By understanding how to effectively apply for and manage a line of credit, businesses can maintain financial flexibility and support their long-term success.

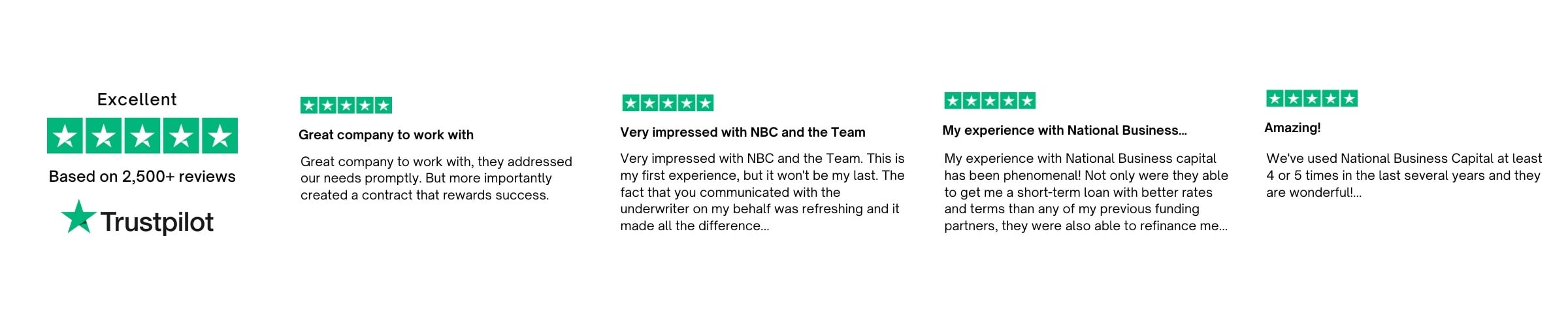

For tailored advice and expert guidance, reach out to the expert Business Finance Advisors at National Business Capital. We can advise you on the options available to your company, advocate for the terms your business deserves, and set the foundation for more competitive rates, terms, and amounts in the future with our guidance.

Complete our easy application today to get started with your advisor.

Frequently Asked Questions

How Does a Business Line of Credit Work?

A business line of credit works similarly to a credit card. A lender sets a credit limit based on the business’s creditworthiness and financial health. The business can draw funds up to this limit as needed, repay the borrowed amount, and then borrow again. Interest is charged only on the amount borrowed, not on the full credit limit.

What Are the Requirements for a Business Line of Credit?

To qualify for a business line of credit, businesses typically need:

- A good personal and business credit score.

- At least one to two years of business history.

- Consistent revenue streams.

- Financial documents such as tax returns, profit and loss statements, and bank statements.

How Can A Business Line Of Credit Help My Business?

A business line of credit provides financial flexibility, allowing businesses to manage cash flow fluctuations, cover unexpected expenses, and seize growth opportunities quickly. It can be used for various purposes, including purchasing inventory, funding marketing campaigns, and managing seasonal demands.

How Is A Business Line Of Credit Different From A Term Loan?

A business line of credit differs from a term loan in several ways:

- Flexibility: A line of credit offers revolving access to funds, while a term loan provides a lump sum upfront.

- Interest: Interest on a line of credit is charged only on the amount borrowed, whereas interest on a term loan is charged on the entire loan amount.

- Repayment: Lines of credit typically require interest-only payments with flexible principal repayments, while term loans have fixed monthly payments.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Joseph Camberato

Joe Camberato is the CEO and Founder of National Business Capital. Beginning in 2007 out of a spare bedroom, Joe and his team have financed $2+ billion through more than 27,000 transactions for businesses nationwide. He’s made it his calling to deliver the educational and financial resources businesses need to thrive.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.