Table of contents

Looking for fuel to add to your business’s fire is no easy feat. Many thriving small and medium-sized businesses struggle to figure out how to get a business loan. Fortunately, we’ve made it easy by breaking down the process. This article will walk you through the six simple steps to secure commercial funding for businesses so you can feel confident applying for a loan.

1. Decide What Type of Loan You Need

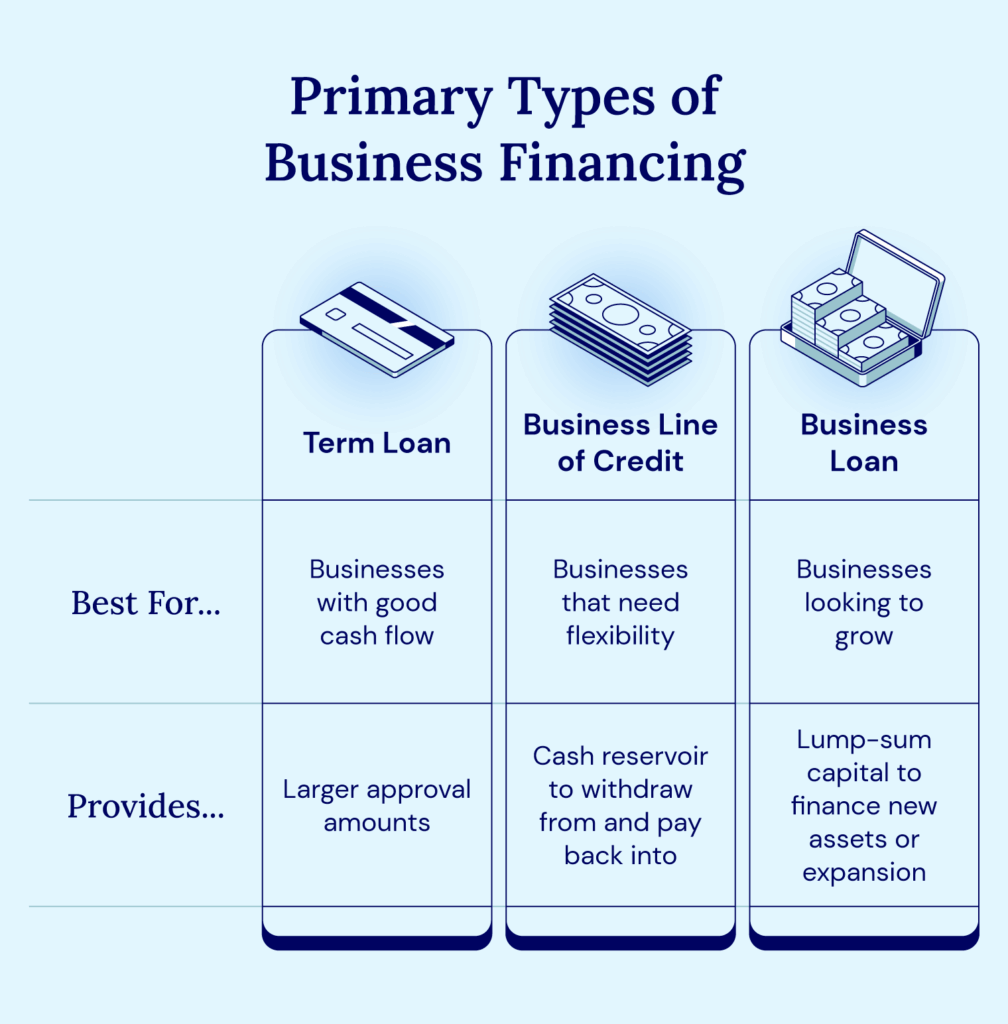

There are three main types of business loans. They each serve different purposes, and you’ll want to know which option is best for you before sitting down with a lender.

- Term loan: This is for businesses with good cash flow. Lenders aren’t willing to approve business loans without at least a couple of months of business history or any revenue. In this case, you’ll have to explore business credit cards or personal loans.

- Business line of credit: This flexible type of financing gives you access to a reservoir of cash you can use for a large variety of expenses. Simply withdraw funds, repay, and reuse up until your credit limit. Revolving business lines of credit are ideal for ongoing or unexpected expenses, such as payroll, cash flow disruptions, marketing initiatives, inventory purchases, or even as an emergency fund.

- Business loan: Business loans work best when you use them to invest in your next phases of growth. Whether it’s a government-backed SBA loan or a traditional loan, you can access a large lump sum of capital to buy equipment, real estate, inventory, open a new location, and ultimately grow your business.

