Table of contents

Successful businesses track everything that goes into and comes out of their operations. One way that entrepreneurs will do this is through their cash flow statement—a living document that follows the cash coming into and leaving your business.

There are a few different components to this statement, with each being equally as important as the last, but it’s essential for any entrepreneur to familiarize themselves with the entirety of their cash flow statements to ensure they’re not spending more than they’re earning.

Cash flow statements are broken down into 3 categories:

- Cash Flow From Investing Activities

- Cash Flow From Operating Activities

- Cash Flow From Financing Activities

1. What Is Cash Flow From Financing Activities?

Cash flow from financing activities describes the incoming and outgoing capital that a business raises and repays, whether through debt financing, equity financing, or dividend payments.

Basically, it’s the money you receive from securing financing for your business and the money you’ve spent to pay off that expense, minus any dividends you paid out to shareholders.

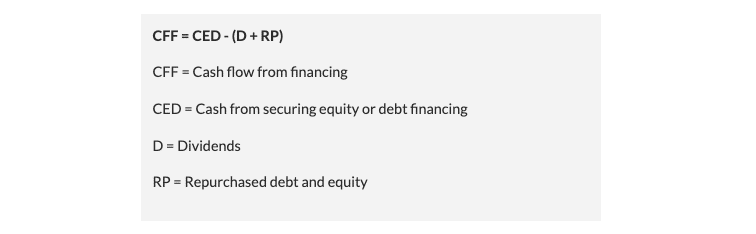

It sounds complicated, but it gets easier once you know the cash flow from financing activities formula:

Let’s break this down: Your Cash Flow From Financing Activities balance will equal the capital you’ve secured through capital markets minus your dividends plus what you’ve repaid on your financing.

This formula will allow you to see the progress you’ve made on your repayment over a set period of time.

If the result is a positive number, this means that your business has increased its cash reserves and, therefore, expanded its overall assets. A negative balance indicates that you’ve paid out more capital than you’ve secured. For example, a negative balance can result from issuing dividends to shareholders or paying off long-term debt.

Any business that has a financing relationship should also evaluate its Cash Flow From Financing Activities (CFF) on a consistent basis to make sure they’re in a good financial position. By doing so, you can stay on top of your borrowing and notice problems before they go too far.

2. What Are Some Examples of Financing Activities?

Some of the most common examples of financing activities for CFF (Cash Flow From Financing Activities) include treasury stock, business loans, new stocks or dividends.

Financing activities will differ depending on your type of business, but here are a few of the most common financing activities found on cash flow statements:

- Purchasing/selling treasury stock

- Securing/repaying a business loan

- Issuing new stock

- Paying dividends to shareholders

- Issuing/redeeming bonds

Small businesses won’t have stock or dividend transactions on their cash flow statement, so they’re mostly concerned with securing and repaying business loans they’ve secured.

However, this component of your cash flow statement is important for any business, even one that isn’t publicly traded.

You need to have a solid understanding of your cash flow to make educated decisions in your business moving forward.

If you don’t, you might make a move that isn’t financially viable for your company at that time, potentially creating a very restricting scenario and limiting what your organization can achieve.

3. What Are the Three Components of a Cash Flow Statement?

Cash flow statements include three key components: cash flow from investing activities, cash flow from operating activities, and cash flow from financing activities.

3.1. Cash Flow From Operating Activities

Your cash flow from operating activities is the cash you generate from providing your product or service minus the amount you’ve paid for expenses and other business expenditures.

Essentially, it’s the money you make minus the money you’ve spent over a given time period.

The total amount will be either positive or negative depending on how your business performed within the time frame you’re evaluating, with positive balances showing that you earned more than you spent.

If your total is negative, you’re paying more in expenses than you are generating, which is a red flag of uneven business performance.

3.2. Cash Flow From Investing Activities

This section includes the cash you generate from the purchase and sale of long-term assets, such as equipment, real estate, and facilities.

If you’re selling more than you’re buying, the total amount of your cash flow from investing activities will be positive, showing that you’re bringing in more cash than you’re investing.

A negative result doesn’t necessarily mean that your business is in jeopardy; It simply means that you’re investing more than you’re selling.

However, it’s still important to monitor these numbers to ensure you’re able to respond to an unforeseen challenge or afford a growth opportunity.

3.3. Cash Flow From Financing Activities

As stated above, cash flow from financing activities describes the money your business generates from financing activities and how much you’ve repaid.

It includes equity financing, debt financing, and dividend payments you’ve given to shareholders. When you’re looking to calculate this component of your cash flow statement, you’ll take the amount of capital you’ve secured through financing over a period of time and subtract the amount you’ve repaid.

The total amount will stand as your cash flow, with a positive value displaying that your business gained more in assets than it lost through repayment.

Cash flow is difficult to manage at any stage of business. It requires you to take yourself out of the day-to-day and focus on the finer details, which might not be what you want to do at the end of a long day.

However, regardless of how tedious of a task it is, consistently monitoring your cash flow is one of the best ways to keep your business on a path toward success.

4. Why Are Financing Activities Important?

Financing activities are important because they can help you see exactly how much you still owe on a business loan. Essentially, they are a running total of your outstanding loans and how much you’ve repaid.

While you might be able to keep track of your payments in your head, monitoring your cash flow from financing activities is an easy way to see what’s left of your business loan. It’s also a great resource for entrepreneurs who take out more than one business at a time.

