Table of contents

When it comes to running and growing a healthy business, cash flow is king. A timely influx of capital can be the speed boost your business needs to scale between financing opportunities. That’s why some businesses turn to accounts receivable financing to cover those gaps and keep momentum.

As AR financing is self-secured through unpaid invoices, it provides a good opportunity for businesses that might need to preserve capital for ongoing operations, keep growth plans on track, and more. This method of financing is also useful because it allows a business to receive immediate cash flow from financing without requesting immediate payment from clients.

In this article, we’ll dig into how accounts receivable financing works, the different types of AR financing and how they differ, its benefits and risks, and how to qualify for this type of funding option.

What Is Accounts Receivable Financing?

Accounts receivable financing is a method businesses use to cover cash flow gaps and low funds by offering unpaid invoices as collateral. Working with a lender, the business can access these funds through a line of credit or loan.

If you’re not looking to collateralize your receivables, National Business Capital has a wide range of funding options focusing on your cash flow, not assets. These options can support your growth initiatives without risking or tying up your assets.

How Does Accounts Receivable Financing Work?

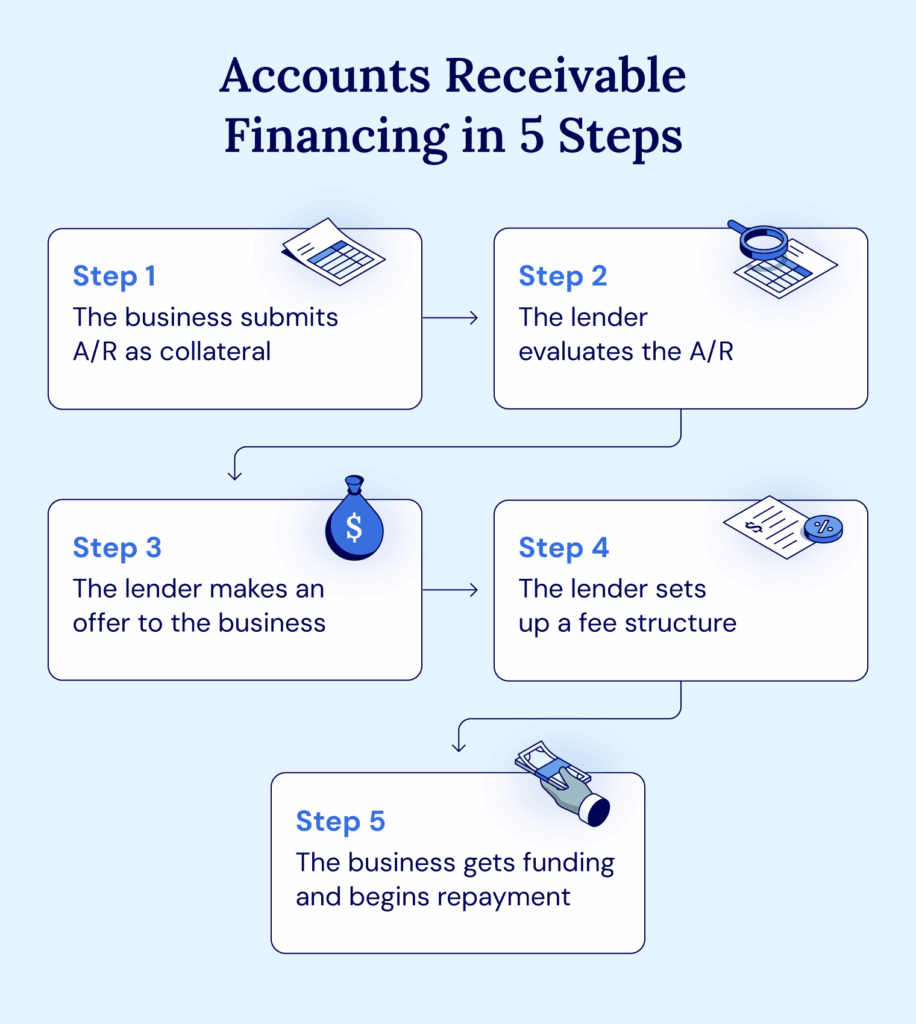

When choosing between AR or a revolving line of credit, the AR financing option might seem slightly more complex, but the process is quite simple. Here’s how it works:

- Business submits their unpaid invoices, or accounts receivable, to the lender as loan collateral.

