Table of contents

Businesses in the manufacturing industry hold unique importance in our economy. It’s a powerhouse industry that creates substantial value through innovation, and it’s evolved and expanded over the years – as have the sophisticated solutions for manufacturing financing.

From manufacturing business loans and lines of credit to alternatives like invoice financing, leveraging the right financial tools can help your business meet current needs and plan for future growth.

In this article, we’ll look at how manufacturing financing works, what types of lending products are available, and explore how you can qualify and apply for the financing you need to achieve your business goals.

What Is Manufacturing Financing?

Manufacturing financing consists of specialized financial products designed to address the unique financial issues businesses in the manufacturing industry face. Flexibility and easy access to capital are key.

From covering labor costs and purchasing raw materials to fueling expansion, these term loans and lines of credit allow manufacturers to invest in their operations without compromising cash flow.

How Does Manufacturing Financing Work?

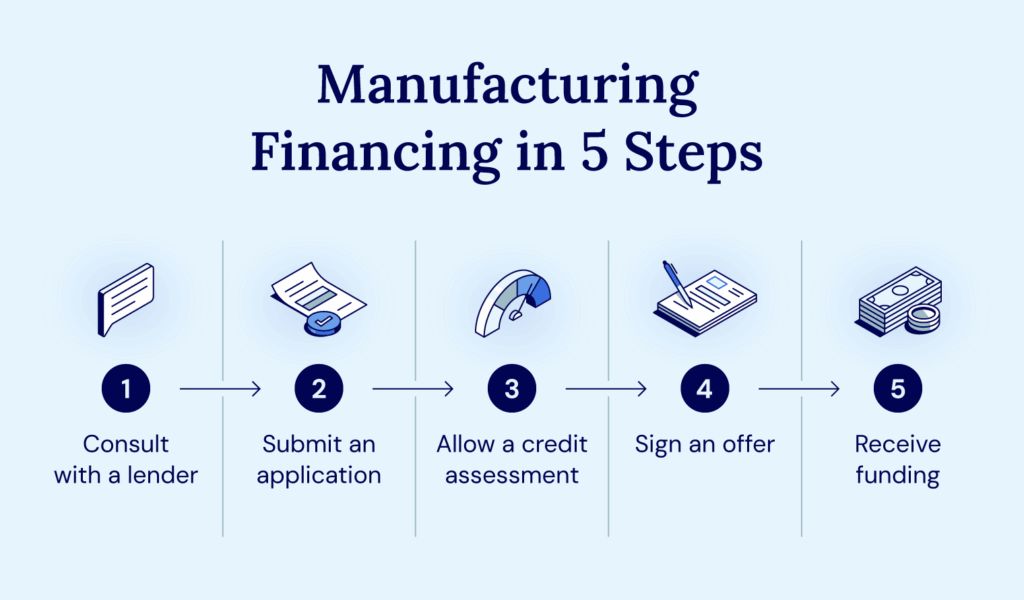

There are multiple stages to the manufacturing financing process. Here are the key process steps you can expect when applying for loans, lines of credit, and other financial solutions.

- Initial consult with a lender: Meet with a lender to review your available financing options and learn more about their financing process.

- Submitting your application and documentation: Fill out your application and submit it along with additional documentation the lender has requested, like tax returns, business plans, etc.

- Credit and risk assessment of your business: The lender reviews your application, supporting materials, and creditworthiness before extending an offer.

- A financing offer is issued, and the agreement is signed: Based on their review, the lender extends you a financing offer with set terms. You and the lender sign the agreement if the offer is mutually acceptable.

- Disbursement of the funds: The capital is disbursed to the appropriate account, and you can begin utilizing funds as needed.

The length of each of these steps and the lender's requirements depend on the type of financing you seek. In the following sections, we will delve into core manufacturing lending options as well as common alternatives like net terms and factoring to help you choose the best financing strategy for your business needs.

Types of Manufacturing Financing

There are many types of financing for manufacturers, each addressing a specific business need. Here are seven funding solutions for everything from purchasing new equipment to financing expansion.

Secured Loans

This type of manufacturing loan is secured by one or more business assets, including equipment, property, or inventory. Secured loans, like SBA loans, come with a set payoff period or term, typically ranging from one to ten years, and are ideal for funding significant one-time expenses, like business expansion.

Unsecured Loans

Similar to a secured loan, an unsecured loan gives a business one-time access to significant capital with a set loan repayment period. However, qualifying for this type of term loan without collateral will depend entirely on creditworthiness, making this financing solution best for well-established companies.

Lines of Credit

A business line of credit offers businesses access to capital as needed, up to a set limit. Interest is charged only on the amount drawn, not the entire credit line. This flexibility makes this financing option a good choice for covering ongoing expenses or for use as an emergency fund.

Invoice Financing

This type of short-term business loan offers manufacturers immediate access to cash. By leveraging outstanding invoices, a business can access the funds to cover payroll and bills while completing large orders.

Factoring

A different way of leveraging invoices is to sell them to a factoring company. The factoring company will then collect payment directly from a manufacturer’s customer. Invoice factoring gives manufacturers quick access to cash and can be a good choice for smaller businesses that don’t mind another company taking over payment collection.

