Table of contents

You've got three growth plans ready: a bulk order to lock in discounted supplier pricing, a striking seasonal marketing campaign, and you want to open a pop-up in an amazing location. You check your business line of credit rates and discover that your lender's taking such a big cut that they’ll make more of your ideas than you will. That’s when you know it’s time to find a better deal.

Read on to find out what business line of credit rate lenders currently charge, how they decide on their rate, and how to get a better deal for your business.

What is the average interest rate of a business line of credit?

Business line of credit rates vary depending on your lender. At traditional financial institutions, rates can vary – banks traditionally give rates at prime plus 2–3% – but the current rates are:

- Variable interest rates: 8.6% at metropolitan banks and 8.3% at regional banks

- Fixed rates: 7.4% at metropolitan banks and 8.4% at regional banks

Alternative and private credit lenders charge anywhere from 7% to 25%, which can rise to 60% for businesses with a bad credit rating.

Average rate for business lines of credit by lender type

The type of lender you use for your business line of credit partly determines the rate you pay.

Here’s how business line of credit rates average out across lender types:

| Type of financing | Interest rate |

|---|---|

| Banks | 7.4%-8.6% |

| Non-bank | 7%-25%, higher for bad credit |

Remember that the average rate is just the starting point. Loan fees, closing costs, and maintenance charges increase the cost of credit.

Current business line of credit rates comparison

In addition to lender type, factors like your business credit score, financial performance, facility size, and industry directly impact your business line of credit rate.

One way to see that in action is by comparing starting rates across different lenders. Each one tends to specialize in a particular type of business or funding need:

| Lender | Best use case | Starting rate |

|---|---|---|

| National Business Capital | Large credit lines | 1% per month |

| Lendio | Low-credit-score companies | 0.64% per month |

| Wells Fargo | Sub-$500,000 revenue businesses | 0.77% per month |

| OnDeck | Sub-$250,000 credit lines | 3.85% per month |

| TD Bank | Interest-only repayments | 0.69% per month |

| Bank of America | General SMBs | 0.77% per month (unsecured), 0.71% per month (secured) |

| Rapid Finance | High-risk businesses | Not publicly available |

Some things to keep in mind:

- The table shows starting rates as monthly interest percentages.

- Wells Fargo and TD Bank charges depend on the Federal Reserve rate. For this article, we've set that at 7.50%.

- You pay interest on the outstanding principal and not the full credit limit.

Deep dive: Best business line of credit lenders

Below, find a list of seven of the top lenders, including who they work with, how quickly they fund, and the pros and cons of each service.

1. National Business Capital: Best for large credit lines

| Line of credit amounts | Starting interest rate |

|---|---|

| $250K to $15M | 1% per month |

National Business Capital specializes in high-limit credit lines between $250,000 and $15M. You can choose between weekly or monthly payments and repay your facility early with no penalty.

Limited liability companies (LLCs), corporations, and partnerships can all apply to borrow up to the value of their collateral on secured lines and their revenue on unsecured lines.

“Ours is a fast and easy process that we try to make as stress-free as possible,” says Matt Presta, financial advisor at National Business Capital.

He continues, “Our relationship managers move quickly to turn funding around, but we also take time to understand each client’s long-term goals. We’re here to support companies through every stage of growth – not just offer a one-time facility."

Lines of credit are just the beginning for most National Business Capital clients. As they move through different stages of development, they return to their Business Advisor for term loans, cash flow financing, equipment financing, and other packages.

Pros:

- Competitive rates on secured and unsecured credit lines

- Interest rates start at 6%

- Easy application process

Cons:

- Interest rates and terms vary

- Not designed for startups

This funding can go toward projects like fueling their expansion, competitor acquisitions, and other long-term growth projects.

2. Lendio: Best for businesses with a low credit score

| Line of credit amounts | Starting interest rate |

|---|---|

| $1,000 to $250,000 | 0.64% per month |

Lendio connects businesses with secured and unsecured credit lines from $1,000 to $250,000. Most lenders on the platform accept credit scores starting around 600. Some providers release funds within two business days. Interest rates vary widely, starting at 8% and stretching up to 60%.

Arrangement fees can be up to 5%. The company works with companies in business for six months or longer with a minimum monthly revenue of $8,000.

