Table of contents

Juggling employees, overhead, payroll, taxes, equipment, and seasonal fluctuations is all part of owning a restaurant. However, this can make it seem impossible for busy restaurant owners to pursue everything from big opportunities like relocating to everyday problems like broken equipment.

To help finance restaurant purchases without disrupting cash flow, most seek restaurant business loans from outside sources, including banks and private credit lenders.

But with so many options available, how do you even know where to start? Here's a breakdown of the types of restaurant business loans available and the best providers.

Table of Contents

Juggling employees, overhead, payroll, taxes, equipment, and seasonal fluctuations is all part of owning a restaurant. However, this can make it seem impossible for busy restaurant owners to pursue everything from big opportunities like relocating to everyday problems like broken equipment.

To help finance restaurant purchases without disrupting cash flow, most seek restaurant business loans from outside sources, including banks and private credit lenders.

But with so many options available, how do you even know where to start? Here's a breakdown of the types of restaurant business loans available and the best providers.

Table of Contents

- What Is a Restaurant Business Loan?

- Types of Restaurant Business Loans

- Where to Secure a Restaurant Business Loan

- Restaurant Lender Comparison Chart

- Best Restaurant Funding Providers

- Benefits of Restaurant Business Loans

- How to Get Funding for Restaurants

- How to Compare Business Loans for Restaurants

- Explore Restaurant Funding Options With NBC

What Is a Restaurant Business Loan?

A restaurant business loan is a financing option specifically designed to meet the unique needs of restaurant owners. These loans provide access to capital that can be used for various purposes, like purchasing equipment, renovating space, expanding operations, or managing cash flow.Types of Restaurant Business Loans

