Economists have been debating the possibility of a recession for nearly a year now. This began when the U.S. experienced two consecutive quarters of negative gross domestic product (GDP) in the first half of 2022.

Treasury yields first inverted in March 2022, which sometimes acts as an indicator of a coming recession. But the labor market and consumer spending remain strong, and the most recent Consumer Price Index (CPI) reading suggests inflation is slowly starting to wane.

Then Silicon Valley Bank collapsed in March 2023, followed by Signature Bank days later, triggering fears of a banking crisis. Still, smaller banks are taking the biggest hit, which has negatively impacted the businesses and consumers they lend money.

Small Banks Forced to Tighten Lending Standards

JP Morgan, Wells Fargo, and Citigroup all reported record earnings during the first three months of the year, bringing in more than analysts had projected. The banking crisis seems to have strengthened the country’s largest banks while weakening small to mid-sized banks.

Earnings reports showed that a record outflow of deposits from smaller banks led to huge inflows for large banks. This may be because large banks are seen as a safer option by some consumers.

The problem is that banks with less than $250 billion in assets account for a significant portion of business and consumer lending. Goldman Sachs found that these banks account for 50% of commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.

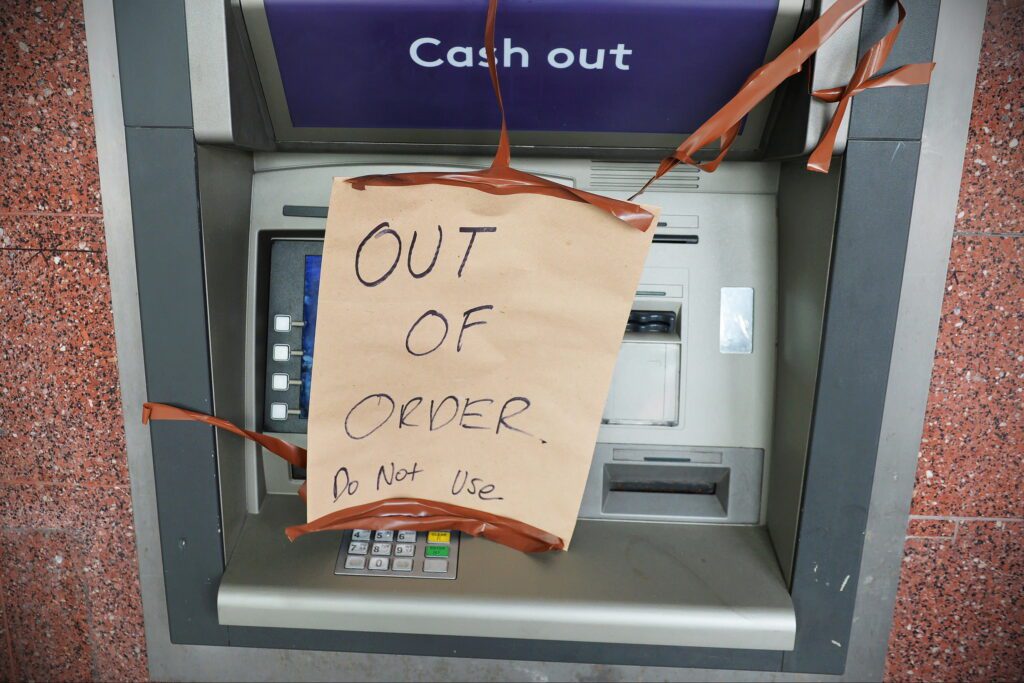

If this trend continues, small banks will be forced to tighten their lending policies, hurting many businesses and consumers. This led Moody’s to downgrade 11 regional banks due to “a deterioration in the operating environment and funding conditions.”

How to Access the Capital You Need

The U.S. may be headed toward a recession, but most economists and financial experts agree it will likely be mild. The biggest threat seems to be to small to mid-sized banks, which will negatively impact businesses and consumers that rely on these banks for lending.

According to the National Federation of Independent Business, most small business owners are pessimistic about future economic conditions, and most find it harder to access loans than three months ago.

If economic conditions begin to worsen, the most important thing businesses can focus on is access to cash. Cash will give small businesses the resources they need to continue to operate and pay employees and vendors.

For that reason, many businesses will turn to business loans or lines of credit to access the capital they need. Banks and credit unions tend to offer the lowest rates on loans, but the funding process takes longer, and these loans will be increasingly harder to access.

That’s why you might consider applying with a non-bank lender since they provide a streamlined application process and fast funding. If you opt for a lending marketplace, you’ll submit your application once and receive offers from multiple lenders.