Table of contents

Growing a small business requires flexible financing solutions that can keep pace with your growth ambitions. While traditional lenders often require extensive collateral and lengthy approval processes, cash flow financing presents a faster, more flexible option. According to the National Small Business Association (NSBA), 37% of businesses can’t secure the financing they need. Cash flow financing offers exactly this type of agile funding solution.

Cash flow financing provides working capital based on your business's revenue stream rather than requiring collateral or perfect credit. You can seize growth opportunities, manage seasonal fluctuations, expand operations, and stay competitive. In this guide, we’ll explore how cash flow financing works, what types of funding are available, and what steps you can take to qualify for cash flow financing.

What is cash flow financing for small businesses?

Small business loans for cash flow are an unsecured type of financing designed for businesses at all stages of operation. Instead of collateral, lenders use your business’s revenue performance to determine eligibility.

A lender will evaluate your previous cash flow, projected future cash flow, and other factors to assess your creditworthiness. Credit scores and time in business play less of a role here than in asset-based solutions.

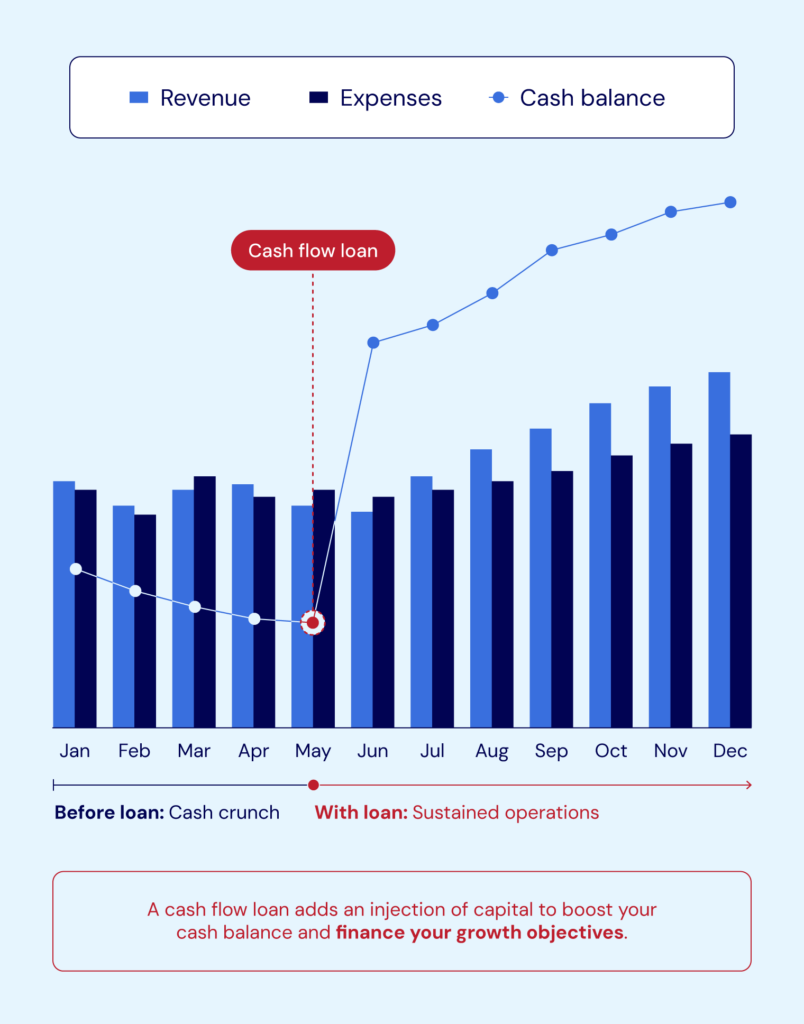

For an idea of how cash flow financing works, take a look at the chart below.

Cash flow funding rapidly boosts a business’s cash balance, allowing it to take advantage of growth opportunities. The quick access to capital makes cash flow loans a great choice for businesses with immediate opportunities. These loans can also be used as a bridge loan to help you stay on top of expenses while you secure a more permanent financing solution.

How do small business cash flow loans work?

Small business cash flow loans work by granting your business funding based on past and future cash flow. Lenders will plug your cash flow projections, seasonal income, percentage of returning customers, expenses, and incoming and outgoing transaction history into a formula to determine your maximum borrowing amount.

You don’t need collateral, and the lender issues funds in a lump sum payment. Repayment is calculated based on your future projected cash flow, and payments are often automated.

You can use the capital for any business needs, like covering payroll, making a large capital purchase, and bridging seasonal gaps.

Cash flow loans vs. asset-based loans: Main differences

The key difference between cash flow loans and asset-based lending is collateral. When applying for cash flow loans, you won’t be required to offer an asset as collateral; instead, you will be evaluated based on your cash flow information.