Pros:

- Secured and unsecured credit lines

- Lower credit scores accepted

- Limited trading history accepted

Cons:

- Up to 60% interest, far higher than credit cards

- $250,000 max is limiting

- 5% arrangement fee may be charged

3. Wells Fargo: Best for companies with sub-$500,000 revenue

| Line of credit amounts | Starting interest rate |

|---|---|

| $5,000 – $150,000 | 0.77% per month |

Two of Wells Fargo's BusinessLine and Small Business Advantage products, neither of which requires collateral, target smaller businesses, an underserved market. Rates start at prime plus 1.75% and the maximum limit is $150,000. Its other product, the Prime Line of Credit, offers secured facilities of up to $500,000 on a three-year term or $1M on a one-year term.

The minimum credit score is 680, and applications can take up to two weeks to process. Larger facilities require additional documentation and collateral, and businesses seeking a limit of $250,000 or more must meet with a relationship manager.

Pros:

- Unsecured credit lines for new businesses

- Linked Mastercard to access funds

- Rewards program available

Cons:

- $90-$175 account fee

- 0.5% opening fee

- Advance fees on OTC and wire transfers

4. OnDeck: Best for sub-$250,000 credit lines

| Line of credit amounts | Starting interest rate |

|---|---|

| $6,000-$250,000 | 3.85% per month (average) |

OnDeck offers business credit lines between $6,000 and $250,000 on 12, 18, or 24-month terms, aimed at businesses seeking short-term liquidity. Annual percentage rates start at 29.9% and reach up to 65.9%, with the average customer paying 52.6%.

A $20 monthly maintenance fee applies. OnDeck typically requires a personal credit score of 625, at least $250,000 in annual revenue, and a minimum of two years in business. Credit lines are not available in North Dakota or in certain restricted industries.

Pros:

- 24/7 access to capital

- Soft credit check only

- Build up your credit rating

Cons:

- Average APR 50%+

- $20 monthly maintenance fee

- Personal guarantee required

5. TD Bank: Best for interest-only repayments

| Line of credit amounts | Starting interest rate |

|---|---|

| $250,000 – $500,000 | 0.69% per month |

TD Bank offers business lines of credit ranging from $250,000 to $500,000, with rates starting at prime +0.74% annually. It offers an interest-only repayment option to reduce clients' minimum monthly repayment; however, repayments will not impact the account's principal balance.

Customers must renew the facility annually and pay an annual fee on limits over $250,000. The bank requires a personal credit score in the high 600s and will take accounts receivable as collateral on secured lines. For credit lines above $250,000, you must apply in person at a local branch. TD currently operates in 15 states and Washington, D.C.

Pros:

- Interest-only repayments available

- Free waived on smaller credit lines

- 600-700 credit score applicants considered

Cons:

- 12-month renewal

- Limited geographical coverage

- Apply in person for $250,000+ lines

6. Bank of America: Best for SMBs

| Line of credit amounts | Starting interest rate |

|---|---|

| $250,000 (unsecured) and $250,000 (secured) – upper limit not advertised | 9.25 % APR (unsecured), 8.50 % APR (secured) |

Bank of America's Business Advantage Credit Line is for established SMBs with predictable revenue and owners with a personal FICO score of 700 or higher. Unsecured lines offer a $250,000 minimum, and to qualify, businesses need at least two years of trading history and $250,000+ in annual revenue.

Secured lines offer a minimum $250,000 at a slightly lower interest rate but require $250,000+ in annual revenue. Secured customers may use a blanket lien or a Bank of America CD as collateral. Applicants may also need a BoA business checking account to qualify.

Pros:

- $250,000 annual revenue minimum for unsecured

- $250,000 annual revenue minimum for secured

- Reward program reduces interest rates

Cons:

- High credit rating required

- Annual account reviews

- Blanket lien for collateral

7. Rapid Finance: Best for high-risk businesses

| Line of credit amounts | Starting interest rate |

|---|---|

| $5,001-$250,000 | Varies – interest or fixed fee (not publicly disclosed) |

Rapid Finance provides revolving credit lines from $5,001 to $250,000 to newer companies and ones with weaker credit reports. Term ranges from as little as three months to a more manageable 18 months. Businesses can transfer funds to their business checking account by ACH or a Rapid Access Card linked to the borrower’s account.

