Table of contents

You're getting more clients signing up for bigger deals than ever before. Right now, your business has real momentum. However, payments take some time to come in, so you're constantly trying to find capital to spend on scaling the business and covering operational expenses.

In situations like this, a working capital loan can provide the breathing room you need to continue growing the business without slowing down while still settling your bills on time.

Read on to find out what a working capital loan is, the different types of working capital loans, and how to improve your chances of getting approved fast.

What is a working capital loan?

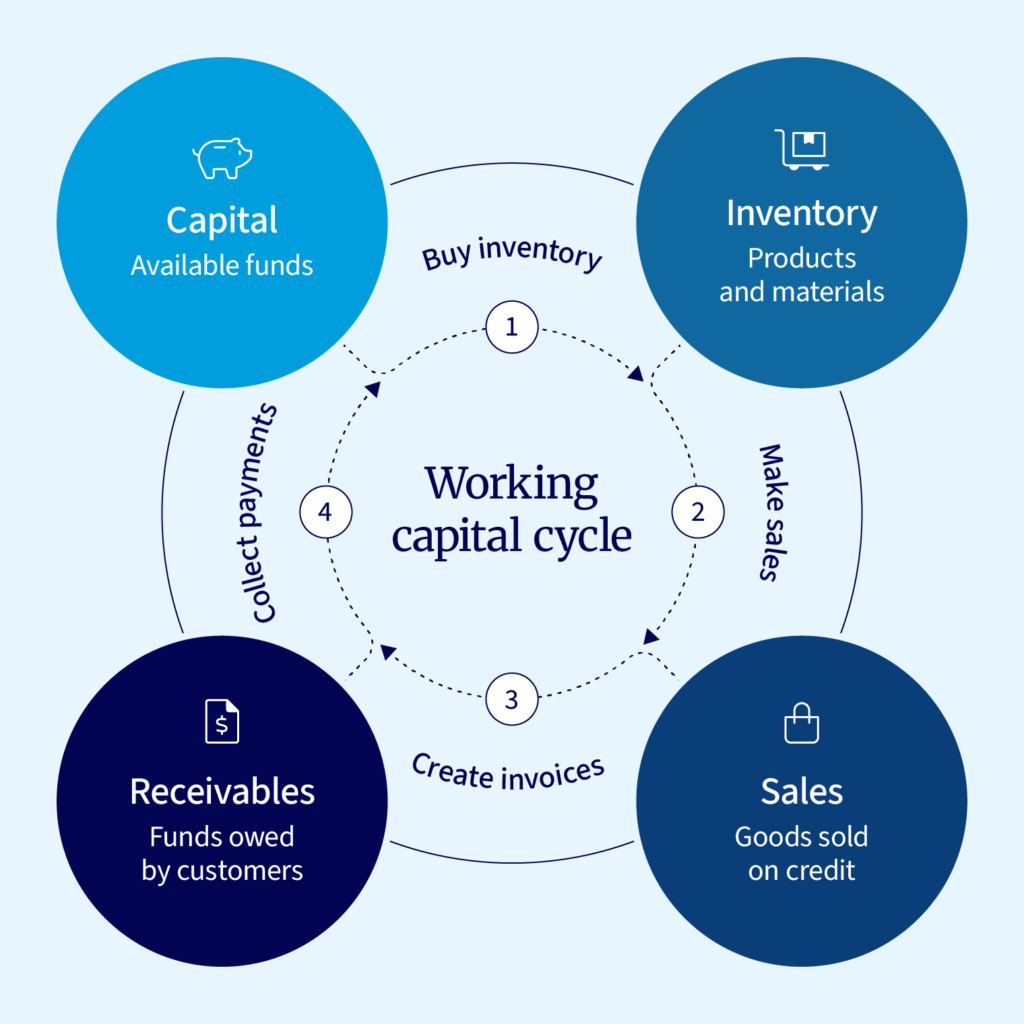

Working capital loans are a type of financing that gives businesses the funds they need to meet their short-term business expenses and, in many cases, take on opportunities they’d otherwise have to pass up.