While other types of business financing are available, these three options are the most common loans for traditional small- and medium-sized businesses.

2. Determine if You Qualify for a Business Loan

A small business loan brings about many benefits, but not every business will qualify. While some lenders can be more lenient than others, your ability to secure a small business loan boils down to several factors – take a look.

“Having a strong business credit profile helps ensure SMB owners have a high chance of approval. When they don't have business credit, lenders will rely on the owner's personal borrowing history to assess risk. Any unsecured financing that a business is committed to repaying, on schedule, increases their odds for future financing opportunities.”

–Josh Gold, EVP of Sales at National Business Capital

Do You Meet the Minimum Credit Score Requirements?

Your credit score is one of the most important factors lenders will look at while evaluating your application. Prepare for a business credit check as well as a personal credit check. If your business hasn’t developed a credit history, your personal score will have more weight. It’s important to note that Banks and credit unions rarely approve a small business loan if your credit score falls below 700, but private credit lenders tend to be more lenient.

Have You Been in Business Long Enough?

Small business loan term lengths usually start at one year and can go upwards of 20 years. Lenders want to ensure your business has a solid track record to mitigate risk. Most banks and credit unions will require at least two years of business history. Anything less, and you could be turned away. Private lenders tend to be more flexible about business history requirements – most will be willing to approve businesses with six months to one year of operations.

Do You Make Enough Money?

Banks and credit unions want to see at least $250K of consistent annual revenue to secure a small business loan. Private credit lenders are less strict, and some may be willing to approve your business if it can show at least $120K in annual revenue. Make sure to contact prospective lenders and ask about their minimum revenue requirements for a more exact estimate.

Can You Afford the Payments?

Strong revenue is a positive signal to lenders, but only so long as expenses aren’t eating up a large portion of that income. Lenders want to know that you can comfortably repay your business loan. Your cash flow, or the money moving in and out of your business bank account over time, indicates whether you’ll be able to manage your business loan payments.

Ideally, you’ll want your total monthly gross income to be at least 1.25 times your total monthly expenses – including the loan payment. This ratio might vary according to different lenders, so make sure to ask each prospective lender about their preferred income/expense ratio.

Do You Have Collateral?

Some lenders will insist you secure your small business loan with collateral. Loans where lenders have put up collateral, otherwise known as secured loans, are seen as less risky in the eyes of lenders than loans without collateral or unsecured loans. Collateral is any type of asset you or your business owns.

Types of collateral include real estate, accounts receivables, inventory, and even equipment. In the event you fail to repay your business loan, the lender can seize the assets you’ve used as collateral – so be cautious about lending terms for large secured business loans.

Tip: Collateral can raise your borrowing amount and even get you a lower interest rate in some cases. Unfortunately, collateral loans can be very risky, as they give the lender the right to come after your business and personal property. You should exercise caution before using your assets as collateral.

