Table of contents

There’s no doubt that commercial real estate can be volatile in terms of supply and demand, and few industries have had to deal with those ups and downs like construction companies. Construction financing is a helpful method for these companies to withstand that unpredictability and ensure reliable growth and flexibility, no matter the market conditions.

Construction funding helps companies keep cash flow stable and can also help companies expand, reach new markets, and ultimately build a successful long-term business. In this article, we’ll look at the ins and outs of this type of financing, the potential benefits of a construction loan, and how it may help your construction business survive and thrive.

Key takeaways

- Construction financing provides flexible funding for equipment, materials, and operational costs.

- Down payments typically range from 20-30%.

- Options available include lines of credit and equipment financing.

What is construction financing?

Construction financing is an easy method for construction companies to acquire needed funding. Some uses might include:

- Expanding contract labor

- Acquiring needed permits

- Buying equipment

- Building materials

This is just a short list of ways you could take advantage of construction financing. Like any other type of financing option, you’ll need to meet certain requirements to qualify for a construction loan.

How does construction financing work?

Let’s say your construction business has a huge job coming up next year. You’ve completed this type of job before, but this particular project is on a different scale. You need more equipment, and lots of it. In that type of situation, you might strongly consider getting temporary financing for the new equipment.

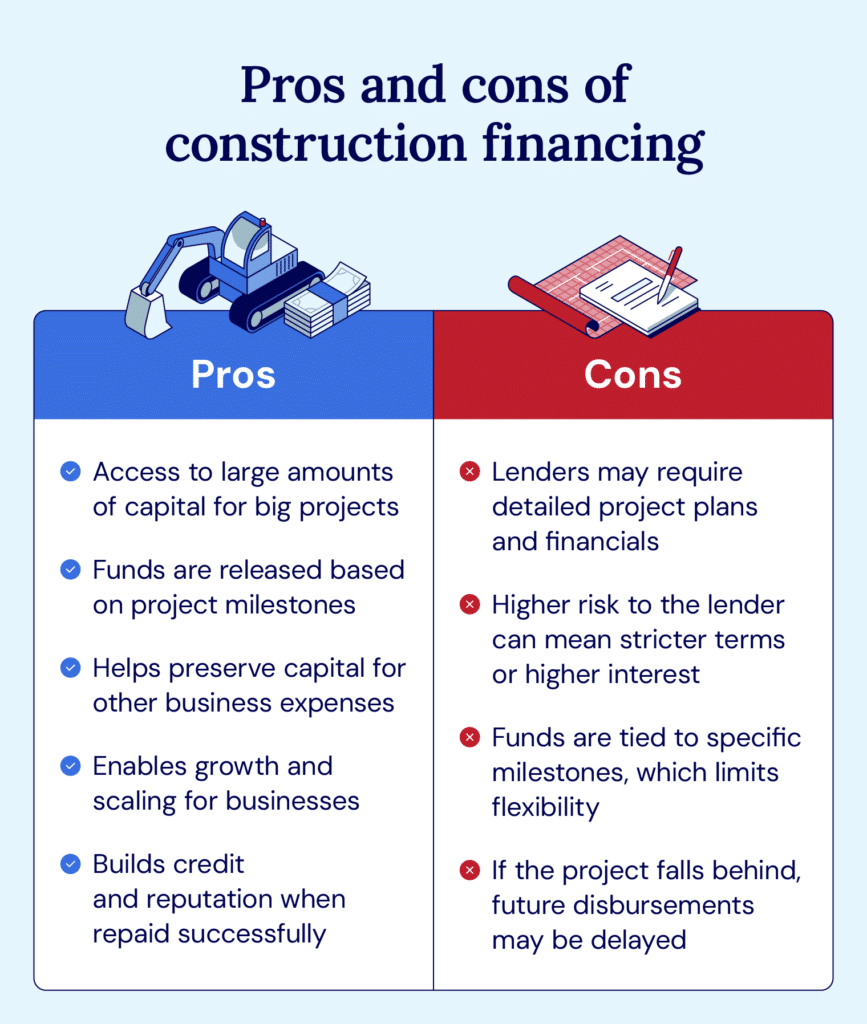

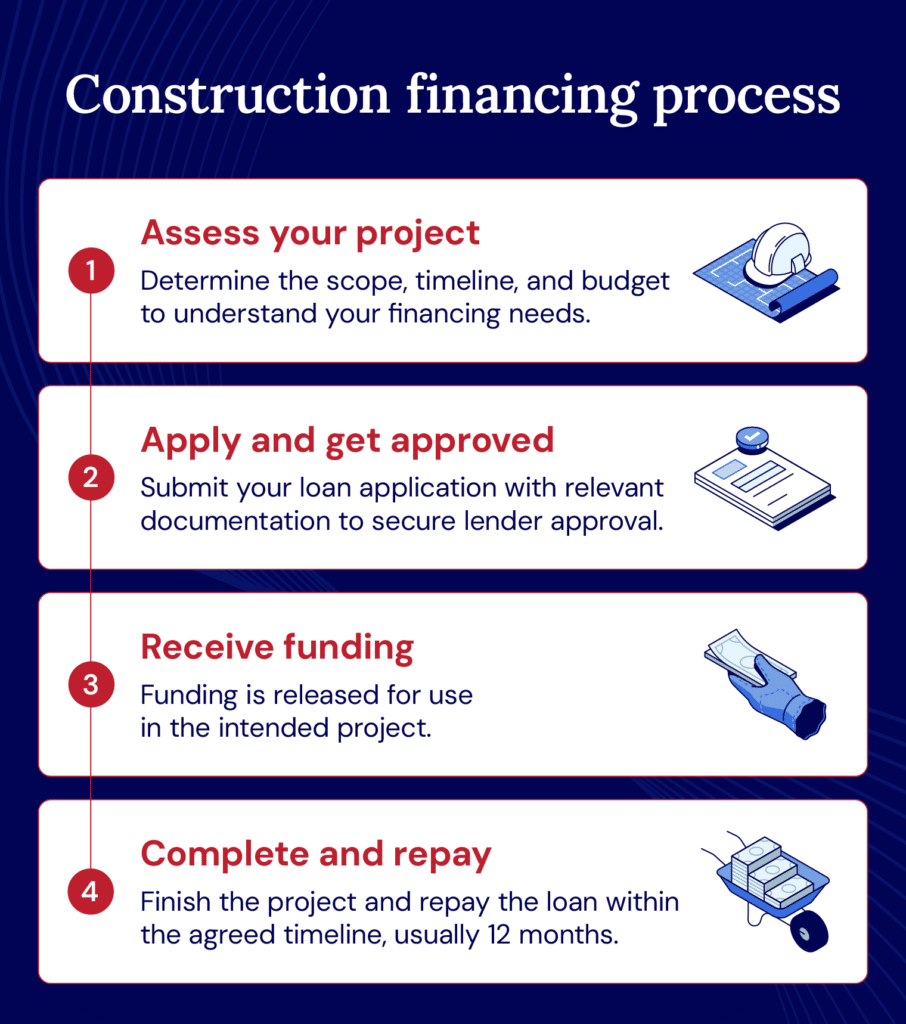

The next piece is learning how to get funding for a construction company, and that starts by simply getting approved. Once your business receives construction financing, you’ll have until your term is up to finish the building process and repay the loan. The lender will want detailed information about the project in order to guarantee funding.

To qualify, you’ll need to be a licensed and experienced construction business with a good credit history and financial track record. This is mainly because banks view these types of loans as riskier because of the amount of capital involved and the potential for construction projects to go unfinished, leaving the bank with no collateral.

How do contractors qualify for construction financing?