Daily, weekly, or monthly payments are available. The lender performs a soft credit check during prequalification and a full check when a customer applies for business financing. Secured lines may require a blanket lien over business assets.

Pros:

- Instant drawdown of approved funds

- Fast application process

- Choose daily, weekly, or monthly repayments

Cons:

- No published rates

- Account reviews as little as every three months

- $250,000 is too small for many SMBs

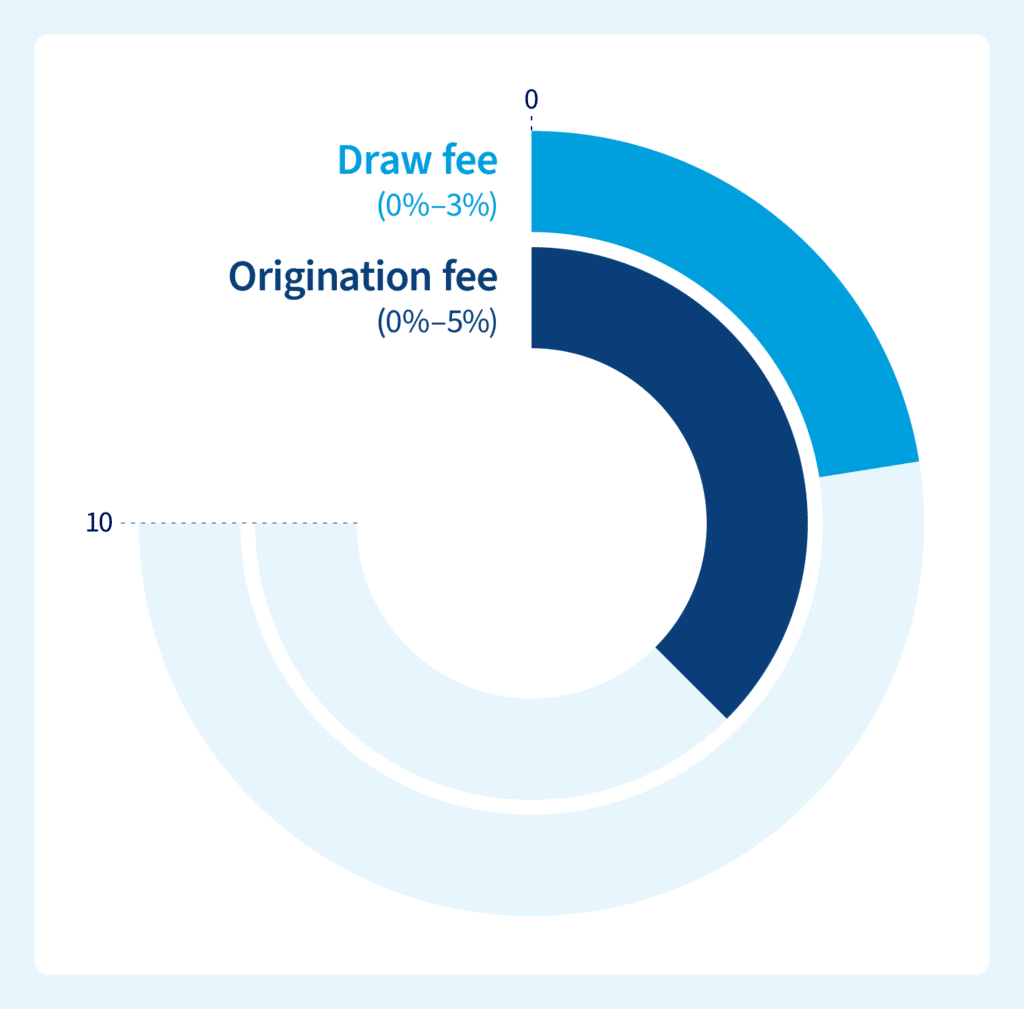

Business line of credit fees

Interest isn’t the only cost you’ll pay on a business line of credit, so a low rate doesn't always mean you get the best deal. Here are other fees to look out for:

Here's what each of these fees consists of:

| Annual fee | Some lenders charge a yearly fee to keep the credit line open, like Wells Fargo’s $90-$175 fee, even if you never use it. |

|---|---|

| Draw fee | Some lenders apply a percentage-based fee each time you draw down funds. |

| Maintenance fee | Monthly fees cover account servicing and reporting, like OnDeck’s $20 per month charge. |

| Origination fee | This one-off fee covers setup costs and other expenses, like Wells Fargo’s 0.5% charge based on account limit. |

Business line of credit alternatives

Business lines of credit work very well when business owners need to plug a gap in cash flow or invest in a short-term project to boost their revenue or capacity.