Short-term gaps in funding happen for many reasons, like late customer payments, an unexpected expense like urgent equipment repairs, or a temporary dip in sales. Working capital loans help bridge those gaps so you can pay staff, cover rent, settle your supplier invoices, and gear up for the next wave of growing your business.

Repayment of business working capital loans is swift, varying from a few weeks to 18 months. When deciding how much you want to borrow, start with what you need to cover your working capital shortfall.

When funding a short-term project, calculate the necessary financing by first pricing in the cost plus a contingency. This helps avoid encountering the same financial hurdles.

| Use case: Your company is launching a brand new product. Orders pile in, but you don't take payment until dispatch. The loan allows you to ramp up manufacturing to meet 100% of the demand while keeping enough in the bank to pay for daily operations. Without this form of short-term manufacturing financing, you couldn't produce at scale, so you’d miss out on generating significant revenue. |

|---|

Types of working capital funding

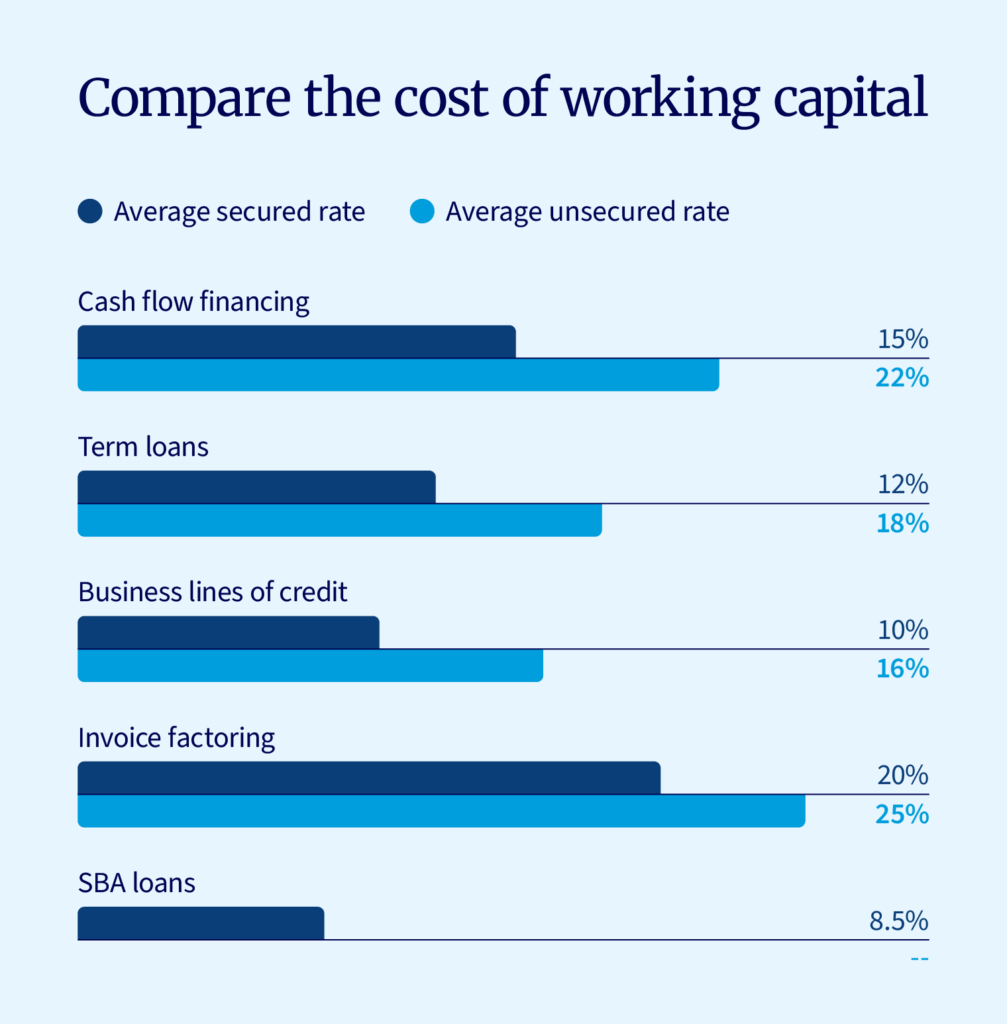

The best working capital loans provide you with the funding you need, a repayment schedule that doesn't impact your cash flow, and competitive interest rates that won't eat away at your margins.