- The lender evaluates the unpaid invoice.

- The lender makes a funding offer.

- If the business accepts, the lender sets up a fee structure.

- Business begins repayment of the loan.

While this process is consistent across the financing industry, it never hurts to talk with your lender to determine if their AR financing process is different.

Types of AR Financing

If you’re considering AR financing, you’ll typically have two main options, but there are also some smaller, less frequently used variants. Let’s break down each one and how they differ from each other.

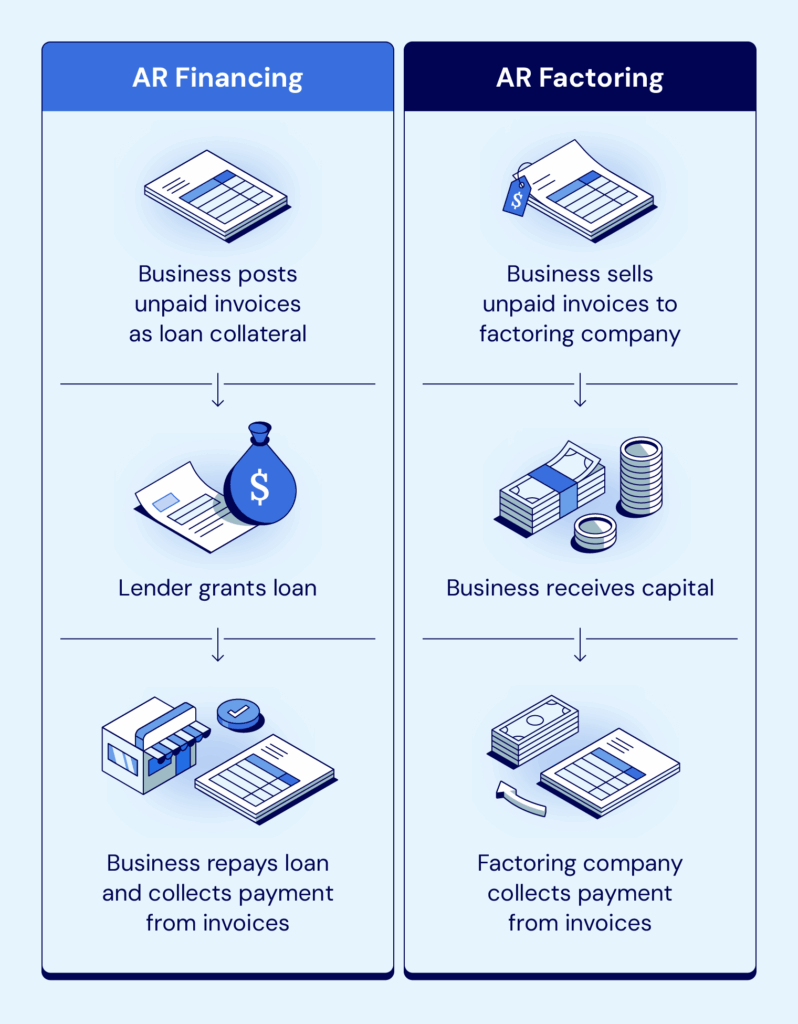

Accounts Receivable Loans

As we’ve mentioned, asset-based lending allows businesses to borrow capital from a lender against their unpaid invoices. The lender determines a percentage of the value of the receivables and offers the business a line of credit. The business then receives payment from clients and, in turn, repays the loan. This type of accounts receivable financing allows businesses to keep control of their invoices.

Invoice Factoring

Invoice factoring is hiring a factoring company to oversee receivables and manage payment collection with clients. The business sells these unpaid invoices at a discounted price, and the factoring company advances a portion of the overall invoice value – between 70% and 90% – to the business immediately.

Other Variations and Types

Some other variations and types of AR financing and invoice factoring include:

- Recourse factoring: The business assumes risk by having to buy back receivables that the factoring company was unable to collect.

- Non-recourse factoring: The factoring company takes on most of the financing risks.

