Table of contents

Long-term business loans are a popular resource when covering the cost of large capital expenditures or planning for major growth moves.

With long repayment periods and reasonable interest rates, long-term loans can enable you to tackle your business goals without compromising your cash flow. Let’s explore the different types of long-term loans available, how to get a loan, and learn more about the top seven long-term business loan lenders.

What is a long-term business loan?

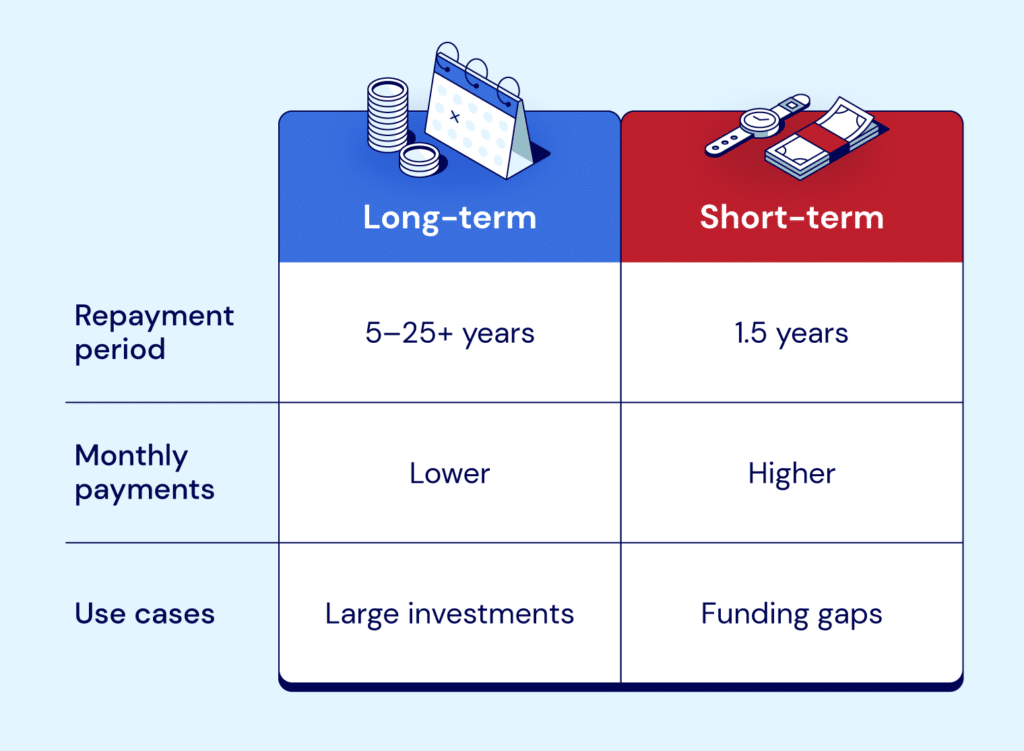

A long-term business loan is a type of loan that you repay over an extended period of time, typically one year or more. The average repayment term on a long-term business loan falls between two and five years, but some can be as long as 25 years.

These loans are ideal for large-scale investments. Heavy equipment purchases, acquisitions, and extensive growth projects are just a few good reasons to go with long-term financing options.

7 best long-term business loans

Many types of lenders offer long-term business loans, from traditional banks and credit unions to private credit lenders and other financial companies. Here is a quick comparison of the seven top lenders and their long-term loan options.

| Lender | Best for | Max loan amount | Term length | Minimum interest rate |

|---|---|---|---|---|

| National Business Capital | Personalized loan solutions | $15 Million | Up to 5 years | 12% |

| Bank of America | SBA loans | $15 Million | Up to 25 years | Varies |

| TD Bank | Credit lines | $15 Million | Up to 25 years | Not disclosed |

| Credibly | Cash flow loans | $15 Million | Up to 10 years | Not disclosed |

| SoFi | Equipment financing | $2 million | Varies | Not disclosed |

| Fora Financial | Small loans | $1.5 million | Up to 18 months | 1.11 factor rate |

| Lendio | A variety of loan types | $2 million | Up to 10 years | 8.49% |

Best long-term business loans at a glance

From basic terms loans to flexible equipment financing options, each of the top seven long-term business loan lenders offers a range of loan products and services. Let’s take a closer look at terms, loan types, and the reputation of each of these companies.

National Business Capital

- Best for: Personalized loan solutions, advisor service

- Maximum loan term: 5 years

- Loan types offered: Cash flow financing, secured loans, equipment financing, line of credit, and SBA loans

- Funding speed: As little as 24 hours

- Trustpilot rating: 5 stars

As a private credit lender, National Business Capital works to find the best options for your company. When you apply, you get personalized guidance from a Business Advisor, a wide variety of loan types to choose from, and a quick application-to-funding speed. This attention to service has earned National Business Capital a five-star reputation.