Tracking your financing activities is just as important to investors and lenders as it is to you. When you apply for a business loan, the lender you’re dealing with performs a comprehensive evaluation of your business to determine the level of risk associated with financing your operation.

They’ll review your financial information, including your cash flow, credit history, and revenue reports, to see if your business is capable of paying back the borrowed amount within the term.

Expect all three components of your cash flow statements to be heavily scrutinized during this process. The lender will evaluate your operating, investment, and financing activities to understand your business’s revenue sources and financial health.

If your cash flow is positive and you’re earning more than you’re spending, you have a good chance of reaching an approval.

5. What’s the Difference Between Debt and Equity Financing?

The difference between debt and equity financing is the way you acquire capital for your business. Debt financing involves taking out a conventional loan, while equity financing involves securing capital in exchange for business ownership.

5.1. Debt financing

Debt financing is much as the name suggests—you’re taking on financial debt in exchange for capital for your business. You’ll repay the borrowed amount over the length of the term and, if you make timely payments and don’t default, come out on the other side with no debt attached to your name.

Debt financing comes in a variety of forms, including term loans, business advances, equipment financing, and much more. You can secure a debt financing option through banks, credit unions, online lenders, and FinTech marketplaces, like National Business Capital.

5.2. Equity financing

Equity financing, on the other hand, involves transferring a portion of the equity in your business to an investor to raise capital. Think of it like the popular TV show Shark Tank, where the investors offer funding to business owners in exchange for a percentage stake in their company.

Most entrepreneurs try to avoid this option because they want to maintain equity in their business, but if you’re finding it difficult to secure other methods of financing, it might be worth considering.

However, there’s almost always a way around equity financing, especially in our modern world. Debt financing has become more accessible with the emergence of online lenders and FinTech marketplaces, which has allowed more entrepreneurs to secure the funds they need to grow without sacrificing ownership.

There are options for startups, those with bad credit histories, and other situations where you’d typically have trouble reaching an approval; You just need to be savvy enough to find the right lender for your specific circumstances.

6. What Are the Most Common Debt Financing Options?

The most common debt financing options include term loans, business lines of credit, equipment financing, revenue-based financing, and SBA loans, among others.

Entrepreneurs commonly leverage debt financing options to secure the resources they need to tackle challenges and grow. There are various different forms of debt financing, such as:

| Type of Financing | Description |

|---|---|

| Term Loans | Term loans are a one-time lump sum payment that you must repay within the term outlined by your lender. You’ll pay interest on top of the borrowed amount, and you may need to offer an asset as collateral to “secure” the financing. |

| Business Line of Credit | A business line of credit is a credit line that you can draw from whenever you need cash for a business expense. Once you pay off the amount you’ve borrowed, you can draw from the same funds again, allowing you to stay one step ahead of the latest challenge. |

| Equipment Financing | If you’re looking to break down a sizeable equipment purchase into more manageable monthly payments, you can’t go wrong with equipment financing. This financing option allows you to afford the expensive equipment you need when you need it, but you’ll have to pay an interest rate on top of the equipment’s price as well. |

| Revenue-Based Financing | Revenue-based financing is essentially a loan for your future sales. Lenders will review your financial information to determine how much revenue your business will generate in the future, then offer you funding based on that amount. You’ll have to pay a portion of your future sales to the lender, however, as they’ll charge a fee for providing the service. |

| SBA Loans | SBA loans come in many shapes and sizes, but all of them are provided through the Small Business Administration and SBA-sponsored lenders. You can secure up to $15 Million through their 7(a) and 504 programs. You can leverage their microloan program for smaller amounts, which features borrowing amounts of up to $50,000 and flexible terms. |

If you’d rather skip the line and streamline your search for financing, look no further than National Business Capital, the market leader in $250k to $5m transactions.

We’re a time-saving machine for business owners, complete with an award-winning team behind every deal. Our expert Business Finance Advisors take the time to learn about you, your business, and the challenges you’re facing to find the RIGHT lender for your business through our exclusive, long-standing relationships.

We’re in the business of helping you get back to business; Speak with our team today and see how National Business Capital can help you set your plans into motion.

7. Streamline Your Search for Competitive Financing Options With National Business Capital

Cash flow statements are essential to the survival of your business, and Cash Flow From Financing Activities can be a good way to give a boost to your business.

Every entrepreneur should familiarize themselves with their cash flow from investing activities, cash flow from operating activities, and cash flow from financing activities to ensure that their business is in a good financial position to continue serving customers at the pace they expect.

It’s difficult to learn about it, but once you do, you’ll have a much better grasp on the strength of your business and, more importantly, the opportunity to fix cash flow problems before they start causing an issue.

While your cash flow from operating and investing activities is often easier to determine, that doesn’t mean you should neglect the third component, especially if your business is actively involved in financing your growth.

Most successful businesses have secured financing at one point or another to streamline their growth, and you can follow suit if you feel that you’re ready to take your business to the next level.

Once you do, you can give the experienced Business Finance Advisors of National Business Capital a call, and they’ll connect you with the right lender for your specific circumstances using exclusive lending relationships.

Speed, simplicity, and professionalism—just a few things you can expect from National Business Capital’s award-winning team. With over $3 billion secured through 25,000+ transactions since 2007, we’re uniquely capable of helping you secure the funds you need to grow your business.

Complete our digital application today, and take the first steps toward your full potential!