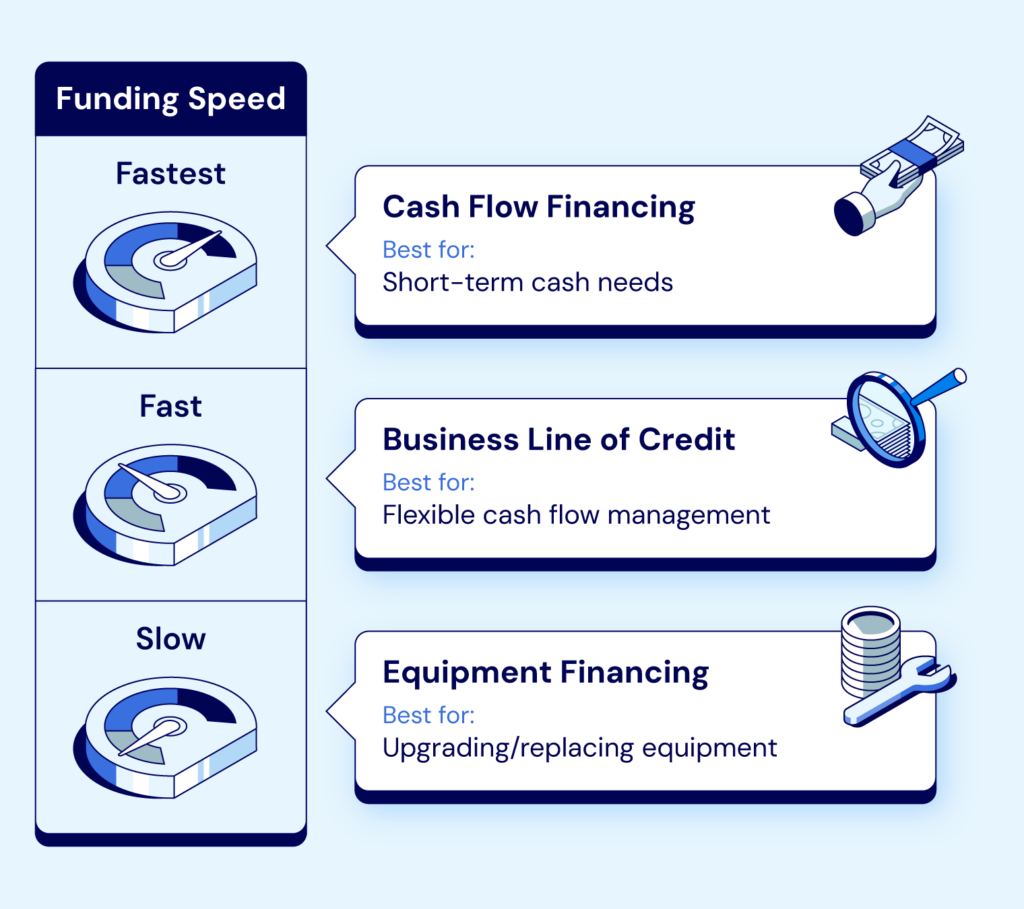

Restaurant business loans come in various forms, each with its own terms, eligibility requirements, and interest rates.| Best for … | Interest Rate | Loan Term | Funding Speed | |

|---|---|---|---|---|

| Business Line of Credit | Flexible cash flow management | Varies | Revolving | Fast (few days) |

| Equipment Financing | Upgrading/replacing equipment | Varies | 12-60 months | Slow (a few days to a week) |

| Cash Flow Financing | Short-term cash needs | Varies (based on revenue share) | 3 to 5 years | Fastest (24 hours) |

Business Line of Credit

Best for: Flexible cash flow management A restaurant business line of credit is one of the fastest, most convenient financing options available at your disposal, designed to meet the exact needs of your business. One of its best features is that you only pay interest on the amount that you use, not on the whole amount of the line of credit. Even if you do not have an immediate need for funding, a line of credit is always smart to have for emergencies or when an incredible opportunity arises. Restaurant owners have been taking advantage of business lines of credit for discounts on bulk purchasing, short-term cash flow, fast access to working capital, bridging of slow account receivables, and taking advantage of exciting opportunities with a small window to pay their taxes in a timely fashion. As opposed to other restaurant financing options, business lines of credit are revolving, which means that you can borrow up to a predetermined amount, pay, and draw more funds as needed. You can choose between an unsecured line of credit (doesn’t require collateral) and a secured line of credit (requires collateral).Equipment Financing

Best for: Upgrading/replacing equipment Among the most common restaurant financing options you can apply for is restaurant equipment financing. As a restaurant owner, you can lease or finance the necessary equipment to run your establishment. Leasing offers affordable monthly payments through customized terms specific to your business. There are typically comprehensive packages offered, ranging from 12- to 60-month terms, which offer a solution to any type of restaurant owner. This type of financing or leasing usually has great tax benefits as well. With restaurant equipment financing, it is also important to know that the financed equipment itself usually serves as collateral, potentially reducing the need for additional security. You can choose between fixed and variable interest rates.Cash Flow Financing

Best for: Short-term cash needs Cash flow financing provides a unique way for restaurants to obtain funding by tapping into their future sales. This model involves a lender essentially purchasing a percentage of your projected revenue at a discounted rate. It provides your restaurant with an upfront cash advance, repaid through a portion of your incoming revenue stream. This type of financing is often more accessible and efficient for addressing short-term cash needs, as most funds can be secured in 24 hours or less. Additionally, repayment is typically aligned with your daily sales, fluctuating based on your business performance rather than adhering to a fixed schedule. They're also typically unsecured, meaning you don't have to put up any collateral.Where to Secure a Restaurant Business Loan

Restaurant business loans can be secured from various sources, each with its pros and cons. Choosing the right lender depends on factors like repayment flexibility, credit score, and the urgency of funding. Here's a breakdown of each type of lender so you can make the best decision for your restaurant.| Best for … | Interest Rate | Loan Term | Funding Speed | |

|---|---|---|---|---|

| Private Lenders | Fast funding and flexible options | Varies (higher than banks) | Varies (shorter than banks) | Fast (24 hours - few days) |

| Small Business Administration (SBA) Loans | Low rates and longer terms | Prime rate | Up to 25 years | Slower (weeks to months) |

| Traditional Bank Lenders | Lowest rates and longer terms | Prime + 2-3% | Up to 10 years | Slower (weeks to months) |

Private Lenders

Best for: Fast funding and flexible options Private credit lenders have grown in popularity in recent years due to their fast, streamlined application process. They may offer more flexible repayment options than traditional banks. This route might also be better for restaurants seeking smaller loan amounts or those with less-than-ideal credit. While interest rates may be higher than a traditional bank loan, private lenders' requirements are typically more lenient, and some can help you secure funding faster.Small Business Administration (SBA) Loans

