Wondering, “What is loan principal?” National Business Capital has all the answers you’ll need. Here’s our comprehensive guide on loan principal and business lending.

It’s never been a better time to access capital. Between banks, credit unions, and online lenders, you’ll have a variety of options to choose from, but the benefit of your financing often depends on the terms that you’ve agreed upon with your lender.

You’ll need to review what interest rates, repayment terms, and borrowing amount your lender offers, but don’t think that you need to accept the first offer you receive. Just because one lender offers unfavorable terms doesn’t mean that they all will, so you’ll need to devote time and effort to your search to give yourself as many options as possible.

Once you’ve found a lender that meets your needs and you’ve secured your financing, you’ll begin to use the funds and pay back what you’ve borrowed. The amount you’ve borrowed, minus the interest rate, is the principal amount, but the total amount you’ll pay is the principal plus the interest rate.

Make sure you’re fully prepared to pay back the principal and your interest rate payments before you sign your name on the dotted line. There are some entrepreneurs who falsely assume they’ll only need to pay back $300,000 on a $300,000 loan, but these individuals forget about the interest rate, and they might run into a situation where they need to default on their payments if they’re not careful.

Loan principal isn’t necessarily complicated, but it’s an important thing to keep in mind as you move through the business lending process. If you’re wondering, “What Is Loan Principal?” NBC can help. Read on for all the information you need to know about loan principal and, more importantly, how to maximize the benefit of your financing.

What Is Loan Principal, and How Does It Work?

Loan principal is the amount of money you’re seeking to borrow, minus the interest rate payments and other fees. Interest rates and other fees are applied to the principal, increasing the total amount you’ll repay to your lender. For example, if you secure a $400,000 business term loan with a 3% interest rate, then the principal amount would be $400,000, and the initial interest payment would be $12,000.

The same idea applies to other forms of financing, like business lines of credit, but it’s more difficult to conclude what your total principal amount is in situations where capital is given at multiple different times. With business lines of credit, the principal is the total amount that you’ve borrowed from your revolving credit line. If you borrowed $50,000, $20,000, and $30,000 respectively, then your total principal amount would be $100,000.

If you’re financing equipment, then the principal amount is the cost of the equipment you’re purchasing. The interest rate is applied to that cost, and the total amount you’ll pay for the equipment is the cost of the equipment plus the interest rate multiplied by the equipment’s price.

Your interest rate is multiplied by the principal amount, then added to the principal, totaling the amount you’ll repay to your lender. If your loan is on the higher end of the financing spectrum and your interest rate is high, the total amount you’ll pay on your loan will be much higher than the principal amount. Conversely, if your interest rate is low, you’ll pay less in interest, and the amount you repay will reflect the principal amount more closely.

How Is Loan Principal Paid?

Your minimum monthly payments are usually a combination of interest and principal payments. Essentially, you’re paying a percentage of each every month, but you might be able to make “principal-only” payments depending on your lender, which are extra payments you send each month to pay off your principal amount specifically.

Principal-only payments are ways to reduce the total amount you’ll repay to your lender. Lower principal amounts mean lower interest payments, so it’s in your best interest to make these payments when possible. While this won’t necessarily reduce your monthly payment significantly, it can potentially reduce the number of payments you make on your loan, allowing you to be debt free sooner rather than later.

Some lenders allow you to pay off your interest before paying off the principal, but this doesn’t necessarily offer many benefits unless you’ve missed a few payments. By paying off only the interest rate, you are making progress on your loan payment, but the interest rate will continue to accrue throughout the term of your loan. This means that you’ll likely still be paying interest within the following months, so make sure to double-check your decision before you send your payment.

Basically, you pay a combination of the interest and principal amounts through your minimum monthly payment. You can choose to structure your payments differently, but this often depends on your lender and their guidelines. If you want to keep your total payments low, try to pay off the principal amount as soon as possible: Low principal amounts generate lower interest payments.

Is It Better to Pay the Principal or Interest?

Think about it like this:

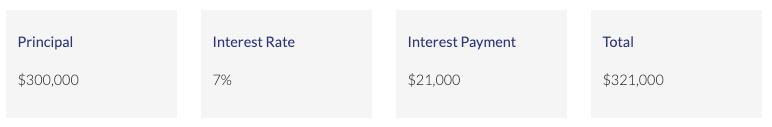

In this scenario, your total payment after one month of interest on a $300,000 loan is $321,000. This might seem high, but as you start making your monthly payments and chipping away at the principal, the total amount decreases.

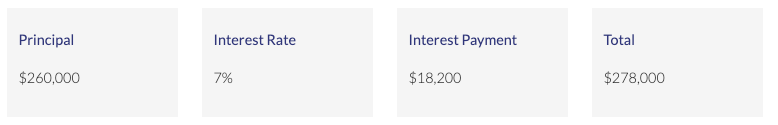

Here’s what another entrepreneur’s loan might look like once they’ve made some payments:

Now that there are payments made towards the principal, the interest payment per month is lower. The entrepreneur will still have to pay off the interest payments from the previous months, but as you can see, the amount you’ll pay dramatically decreases with each payment on the principal.

However, this only applies to fixed interest rates. Variable interest rates, where the percentage changes, are commonly based on another interest rate or index that changes routinely. If the index your variable interest rate is tied to increases, you can expect the interest rate on your loan to increase as well

It might seem beneficial to get yourself out from under a mountain of interest payments weighing down your principal, but this creates a “treading water” situation. Your principal will remain the same if you only pay off your interest payments, and you’ll have to pay the same amount in interest each month, which can add up quickly.

Paying off your principal first only makes it easier to make your monthly payments. As principal decreases, so do your monthly interest payments, allowing you to ease the burden of your financing at a faster rate. If you can, you should inquire about principal-only payments to speed up the process further. That is, of course, if making an extra payment each month is within your financial capabilities.

Compare Principal and Interest Payments Between Lenders With National Business Capital

Business owners don’t have an abundance of time on their hands. Many won’t be able to clear their schedule to research lenders and their programs, leaving them without the capital they need to take their operations to the next level. Rather than let the growth opportunities that come your way pass you by, you can streamline your search for financing with National Business Capital’s 75+ lender marketplace and experienced team.

Our Business Finance Advisors take the time to learn about you, your business, and your challenges to connect you with best-fit financing solutions for your business’s challenges. We’re there for you before, during, and after the deal, establishing a relationship that you can leverage for any future financing needs. Don’t worry: We’re only a phone call away, and you can always reach out to us with questions about future funding, current funding, or general advice on how to maximize the benefit of your financing.

Ready to start growing your business and outpacing your competition? Complete our digital, streamlined application, and one of our experienced advisors will be in touch with you soon!

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.