Bank of America

- Best for: SBA loans

- Maximum loan term: 25 years

- Loan types offered: Term loan, secured loan, line of credit, equipment loans, and SBA loans

- Funding speed: As little as 1 week

- Trustpilot rating: 1.3 stars

In addition to traditional banking services, Bank of America offers long-term business loans. The process of navigating SBA loans is particularly straightforward. However, borrowing requirements are high; you’ll need to have 2+ years in business and a credit score above 700.

TD Bank

- Best for: Credit lines

- Maximum loan term: 25 years

- Loan types offered: Term loans, secured loans, equipment financing, line of credit, and SBA loans

- Funding speed: As little as 1 day for loans under $250,000

- Trustpilot rating: 1.4 stars

TD is a full-service bank that offers several business loan options. One of their top products is credit lines, which provide borrowers with an interest-only repayment period. The downside to TD Bank is that the minimum requirements are high, and financing options are limited for small businesses.

Credibly

- Best for: Cash flow loans

- Maximum loan term: 10 years

- Loan types offered: Term loans, line of credit, equipment financing, SBA loans

- Funding speed: As little as 24 hours

- Trustpilot rating: 4.8 stars

While Credibly offers a few types of long-term loans, its primary focus is cash flow loans. The minimum credit score for this type of loan is only 500; however, the maximum repayment term is 24 months.

SoFi

- Best for: Equipment financing

- Maximum loan term: Varies

- Loan types offered: Equipment financing, line of credit, term loans, SBA loans

- Funding speed: As little as 24 hours

- Trustpilot rating: 4.3 stars

SoFi can be a great option for equipment financing. However, SoFi is not upfront about term lengths or APRs available, so you may not be able to get the terms you are looking for.

Fora Financial

- Best for: Small loans

- Maximum loan term: 18 months

- Loan types offered: Term loans

- Funding speed: As little as 24 hours

- Trustpilot rating: 4.5 stars

Fora Financial is a company offering quick funding times on small loans. Best for short-term loans, Fora Financial is not a good choice if you are looking for a repayment period longer than two years.

Lendio

- Best for: A variety of loan types

- Maximum loan term: 10 years

- Loan types offered: Line of credit, SBA loans, term loans, equipment financing, and acquisition loans

- Funding speed: as little as 24 hours

- Trustpilot rating: 4.7 stars

Lendio is a marketplace that matches you to the best loan offer. While they support many different loan types, there is zero transparency, and documentation requirements can be excessive.

How do long-term business loans work?

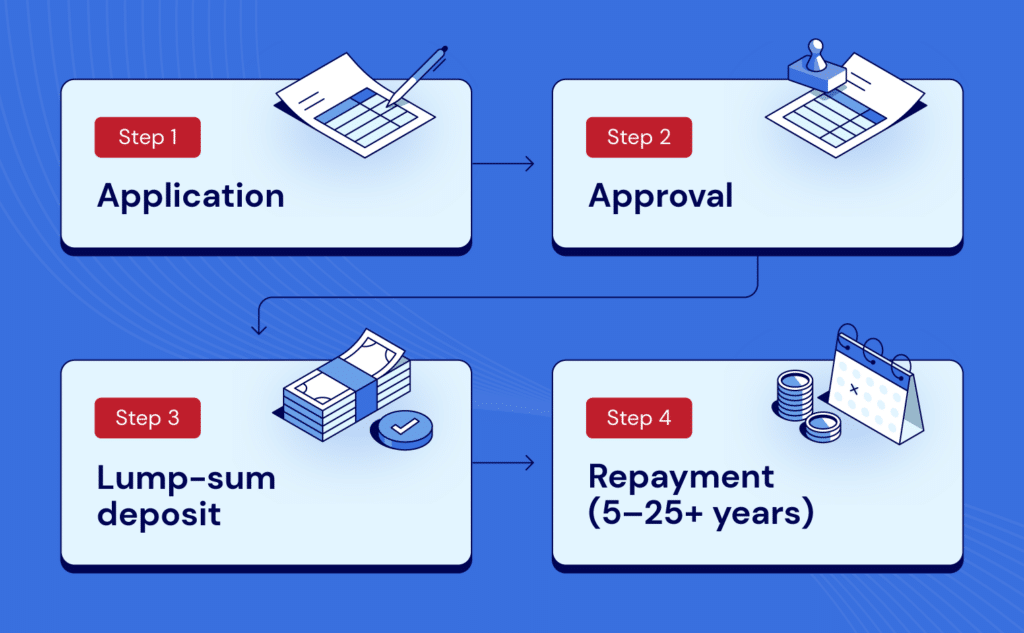

With a long-term business loan, you’ll agree on a set funding amount, interest rate, and repayment schedule with your lender. Your funds will be deposited upfront and in a single lump sum. From there, you can use the capital for your intended project and repay your debt over time.