3. Compare Small-Business Lenders

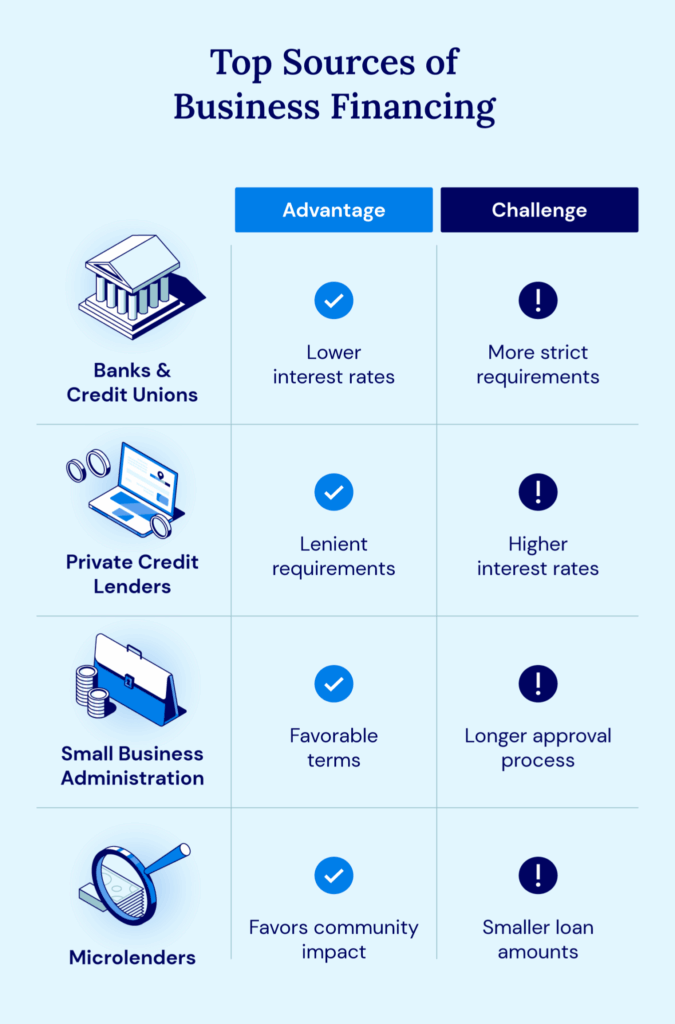

The next step is deciding which type of lender you’d want to work with. You have four main options: banks and credit unions, private credit lenders, the government, and microlenders.

For additional funding options, check out our ebook: How To Get Business Financing When Banks Say No.

Business Loans From Banks & Credit Unions

Banks and credit unions offer business loans, business lines of credit, refinancing options, and more. The best part about working with traditional lenders is that they tend to offer lower interest rates. However, these lenders also maintain strict requirements. You’ll need to have been in business for at least two years and have good credit to qualify for bank lending.

It’s important to remember that the application process at banks and credit unions is notoriously slow. Receiving funds can take several weeks or months, and any mistakes or errors on forms can set you back. For this reason, bank and credit union business loans may not be a great option for companies that need funding fast.

Business Loans From Private Credit Lenders

Private credit lenders and fintech companies tend to be very lenient regarding requirements. It’s possible to secure financing even if you’ve only been in business for a few months. These lenders are also more likely to consider approving businesses with less-than-perfect credit or lacking in collateral.

Alongside greater approval odds, private credit lenders work a lot faster than banks or credit unions. It’s possible to receive funding in a matter of days – sometimes hours. On the downside, business loans from private lenders tend to have higher APRs than banks.

Business Loans From the Government

The Small Business Administration (SBA) offers several loan programs to help small businesses access funding. These loans often come with favorable terms, including lower interest rates and longer repayment periods.

However, the SBA loan requirements can be strict, and the process can be complex, requiring extensive documentation. Eligibility requirements can also be strict, and approval times can vary. For those reasons, government-backed loans are best suited for businesses with time to navigate the process.

Business Loans From Microlenders

Microlenders are mission-based organizations that provide small business loans to businesses that may not qualify for traditional financing. These loans are typically under $50,000 and are geared toward startups and businesses in underserved communities.

Microlenders often prioritize social impact alongside financial returns, making them a good option for businesses with a strong community impact. However, the smaller loan amounts might not be sufficient for businesses with significant funding needs.

Are you interested in receiving more business insights like this? Subscribe to our Newsletter here!

4. Gather the Required Materials for Business Loan Approval

Before applying, it’s important to review and gather all required documents. Below, we’ve outlined the most common documents requested. Take the time now to locate the following files and make sure they’re easily accessible:

- Business and personal tax returns

- Business and personal bank statements

- Business legal documents (proof of ownership, commercial leases, franchise agreements)

- Business plan

The exact documents you will be asked to provide will depend on your lender. For example, the process of how to get a small business loan will differ from getting a loan for larger businesses. In addition, most private credit lenders won’t ask for a business plan. But doing the research in advance and gathering all required documents will help keep you prepared, avoid mistakes, and even possibly speed up the application process.

5. Apply for a Business Loan

Now that you know how to obtain a small business loan, you’re ready to apply for one. You can do that easily with National Business Capital, where we take pride in our streamlined, client-focused process. We’re a direct private credit lender that also partners with 75+ lenders, allowing you to apply once, receive multiple offers, and choose the best possible solution based on your business qualifications.

Once you’ve selected a lending partner and have gathered your required documents, move through the application process. With National Business Capital, it’s a frictionless process – complete the application in minutes and upload your documents with zero risk. Then, compare offers and make the right selection for your business.

6. Review Your Loan and Collect Your Funds

Now, the moment you’ve been waiting for: Time to claim your funds and reach your goals. When you receive offers from National Business Capital, you can compare them with expert advice from our team and select the best one for your specific circumstances. Our Business Financing Advisors can even help you get started by finding the perfect financing solution for your business.

Learn more by filling out our digital application.

Choose a Lender With a Client-Focused Approach

Figuring out how to get approved for a business loan can be complex, and choosing the right small business lender matters. If you know how to secure business financing but can’t find the right option that suits your business, your growth opportunities may be limited. However, if you work with a private credit lender like National Business Capital, you can lean on expert Business Financial Advisors to compare offers and help you understand your options. That way, you stand to find a financing solution that’s a perfect fit for your business goals.