Table of contents

Funding, or the lack of it, is a common problem for businesses that can keep them from growing their businesses. Waiting to see if you can generate enough revenue to afford to expand is an option, but this puts you at risk of missing out on key opportunities. That’s where commercial financing can help.

What is commercial financing? It’s a method of borrowing money to support the growth of your company. In this post, we’ll take a closer look at the options available and how you can decide on the best commercial loan options for your business.

What is Commercial Financing?

Commercial financing is an overarching term that describes the different loan options available to businesses through external lenders. You can use it for almost any business expenditure, but many business owners choose to use it for asset purchases, working capital, and large ventures, such as acquiring a competitor’s business.

You can choose between various formats for your funding based on your needs. This may include financing options such as:

- Term loans

- Business lines of credit

- Equipment loans

- Revenue-based financing

Many businesses end up using several different commercial loan types to finance their growth. Consider how each financing option could impact your business’s goals and apply for the ones that will fit your needs most.

How Does Commercial Financing Work?

Commercial loans let businesses borrow capital from dedicated lenders and financial institutions. The type of loan you apply for can dictate how the money can be used, but most SBA loans, term loans, and lines of credit let you use the money for both major and minor business expenses.

Once you accept the loan, lenders expect you to make regular payments on the loan until it’s paid off in full or you renew the loan with the lender. The payment amounts and repayment cadence will depend on the loan and the terms you agree to.

Many of these loans require collateral as a condition of the loan, but not all. The type of collateral you’ll need to use depends on the loan, but may include the following:

- Equipment

- Property

- Future revenue

- Personal assets

- Inventory

Your lender will help you determine if collateral is needed and what type of collateral you need to use.

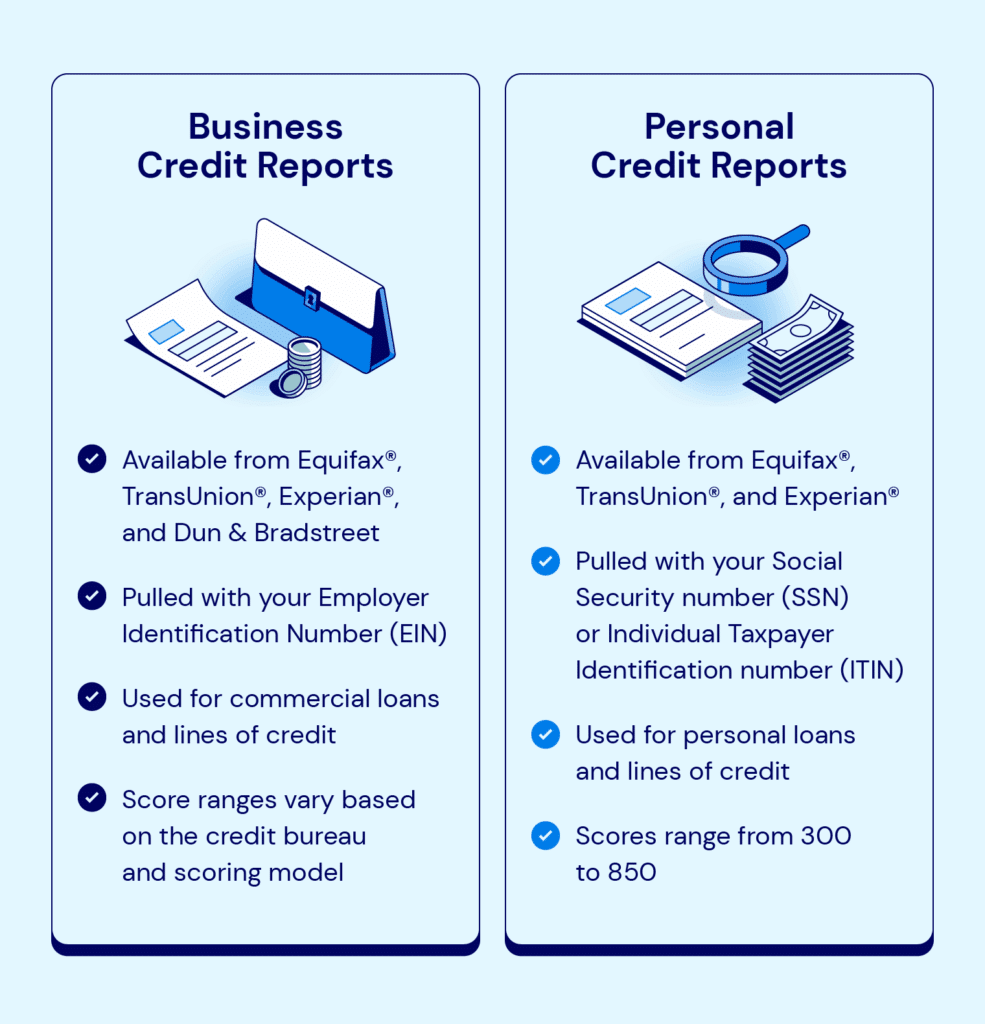

Remember, your business’s credit score may impact the terms of your loan. It’s a good idea to check your credit reports to see where you stand before applying for financing.