Other types of finance that can help include:

- Cash flow financing: Lenders evaluate your business's cash flow track record to determine funding eligibility, rather than relying on physical assets as collateral. You repay it weekly or monthly. Repayments fluctuate with your revenue, so you don’t fall behind during slower months.

- Term loans: You receive a lump sum payment upfront with term loans. You then make regular repayments over a fixed term until you clear the outstanding balance. Business loan interest rates are usually lower than line of credit rates.

- Equipment financing: Lenders fund the purchase of vehicles, machinery, or specialist tools, using the asset as collateral. Because the lender has security, they may offer a lower interest rate and a higher credit limit.

- Invoice factoring: Sell your outstanding invoices to a factoring company, and they pay you up to 95% of their value within 24 hours. When your customers pay, you get the balance minus your factorer’s fee. This can help unlock working capital tied up in unpaid receivables.

Speak to a National Business Capital business finance advisor to determine the right option for your company. Call us or contact us via our contact page.

How lenders set rates for business lines of credit

Lenders price all products, including long-term business loans and business lines of credit, based on how likely they think a borrower will pay everything back on time and in full, including interest and other charges.

Let's look at the five main factors lenders consider when setting an interest rate:

- Security: Collateral like real estate, vehicles, or unpaid invoices reduces lender risk by providing assets to sell if borrowers default, allowing lenders to offer lower interest rates on secured loans. For unsecured solutions, lenders view the lack of collateral as a higher risk since they have no guaranteed recovery method. This increased risk exposure leads to higher interest rates to compensate for potential losses.

- Account size: Larger loan amounts, like $1M+, create greater absolute loss exposure for lenders compared to smaller $50,000 facilities, prompting them to charge higher rates to offset this increased risk. The substantial capital at stake requires lenders to price more conservatively. Higher loan amounts therefore typically command premium interest rates.

- Repayment period: Longer repayment terms reduce monthly payment pressure on borrowers' working capital, decreasing default probability and allowing lenders to offer more competitive rates. Extended timeframes like 25-year commercial mortgages versus two-year terms demonstrate this principle. Lenders reward borrowers with lower rates when repayment schedules are more manageable.

- Credit profile: Strong personal and business credit scores demonstrate reliable payment history, enabling lenders to offer lower rates due to reduced default risk. Borrowers with marginal credit face higher rates as lenders require additional documentation and charge premiums for increased uncertainty. Credit strength directly correlates with the interest rate lenders are willing to extend.

- Line of business: Industries with stable revenue streams and reliable payment histories like professional services receive preferential rates due to predictable cash flows. Riskier sectors such as construction, transport, or food service face higher rates because of volatile income patterns and elevated default probabilities. Lenders adjust pricing based on industry-specific risk profiles.

Add all of those factors together, and that's how lenders decide whether to approve your application and what to charge you. In the next section, we’ll look at how to tip the odds in your favor.

How to get the best business line of credit rate

Give lenders every reason possible to have confidence in your ability to make all repayments on time. A good credit score is a great start, but keep your recent bank statements and financial forecasts ready. If they ask what the capital is for, explain how you'll use it so they can see your purpose and plan.

Offering collateral and signing a personal guarantee is also a good move. That shows you have faith in yourself and helps reduce the lender's risk by taking some of it on yourself.

Fulfill your growth potential with a flexible line of credit

A business line of credit boosts your working capital at the moment you need it, whether you're funding a new contract, launching a marketing campaign, or managing cash flow while waiting for customers to pay their invoices. Choosing the right facility with the limit you need and competitive interest rates gives you the capital to move your business forward without draining your reserves.

National Business Capital is here for every stage of your business journey, from arranging lines of credit today to equipment financing when you need to build your new, expanded premises.

We’ve secured over $3B+ in funding, with credit lines ranging from $250K to $15M+. Choose us as your partner for business growth at every stage of your journey.Complete our digital application form and let’s get you funded.