Here are five popular financing options to help you meet your short-term business needs, together with examples of how businesses use them:

Cash flow financing

Cash flow financing provides a lump sum payment upfront to businesses. Repayments align with your cash flow, so during busy seasons, you pay more and in quieter periods, less.

| Use case: Retailers use cash flow financing to stock up on inventory ahead of peak season. The lower repayments they make when it's quieter preserve their cash flow. Then, when revenue picks up, their repayments increase, meaning they clear the outstanding balance faster. |

|---|

Term loans

Term loans also provide a lump sum of capital upfront. Loan terms generally take between three and 18 months to clear. You make weekly or monthly repayments over the term until you settle the balance.

| Use case: Manufacturers often use this type of small business loan to purchase raw materials in bulk, locking in discounts. For example, a furniture manufacturer buys six months’ worth of hardwood in one go, so they pay a lower price. Their products are flying out the door as fast as they can make them. The loan gives them the capital to buy the raw materials in bulk to meet 100% of customer demand. Sales cover the repayments, so by the time they pay off the loan, their working capital is healthier and their margins are intact. |

|---|

Business lines of credit

A business line of credit gives you flexible access to capital when you need it. Like with a business credit card, you get a limit (the maximum you can borrow) and a balance (the amount you've actually borrowed after any repayments). You can overpay or clear the balance without penalty.

Keep in mind that you have to settle the account in full at some point, normally three to 24 months after you open the facility, unless the facility is revolving.

| Use case: A construction firm uses this short-term funding option to inject working capital while they're waiting for staggered payments to come in from a client. They borrow $250,000 to pay subcontractors and buy material to keep the work going, repaying it when the client's invoice clears. |

|---|

Invoice factoring

Turn your unpaid invoices into a working capital line with invoice factoring. Lenders buy your unpaid invoices and forward you up to 95% of their value on the same day or the next day. You get the balance, minus the factoring fee, when the customer makes the final payment.

| Use case: Staffing agencies use factoring companies to provide short-term financing to cover their payroll. A temp firm with $250,000 in outstanding invoices might factor them because payment is not due for 45 days, and they have to pay the staff at the end of the month. |

|---|

SBA loans

You can use SBA 7(a) and Microloans for working capital, but the average turnaround time on an SBA loan application is 90 days.

| Note: Need new equipment? Tell one of our advisors what you want, and they'll advise you on equipment financing term lengths and monthly payment estimates. We can arrange standard equipment financing as well as SBA-backed loans for equipment purchase. |

|---|

What can I use a working capital loan for?

Working capital loans are best for taking advantage of short-term opportunities and covering expenses, like monthly bills and debt payments. They're not for buying expensive new equipment, expanding your premises, or purchasing a competitor.

Businesses use this type of fast funding for:

- Bridging seasonal gaps: Have enough in the bank to meet your financial obligations when capital goes out faster than it's coming in.

- Managing payroll: To protect team morale and maintain capacity, keep your staff happy by paying them on time and in full.

- Hire extra staff: Cover recruiter fees and the first few paychecks for new team members before they start bringing in a return.

- Stock up on inventory: Buy popular lines to outperform your competitors and lock in supplier discounts to improve your margin on each sale.

- Run well-timed marketing pushes: Make the most of surges in demand and holiday seasons by booking advertising to attract new interest and generate more revenue.

- Staying operational: Use quieter times to repair and upgrade your equipment so you’re ready to move fast when demand picks up.

Working capital financing is great at stabilizing finances and powering growth initiatives at different parts of the buying cycle. They’re not ideal for refinancing a loan or for long-term investments like buying major equipment, expanding your location, or acquiring another business.

Will I need to offer collateral for a working capital loan?

Consider offering collateral for your working capital loan to access lower interest rates and a higher maximum loan amount. Doing so can enhance your loan terms and improve your financial standing. Without collateral, you may face slightly higher costs and stricter eligibility criteria, but this approach ensures you secure the funds you need on favorable terms.