Best for: Low rates and long terms With prime rates, huge offers, and long terms, loans backed by the Small Business Administration are one of the best restaurant financing options for restaurant owners. However, many don’t know that SBA-supported loans are surprisingly hard to get. If you are one of the lucky ones who actually gets approved, your personal assurance and even collateral will certainly be needed to back the funding. You might find that when your own individual funds are on the line, the stress might make it harder for you to succeed. Fortunately, National Business Capital offers SBA loans with eliminated wait times, funding in as little as 24 hours, and an easier approval process! With SBA loans, you can get up to $5 million in funding, with repayment terms of up to 25 years.Traditional Bank Lenders

Best for: Lowest rates and long terms Compared to other financing options, they typically offer lower interest rates and longer repayment terms, making them suitable for long-term investments like purchasing property or major renovations. However, they have more stringent qualification criteria. Banks often require a strong credit score, a well-established business track record, collateral, and detailed financial documentation. The collateral requirement alone often makes this a nonviable option for restaurants. Additionally, the lengthy application process makes banks inaccessible for newer restaurants or those with less-than-perfect credit.Restaurant Lender Comparison Chart

| Lender | Best for | Max Loan Amount | Term Length | Minimum Interest Rate |

|---|---|---|---|---|

| National Business Capital | Diverse needs | $10,000,000 | Up to 10 years | 12% |

| Bank of America | Existing customers | $5,000,000 | Up to 25 years | Varies |

| OnDeck | Short-term needs | $250,000 | Up to 24 months | 27.3% |

| Rapid Finance | Low credit scores | $1,000,000 | Up to 60 months | Undisclosed |

| Lendio | Comparing lenders | $2,000,000 | Up to 10 years | 8.49% |

| Bluevine | Lines of credit | $250,000 | Up to 12 months | 7.8% *for 6 month term |

| Fora Financial | High revenue restaurants | $1,500,000 | Up to 18 months | 1.11 factor rate |

| Fundera | Fast funding | $5,000,000 | Up to 7 years | Varies |

Best Restaurant Funding Providers

The best restaurant financing options include SBA loans for favorable terms, equipment financing for upgrading tools, and lines of credit for managing expenses. Traditional bank loans offer additional flexibility and stability based on business needs and credit profiles. Here are the options you have for a variety of needs:- National Business Capital

- Bank of America

- OnDeck

- Rapid Finance

- Lendio

- Bluevine

- Fora Financial

- iBusiness Funding

- Fundera

1. National Business Capital

- Best for: Diverse needs

- Loan amounts: $10,000,000

- Starting interest rate: 12%

- Term length: Up to 10 years

| Pros | Cons |

|---|---|

|

|

2. Bank of America

- Best for: Existing customers

- Loan amounts: $5,000,000

- Starting interest rate: Varies

- Term length: Up to 25 years

| Pros | Cons |

|---|---|

|

|

3. OnDeck

- Best for: Short-term needs

- Loan amounts: $250,000

- Starting interest rate: 27.3%

- Term length: Up to 24 months

| Pros | Cons |

|---|---|

|

|

4. Rapid Finance

- Best for: Low credit scores

- Loan amounts: $1,000,000

- Starting interest rate: Undisclosed

- Term length: Up to 60 months

| Pros | Cons |

|---|---|

|

|

5. Lendio

- Best for: Comparing lenders

- Loan amounts: $2,000,000

- Starting interest rate: 8.49%

- Term length: Up to 10 years

| Pros | Cons |

|---|---|

|

|

6. Bluevine

- Best for: Lines of credit

- Loan amounts: $250,000

- Starting interest rate: 7.8%

- Term length: Up to 12 months

| Pros | Cons |

|---|---|

|

|

7. Fora Financial

- Best for: High-revenue restaurants

- Loan amounts: $1,500,000

- Starting interest rate: 1.11 factor rate

- Term length: Up to 18 months

| Pros | Cons |

|---|---|

|

|

8. Fundera

- Best for: Fast funding

- Loan amounts: $5,000,000

- Starting interest rate: Varies

- Term length: Up to 7 years

| Pros | Cons |

|---|---|

|

|

Benefits of Restaurant Business Loans

Restaurant financing offers several advantages, including access to capital for various needs like opening a new location, purchasing equipment, or covering operating expenses. Overall, it empowers businesses to grow and thrive in a competitive industry.Supports Business Growth