Net Terms

This financing solution consists of an agreement between a manufacturer and a supplier. The agreement's purpose is to extend the time the manufacturer has to pay an invoice for goods or services. Net terms are typically 30, 60, or 90 days.

Asset Finance

Asset finance involves funding the acquisition of manufacturing equipment and other assets like vehicles or warehouse space. You can handle this in two ways: by taking out a secured loan with a defined repayment period or by leasing/renting the needed assets. Both options give manufacturers immediate access to the assets needed without high upfront costs.

How Does Manufacturing Financing Benefit Businesses?

Running a successful manufacturing business requires a significant investment of time and capital. Access to financing, such as a line of credit or term loan, can provide your business with crucial benefits needed for long-term success.

- Access to capital: Have capital when you need it. With ready access to capital, manufacturers can cover costs to update equipment or expand operations on a schedule that suits their business needs.

- Improved cash flow: With financing in hand, manufacturers can navigate periods of inconsistent cash flow with greater confidence.

- Business growth: A business that expands can serve more customers. As a manufacturer, having the funds to increase warehouse space can allow you to buy new equipment or hire essential staff.

- Flexible terms: Manufacturers aren’t like other businesses. Having flexible terms allows businesses in the manufacturing industry to maintain cash flow and budget for the future.

- Competitive edge: With access to funds when they need it, manufacturers can exceed market demands and compete more effectively against their rivals.

What are your business goals? With access to capital through loans for manufacturing companies, lines of credit, and other financial tools, you can accomplish those goals.

How to Qualify for Manufacturing Financing

Once you’ve decided to seek capital, you’ll need to start finding the right lender and applying for financing. From reviewing your business finances to receiving the funds, here are the four steps you’ll need to take.

1. Assess Your Capital Needs

Before diving into the loan application process, assessing your business’s financial health and determining your specific needs is essential.

- Review Financial Statements: To understand your financial position and borrowing capacity, review balance sheets, income statements, and cash flow statements in detail. This will help you better understand the full financial picture.

- Evaluate Costs: Identify all potential costs associated with your funding goals. For instance, an expansion may require purchasing more advanced manufacturing equipment, hiring additional staff, and expanding your facilities.

- Project Cash Flow Fluctuations: Can your business cover new loan payments? Assess your current cash flow and estimate what your business's cash flow might look like in the long term.

Once you have a good idea of your capital needs, you can proceed to the next step.

2. Gather the Required Documentation

A well-prepared loan application includes comprehensive documentation. Get a head start by gathering documents that give lenders a clear understanding of your business’s financial health and financing needs.

- Craft a Business Plan: Create a detailed business plan that outlines the purpose of the requested financing, details how the funds will be spent, and explains how you will make payments.

- Prepare Financial Statements: Prepare recent financial statements, tax returns for the past two to three years, and documentation detailing owner equity to give lenders insight into the finer details of your operations.

- Estimate Future Cash Flow Based on Financing: Provide projections that show how the funds received will impact revenue and cash flow, including best-case and conservative estimates.

Depending on the lender and financing type you choose, you may need to obtain additional documentation before you can apply.

3. Consult with Lenders and Apply

Now that you’ve strategized and gathered the necessary documents, you can take the next step: finding the right lender and applying.

- Consult with Lenders: Contact potential lenders to discuss financing needs and explore available options. This conversation is essential for understanding the types of term loans your business may be eligible for and the corresponding terms.

- Submit Application and Supporting Documents: Once you’ve found the right lender and financing option, you’ll need to submit your loan application and all relevant documentation. This usually consists of financial statements, business plans, tax returns, and any additional documents the lender requests.

Once you’ve submitted your application, the process will move to the lender for the next steps.

4. Review, Make a Decision, and Receive Funding

Waiting for a lender to review your application and make a decision will take time and may require quite a bit of back-and-forth communication. Regardless of what type of financing you seek, it's important to keep a close eye on the process and respond to lender requests quickly to ensure timely receipt of funds.

- Wait for Application Review: After receiving the application, the lender will begin reviewing it. This process involves evaluating the business’s financial stability, the feasibility of your financing request, and the ability to repay the loan. Additional documentation or clarification on submitted documents might be needed.

- Negotiate with Lenders: If the lender’s initial offer doesn’t fully meet your business’s needs or expectations, there may be room for negotiation on the loan amount, interest rate, repayment terms, or other conditions.

- Receive Final Approval and Loan Disbursement: The loan will be formally approved once both parties agree on the terms. The final step involves signing the loan agreement and disbursing the funds, which should arrive promptly.

To save time and reduce stress during the application process, consider partnering with National Business Capital so our business advisors can help you find the best financing solution to suit your business needs.

Explore Manufacturing Financing Options with National Business Capital

The world of manufacturing financing is complex, and a wide range of funding options are available. Whether you need several million dollars in financing or simply cover a few overhead costs, acquiring financing has significant benefits. But, finding a solid lender is key.

National Business Capital understands the manufacturing industry and the inherent challenges you face. We offer a straightforward application process and provide dedicated Business Finance Advisors who guide you every step of the way. Don’t let a lack of funds distract you from growth opportunities; complete your digital application today.