As we mentioned, financing for construction companies requires the business to provide detailed information. Some examples include:

- Positive financial record: Lenders take on risk when offering construction loans and other financing options. Your credit helps offset that. You’ll need a strong credit score of at least 680 and proof of enough income to justify the loan.

- Completed construction plan: The lender will want detailed information on the plan before it releases financing.

- Proof of licensing and experience: Most lenders will only deal with licensed contractors who have experience making profits and repaying loans.

Be sure to ask your lender about all the construction financing requirements you’ll need to meet before applying. They might also be able to offer simpler construction financing process alternatives.

Types of construction financing for contractors

Contractors have a wide range of options when it comes to construction financing. Some may make more sense for your business than others, so research to find the best loan option. Here are some common examples.

Cash flow financing

This is usually a short-term loan that provides immediate funding without collateral. Cash flow financing might be used in urgent situations, such as the need to meet payroll. Because of the lack of collateral, this financing option comes with higher interest rates.

Business line of credit

A construction line of credit is like any other business line of credit. It offers flexibility since it allows you to draw funds only when needed. The better your credit, the more funds you’ll have access to. This financing option is a revolving line of credit, which means you can repay the loans and then borrow again. You’ll have to pay interest on the capital you actually borrow.

Equipment financing

Equipment financing is a great option for funding the purchase of construction equipment, such as machinery, vehicles, or other tangible assets needed for business operations. It’s designed to be used exclusively for this purpose, and usually, the equipment itself serves as collateral.

Find construction financing options that suit your needs

Contractors and construction companies are like any other business that relies on cash flow, ongoing profit, and steady business to grow and thrive. Construction financing can help these businesses take better control of cash flow management, bridge a short-term gap, and build for the future.

If you’re not quite sure whether construction financing is a fit for your business, National Business Capital can guide you through the entire process, from a quick beginning consultation to completing a financing application. Feel free to reach out to us today.