Table of contents

Securing the right financing can make or break a business. Whether you're purchasing equipment, expanding operations, or managing cash flow, a term loan offers a structured way to borrow and repay over time.

For businesses that need a lump sum with predictable payments, term loans provide a clear path to funding. But how do they work, and what should you consider before applying?

This guide breaks down the essentials — types of business term loans, repayment structures, qualification factors, and how to choose the right option for your business.

What is a Term Loan for Businesses?

A term loan provides businesses with a lump sum of capital, repaid over a fixed period with interest. Companies often use this type of financing for significant, one-time expenditures. It plays a crucial role in growing businesses, funding capital investments, and enhancing operational capacity.

Also known simply as a “term,” this loan structure allows businesses to make regular payments over a predetermined timeframe. The predictable repayment schedule makes it a popular choice for companies looking to manage cash flow while financing growth.

Under this loan structure, borrowers receive funds upfront and repay them in installments. Banks, private lenders, and other financial institutions determine loan terms based on factors like creditworthiness, loan size, and commercial loan interest rates.

How Does a Term Loan Work?

A term loan provides a business with a lump sum of capital, which the business repays in fixed installments over a set period, including interest.

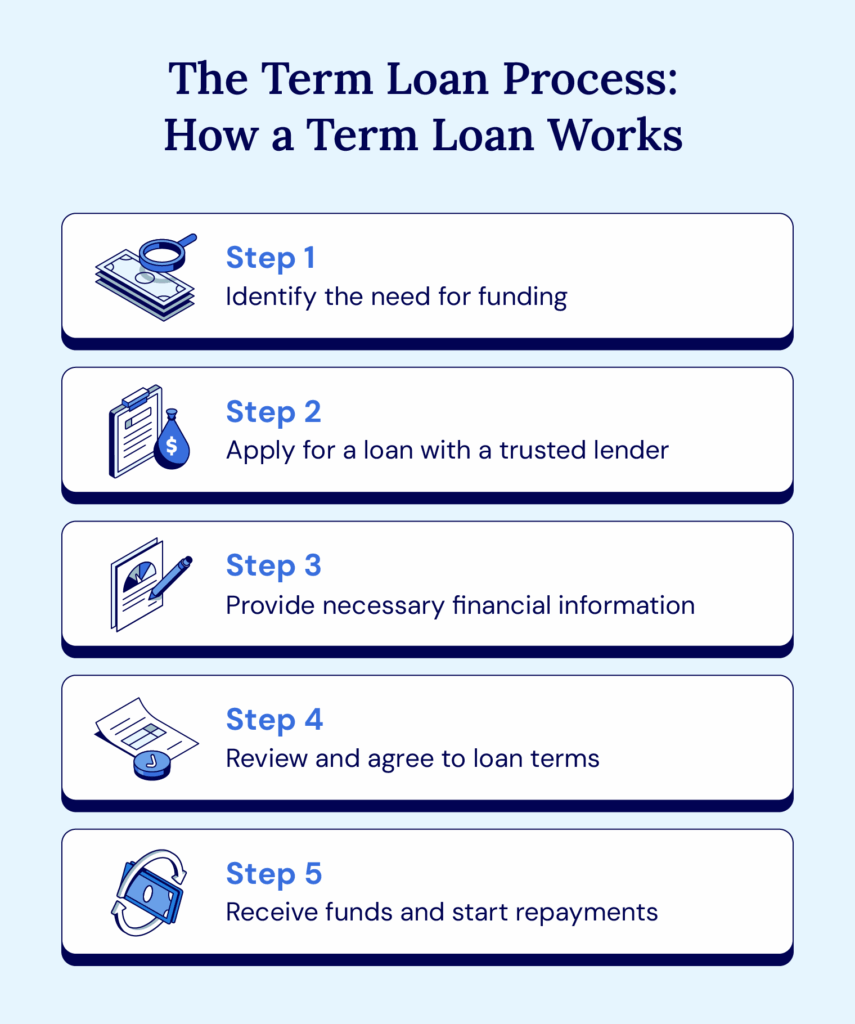

To secure a term loan, a business must first identify its funding needs and then apply through a bank, credit union, or private credit lender. The application process requires details like loan purpose, requested amount, and financial records. Lenders assess risk using this information and a credit check before approving the loan. Many lenders do soft credit pulls to approve applications, however. It’s crucial to ask questions about credit checks up front to avoid being surprised by a credit inquiry you weren’t expecting.

Once approved, the lender issues a loan agreement outlining key terms, including repayment schedule, interest rates, and fees. After signing, the borrower receives the funds and begins making scheduled payments.

How Long Are Term Loans?

Term loans can be short-, medium-, or long-term, depending on the repayment period:

- Short-term business loans typically last less than a year.

- Medium-term business loans range from one to five years.

- Long-term business loans extend beyond five years.

Each option serves different business needs, from covering immediate cash flow gaps to financing large-scale expansions.

Understanding the different types of term loans helps businesses make the right decision.

What is an Example of a Term Loan?

A powerful example of a term loan in action is a resort company that secured $1.1 million to solve a recurring infrastructure issue.

Each winter, a critical bridge on their property would break and limit access to event spaces, costing over $250,000 annually in repairs. This ongoing expense created cash flow challenges and restricted growth opportunities.

Traditional lenders required collateral the resort couldn’t provide, but they secured funding in just two weeks with alternative financing. The loan allowed them to rebuild the bridge permanently, eliminate repair costs, and open new revenue streams.

This case study illustrates how term loans can provide businesses with the capital to overcome financial obstacles and fuel long-term success.

Why Term Loans Could Be Right for Your Business

A term loan can be a strategic solution for businesses looking to fund major expenses while maintaining cash flow stability.

Whether you need capital to invest in new equipment, expand operations, or cover unforeseen costs, term loans for business offer structured financing with predictable payments — making budgeting easier and growth more achievable.

With flexible terms, a team of expert business advisors, and a streamlined approval process, securing a term loan from National Business Capital isn’t complicated.

Start your term loan application today to explore financing options tailored to your business needs.