What Are the Different Types of Commercial Financing?

Businesses have diverse financing needs, which is why there are different commercial financing options that business owners can consider when looking for ways to grow their operations.

Here are some of the most common commercial business loans you may want to consider:

- Term loans: Term loans are business loans that give you access to money in a one-time lump sum payment. These loans are available in both fixed and variable interest rates and have few to no restrictions on how you can use the money.

- Business lines of credit: A business line of credit is revolving credit that business owners can draw on whenever they need capital, but they must manage regular payments to replenish the available credit. Once you pay the borrowed amount, you can draw that funding again, allowing you to have a continuous stream of capital for any situation.

- Revenue-based financing: This method of financing allows businesses to gain capital in an upfront lump sum in exchange for a percentage of their future revenue or sales. Revenue-based financing options are often easier to qualify for than traditional bank loans.

- Equipment financing: Equipment loans are a type of term loan designed to help you finance the purchase of equipment vital to your business’s operations and growth. Since the loan is secured by the equipment you’re financing, lenders may offer lower rates or qualify you for larger loans.

- Small Business Authority (SBA) loans: SBA loans are government-backed loans issued by lenders to qualifying small business owners. These loans are ideal for small businesses that lack the income or equity to qualify for traditional loans. However, these loans can have longer approval times, typically ranging from 3 to 6 months.

- Inventory financing: Inventory financing loans let you access capital to purchase additional inventory to hedge against increased demand. The inventory you purchase secures the loan, so lenders may offer lower rates on what you borrow.

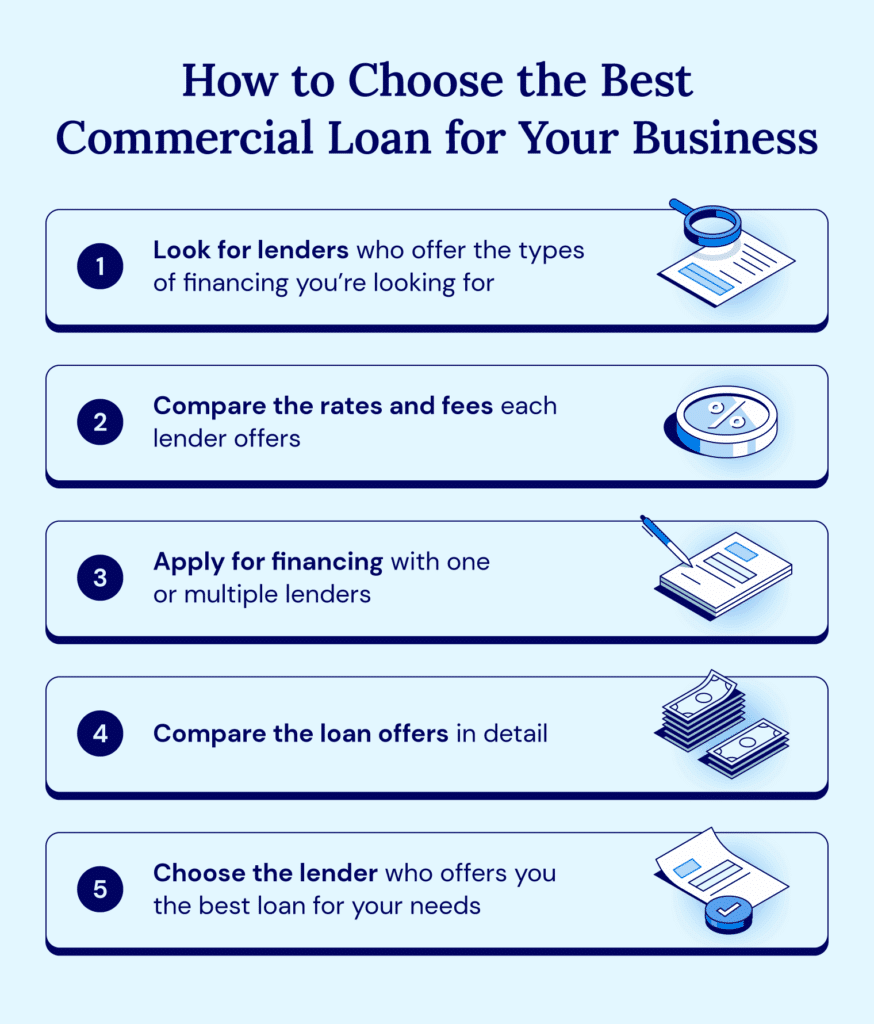

Choose the Best Commercial Financing Option With National Business Capital

Commercial lending can help your businesses scale operations when you don't have the up-front capital to cover their investment or expenses. But before you can find the right commercial loan, you need a private credit lender that will support your business’s growth plans without restraint.

At National Business Capital, we understand entrepreneurs because we are entrepreneurs. We prioritize the client’s experience with a digitalized application process, dedicated Business Finance Advisors, and a reliance on the latest tech to serve the needs of business owners more efficiently nationwide. Apply now and take the first steps on your financing journey.