Here’s a quick overview of some of the distinct differences between cash flow lending and asset-based financing.

| Cash flow loans | Asset-based loans | |

|---|---|---|

| Type of loan | Unsecured funds | Secured funds |

| Who is it good for | Businesses with strong revenue | Businesses with substantial assets |

| Common collateral | Projected cash flow | Equipment, vehicles, and inventory |

| Qualification criteria | Good credit score, substantial cash flow | High-value collateral, strong credit |

Types of cash flow financing for small businesses

Multiple types of small business cash flow loans are available to you. Let’s look at some of the most common options and how they work.

Cash flow financing

Cash flow financing uses business performance to offer access to immediate capital. Lenders evaluate your cash flow statements, revenue trends, and profitability.

If your business deals with cyclical or seasonal activity, you will benefit from this type of financing, as it can help you bridge the slow season and prepare for the busy time of year.

Business line of credit

Business lines of credit are one of the most flexible financing options available. They are revolving credit lines you can draw on whenever you need capital for your business expenses. As you repay what you’ve borrowed, you can draw on the same funds again, allowing you to stay proactive in tackling future challenges.

You can use funds from a business line of credit for almost any business purpose, like helping you pay off expenses, hiring new employees, or launching a marketing initiative.

Short-term cash flow loans

A short-term cash flow loan is your business's easiest cash flow financing option. This type of financing is ideal for small businesses that have healthy, reliable cash flow and need flexible access to capital.

Loan amounts tend to be small, repayment periods short, and interest rates high, but eligibility criteria are low. Younger businesses may be able to qualify with a history of consistent, robust cash flow.

Subordinated debt

Subordinated debt, or sub debt, is funding at the subordinated or secondary position. This means that this lender takes a back seat to other lenders or lienholders in the capital stack. If your business were to fold up shop, your other lenders would collect first, and any funds left would go to paying off your subordinated debt.

In short, subordinated debt is a cash flow solution businesses can leverage for additional capital when they have existing (senior) financing in place.

Pros and cons of small business cash flow loans

Whether a cash flow loan is a good choice for your business will depend on your unique business needs. Here’s a quick review of the pros and cons of a cash flow loan.

| Pros | Cons |

|---|---|

| Doesn’t require collateralQuick funding typeSmooth application process | Interest rates can be highLow loan values |

Cash flow loans can be a great resource for small businesses. However, it's important to balance the benefits of a cash flow loan with the challenges.

Tips to qualify for a cash flow loan

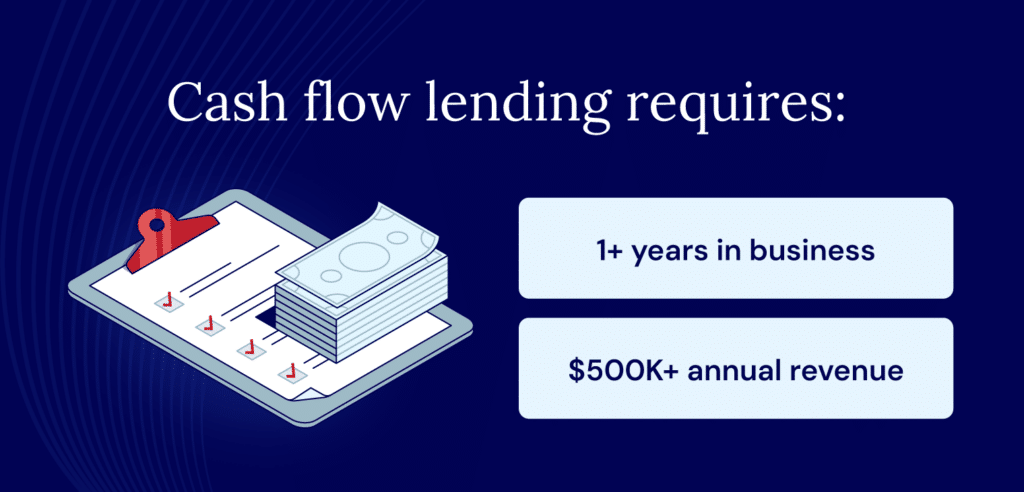

Qualifying for a cash flow loan is much easier than most asset-backed solutions. You don’t need collateral, but you will need a solid revenue history. For reference, here are National Business Capital’s minimum qualifications:

- 1+ year in business

- $500,000 in annual revenue

If you qualify, complete our digital application to start the process. A business finance advisor will reach out to learn more about your business financing needs.

If you don’t qualify for cash flow financing right now, you can try waiting until you’ve been in business longer, work on improving your credit score, and cut down your expenses.

Find cash flow financing with National Business Capital

Cash flow loans for small businesses can help cover the costs of daily expenses, new equipment, facility expansions, and more. With no collateral needed and fast funding, cash flow financing lets you get a business loan with less hassle.

National Business Capital supports various cash flow financing options, including short-term cash flow loans, business lines of credit, and invoice factoring. Working with one of our business advisors, you can get personalized advice on which financing solution is best for your situation. Apply today and take the first step to getting funded.