If your lender suggests a personal guarantee (PG), it's important to understand the implications. A PG means that in case of default, your personal assets, such as savings or property, could be pursued for repayment. It's a significant commitment, so it's wise to carefully evaluate the terms and seek professional advice if needed.

Managing your working capital loan

Manage your working capital loan well to get the financial breathing room to move your business forward while protecting your cash flow. Here are three positive approaches you can take:

- Stick to the plan: Treat the capital from the loan as a project budget and don't spend it on anything other than what you were planning. Every extra dollar you spend on marketing, business apps, and more increases the risk of a capital crunch coming if the revenue you’re counting on arrives late.

- Track your cash flow: Ask why capital has been tight. Go through every expense, including staff, and ask whether they cost more than they bring in. Look at credit control. Are invoices going out fast enough? Are you chasing payments properly? Finally, check out your competitors to see if there's a chance you're underpricing. Fix any issues now to avoid a repeat in the future.

- Stick to your repayment schedule: Most lenders and many suppliers that give you trade credit report your payment history to the credit bureaus. Every late payment knocks your credit score and makes it harder to secure funding in the future.

Pros and cons of working capital financing

Every commercial and personal finance package has its advantages and disadvantages. Below, find five upsides and four downsides of working capital loans:

| Pros | Cons |

|---|---|

| Quick access to funds: Get the capital you need when you need it. Flexible use of funds: Spend the capital where you see fit, like paying staff, buying stock, covering overheads, or running short-term campaigns. Unsecured loan availability: Lenders may work with you if you don't want to pledge any security. Improved cash flow: Get breathing room to meet your bills without affecting your working capital. Short-term repayment period: Clear your repayments faster to free up cash flow for future growth. | Higher cost of capital: Working capital loans have higher interest rates than standard term loans. Short repayment terms: The narrow window to repay your balance can pressure your cash flow. Collateral requirements: Some loans require you to pledge assets you might lose if you default on payments. Not always, though; National Business Capital doesn’t require collateral for working capital. Credit score impact: Missing a payment can knock down your credit score. |

How to apply for a working capital loan

Getting a working capital loan for a small business isn't hard. However, you need to prepare to find the right loan for your company.

Here are our tips to find the right business financing partner and get through the approval process fast:

- Know why you need the capital: Have a figure in mind and a purpose for every dollar you'll spend. If you're covering cash flow, total up every cost you have to meet. If you want to, for example, run an ad campaign to bring in extra revenue, know beforehand exactly where you'll advertise, how much you'll spend on each channel, and where your returns will come from.

- Choose a trustworthy lending partner: Look through every lender's T&Cs carefully for hidden charges. Check out their online customer reviews to make sure they’re legitimate, reliable, and have experience with businesses in your sector.

- Speak to an experienced financial advisor: Explain your plan to an expert at your chosen lending partner. Ask which is the right financial product for your needs and why. Request a summary of the total loan costs and any additional fees you have to pay.

- Get your documents ready: Lenders that offer same-day funding or payout in as little as three business days often require more than your bank statements. For lenders with more complex application procedures, gather these documents together: financials (P&L, balance sheet, and tax returns), debt schedules, and legal documents like leases and franchise agreements. If you're going for a secured loan, you'll need proof of ownership of the assets.

- Check your key numbers: Check your personal and business credit scores. Stay current on all payments so your credit score stays high when the lender runs a full search on you.

- Apply and agree on terms: Once everything’s in place, apply to your lender and be ready to respond to their questions and requests for documentation quickly. When you're accepted, review every term carefully, especially interest rates, repayment schedules, and early payment penalties. If you're happy to proceed, complete the paperwork and the lender will transfer the capital to your account.

Bridge funding gaps with flexible options from National Business Capital

Working capital loans help companies take advantage of business opportunities and successfully manage their cash flow constraints. They're part of an arsenal of financial products available to support businesses at every stage of their journey through National Business Capital.

National Business Capital is a market leader in funding $250K to $15M+ transactions. We've funded $3B+ for companies across America. From business lines of credit to equipment financing, thousands of firms trust us to find them the right funding deal at every stage of their growth journey.Start your application today with National Business Capital and let’s get you funded.