Financing provides flexibility in repayment terms, allowing businesses to align payments with cash flow. Additionally, it can help restaurants build credit and establish relationships with lenders, paving the way for future borrowing opportunities. Moreover, by spreading out costs over time, financing allows restaurants to conserve cash and maintain liquidity for day-to-day operations or unexpected expenses.Allows You to Maintain and Upgrade Equipment

Financing options can provide the necessary funds to repair or replace equipment without disrupting cash flow. Alternatively, it can allow you to upgrade to newer, more efficient equipment to potentially reduce energy costs and improve overall productivity. Either way, the funds can help the kitchen operate at full capacity and efficiency for maximum profitability.Helps You Meet Seasonal Changes

Business often fluctuates depending on the time of year. Financing can help restaurants manage these cash flow changes by providing capital during slower times to cover expenses and prepare for busier periods. This ensures stability and allows owners to plan and invest strategically rather than reacting to immediate financial pressures from seasonal changes.How to Get Funding for Restaurants

Before you dive in, make sure you understand qualification criteria like credit score requirements, business revenue and financials, time in business, and other risk factors. Josh Gold, VP of Sales for NBC, says a strong business credit profile helps ensure SMB owners have a high chance of approval. "When they don't have business credit, lenders will rely on the owner's revenue and personal borrowing history, among other factors, to assess risk. Any unsecured financing that a business is committed to repaying on schedule increases their odds for future financing opportunities," Gold explains. If you are ready to apply for restaurant financing, here are the steps that you will need to follow in order to get through the application process:- Step 1: Fill out an online application. Applications for private credit lenders like NBC don't take as long to complete and will never affect your credit score. You will only need to provide basic information, including your business name, email, and phone number, as well as your gross annual sales and time in business.

- Step 2: Connect with an expert restaurant financing advisor. After filling out your application, an expert advisor will call you in minutes. Tell them about the business goals that you need to accomplish so they can tailor the financing to fit your business's unique needs and obtain the perfect funding option with the terms you desire.

- Step 3: Determine the best restaurant loan for your needs. Once your formal application is completed with help from your expert business advisor, they will get to work to help find the perfect financing match for your restaurant, saving you the time and capital needed to do it yourself!

- Step 4: Analyze your options with your advisor. Consult with your advisor to compare the funding offers you receive and determine the best financing option with terms that best match your business needs.

- Step 5: Receive funds on your timeline. Through a simplified and expedited process that involves industry-leading experience and cutting-edge technology, you will receive the capital you need in as little as 24 hours.

How to Compare Business Loans for Restaurants

Before you apply for any type of restaurant financing options, here are some words of wisdom. Choosing the wrong lender will wind up hurting your restaurant more than helping, so choose wisely and do your research. Traditional lenders are known for giving restaurant owners the raw end of every deal. Approval is extremely difficult, and processing speeds are often sluggish at best. Choosing the right lender will result in easier approval, faster funding, and greater growth potential. Here are some aspects to keep in mind before getting a restaurant loan:- Purpose of loan: Different loans suit different purposes. For example, equipment financing is ideal for purchasing equipment, while a line of credit might be better for managing cash flow.

- Interest rate and fees: Compare APRs from different lenders and be aware of origination fees, closing costs, and prepayment penalties. A financial advisor can guide you through the best options for your situation.

- Terms: Consider repayment length and schedule. Longer terms mean lower monthly payments but more total interest. However, options like cash flow financing can be great for short-term needs with a more flexible repayment schedule.

- Time to fund: If you need money quickly, private credit lenders often have faster approval and funding than traditional banks. If time is on your side, you may be able to prioritize a lower interest rate with a traditional or SBA loan.

- Lender reputation: Look for reviews from other small business owners and choose a lender with a proven track record in the restaurant industry if possible.