- Spot factoring: This is similar to invoice factoring but involves selling one large invoice instead of a series of invoices.

- Invoice discounting: A similar process to invoice factoring but is more private, as customers typically will not realize you’re using an invoice discounting provider.

Once you’ve decided to use AR financing, be sure to talk with your lender about which option makes the most sense for your specific situation.

Accounts Receivable Financing vs. Factoring

Let’s break down accounts receivable financing and invoice factoring by looking at some of the key differences:

| Factors to Consider | AR Financing | Invoice Factoring |

|---|---|---|

| Ownership | Stays with business | Transferred to factoring company |

| Risk | Stays with business | Business (with recourse factoring) / Factoring company (with non-recourse factoring) |

| Cost | Lower interest rates and fees | Higher fees |

| Interest | Charged on borrowed amount | No interest charged |

| Structure | Set up as loan with unpaid invoices as collateral | Unpaid invoices are sold to third-party factoring companies at a discount |

Benefits of AR Financing

AR financing is appealing to businesses for many reasons. Here are a few of the benefits that might attract a business to use this financing option:

- Improved cash flow: One of the primary benefits of borrowing against accounts receivable is the immediate access to growth capital. This quick cash infusion helps businesses meet short-term financial obligations, such as payroll, rent, and inventory purchases, without disrupting operations.

- Flexibility: AR financing offers significant flexibility and speed compared to traditional financing methods. The approval process for borrowing against accounts receivable is typically faster and less stringent, as lenders focus on the creditworthiness of the invoiced customers rather than the business itself.

- Diminished need for collateral: Unlike traditional loans that often require additional collateral, such as real estate or other significant assets, AR financing uses the business’s invoices as collateral. This reduces the need for additional collateral, making it an accessible option for businesses that may not have valuable assets to pledge or want to pledge them.

- Simple application process: Since the invoices serve as collateral, the application process with AR financing is typically simpler and smoother than the traditional loan process.

While this process does have its fair share of benefits, accounts receivable financing also has some potential risks.

Risks of AR Financing

Like many other financing options, AR financing comes with a few associated risks – including possible high costs, customer relationship impacts, and a heavy dependence on the quality of unpaid invoices.

- Potential high costs: One of the main risks associated with borrowing against accounts receivable is the potential for high costs. Factoring fees can range from 1 to 5 percent of the invoice value per month, which can add up quickly. These fees make AR financing more expensive than a traditional loan in the long run.

- Impact on customer relationships: Using a factoring company means that the responsibility for collecting payments shifts from the business to the lender – meaning customers will now interact with a third party for payment issues. Some customers may perceive this as a sign of financial instability, which could impact their trust and confidence in the business.

- Dependence on AR: Accounts receivable financing heavily depends on the quality and reliability of a business’s receivables. If the business has customers with poor credit or a history of late payments, it may face challenges securing favorable terms or even approval for financing.

Businesses will want to carefully consider the benefits and risks of AR financing before stepping into the application process.

Factors to Qualify for AR Financing

Once a business has decided to pursue AR financing, the company will need to make sure it meets certain criteria before applying. Some of the factors to consider include:

- Business history: To appeal to lenders, the business should have been operating for at least six months while generating consistent revenue.

- Creditworthy customers: The lender will want favorable customer credit profiles and will likely prefer larger accounts over small- to medium-sized businesses.

- Invoice quality: The quality of the invoices is based on legitimate sales to creditworthy customers. They should also be clear, accurate, and free of disputes or contingencies.

- Industry: Businesses in certain industries may find it easier to qualify for AR financing if the lender specializes in those same industries.

These factors can vary by lender, and this isn’t an exhaustive list, so make sure you know what your lender is looking for so you’ll have the best chance of qualifying for financing.

Secure Better Financing with National Business Capital

Accounts receivable financing is a quick and simple way for a business to improve cash flow and maintain working capital. Using outstanding invoices, the business can access funds quickly while being more flexible with customer payments. By carefully evaluating and choosing the financing option that best fits its needs, a business can grow more efficiently and effectively while also maintaining smooth operations.

While National Business Capital can help you with any AR financing needs, we also provide small business loans and other financing options. If you’re ready to start the process, find out what you may qualify for by filling out our digital application.