The repayment period on long-term business loans often extends up to five years, or longer, depending on the lender. In fact, it’s not entirely uncommon for terms to span as much as 25 years.

Unlike short-term financing, where repayment periods are usually less than a year, long-term commercial financing allows business owners to pay off debt over a longer time frame. Because debt is stretched out over several years, monthly payments are typically smaller and easier to manage compared to shorter financing solutions. However, long-term financing can be more expensive over time due to interest.

Types of long-term business loans

There are different types of long-term business loans, including equipment financing, commercial funding, SBA loans, and term loans. Let’s review the most common long-term loan types and how they work.

Equipment financing

Equipment financing provides your business with the capital needed to purchase heavy equipment or machinery. These loans are popular with manufacturing and construction companies but can also be used to finance software systems, vehicles, office supplies, restaurant materials, and upgrade or repair existing assets.

The great thing about long-term equipment loans is that you may be able to finance between 80% and 100% of the equipment’s final costs. Even better, equipment financing allows you to break up the sizable cost of the equipment into manageable payments.

The underlying equipment itself functions as collateral for the loan. This means you won’t have to put your existing assets at risk. However, there may be cases where you’ll need to provide a down payment. In the event you’re unable to repay your loan, the lender will seize the equipment to recover their funds.

Term loans

With traditional term loans, you’ll receive a lump sum disbursement and a preset repayment plan. Most equipment loans, commercial real estate loans, and even SBA loans are set up as term loans.

With term loans, payments are typically fixed, not variable, so you’ll know ahead of time how much you’ll be paying and how frequently.

Term loans are great when you know exactly how much capital you’ll need to finance your goal. They help make large purchases or investments more manageable by distributing payments over a lengthy period of time. This way, you’ll be able to repay your debt alongside generating income rather than all at once.

SBA loans

Small Business Administration (SBA) loans are government-backed financing solutions. With the government covering a portion of your loan amount, lenders receive an extra layer of security, which can translate to lower interest rates for you. SBA loans range from under $50,000 up to $15 Million, and repayment terms can stretch as long as 25 years.

You can use SBA funding to cover working capital costs, hire employees, mitigate cash flow disruptions, expand your facilities, invest in marketing expenses, equipment purchases, and more.

In exchange for all their benefits, you’ll have to meet the SBA’s strict set of requirements along with the lender’s separate requirements. Eligibility may be subject to revenue, credit scores, business size, etc.

Pros and cons of long-term business funding

Long-term business loans can be a valuable financial tool for small businesses. However, weighing the pros and cons before applying for a loan is crucial.

| Pros | Cons |

|---|---|

| • Lower interest rates • Larger loan values • Lower monthly payments | • Difficult approval process • Long application-to-funding tim • May require collateral |

How to get a long-term business loan

Getting a long-term business loan looks a bit different from other types of lending. First, there are often strict eligibility requirements, like:

- 1+ years in business

- Over $500,000 in annual revenue

Once you’ve met these basic minimum criteria, you can begin taking steps to search for and obtain a long-term business loan.

1. Shop around

There are many lenders and loan options available, which is why you’ll need to compare rates and terms to find the best long-term business loan for your company. The most convenient and comprehensive way to compare multiple loan offers side-by-side is through National Business Capital.

2. Complete the application

Once you’ve selected a lender and loan option that meets your needs, it’s time to apply for the loan. This typically involves completing the application and providing the required documentation, including financial statements and tax returns. You should also be prepared to answer questions about your business and how you plan to use the loan funds.

3. Close on the loan

The review and funding process can vary depending on the lender you’re working with. Banks and credit unions have extensive wait times ranging from several weeks to a few months, while private credit lenders are faster. Once you sign the loan agreement, the lender will complete your application and release the funds to you.

Find a long-term business loan fast & easy with National Business Capital

Whether you’re looking to expand operations, upgrade equipment, or fund an acquisition, long-term business loans can help you achieve your goals. With low interest rates, large loan amounts, and long repayment periods, you can secure the funding you need without compromising your future.

National Business Capital's business advisors can help you find the best long-term business loan solution. From equipment financing loans and term loans to SBA loans and asset-based lending, we offer a variety of financing solutions. Start your application today and take the guesswork out of finding the best long-term business loan.