Our monthly construction industry trend report combines the latest industry data with our internal findings from National Business Capital’s award-winning team. With extensive experience in the construction industry since 2007, we are thrilled to share these findings and expand on them through our unique expertise.

Our goal is to provide business leaders and decision-makers with the necessary information and data to make well-informed decisions in their business endeavors.

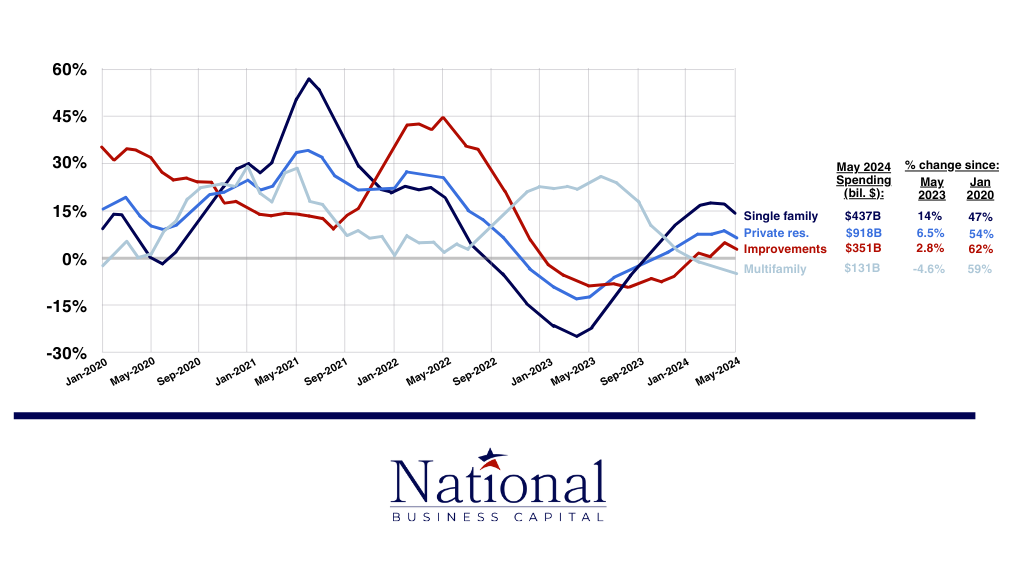

Residential Construction Segment Spending (2020 – 2024)

Residential construction trends highlight industry performance in a critically important sector and speak to broader housing market trends.

Source: AGC

August 2024 – As homebuyers handle inflated costs, the construction industry has worked diligently to create new inventory. Multifamily home construction spending has stayed positive since 2020, while single-family, private residences, and improvement projects spending experienced a brief lull from September 2022 to January 2024. The 16-month negative trend is likely a combination of factors stemming from housing trends.

Single-family and private residences grew rapidly in value and fell significantly in supply over the last 4-5 years. Persistently high interest rates discouraged sellers from moving on from low rates into new mortgages, while heightened demand grew housing prices. This slowed down the housing market in these sectors, which pushed construction activity towards multi-family structures, which were more popular as people rented instead of buying.

Houston, Texas, ranked first for new home construction among all U.S. states in 2023. This city trend is expected to continue into 2024, as strong economic growth and job prospects attract homebuyers from across the country. However, other areas, particularly those in the Northeast, like New York, have seen home construction drop significantly. For example, Rochester, NY, and New York, NY, have seen -4.90% and -14.20% year-over-year changes in active listings, per Yahoo Finance.

We believe this isn’t going to be a long-term trend. As the Federal Reserve eases interest rates and more homeowners become comfortable with a new mortgage, we’ll likely see single-family and private residence spending trends return to normal within the construction industry.

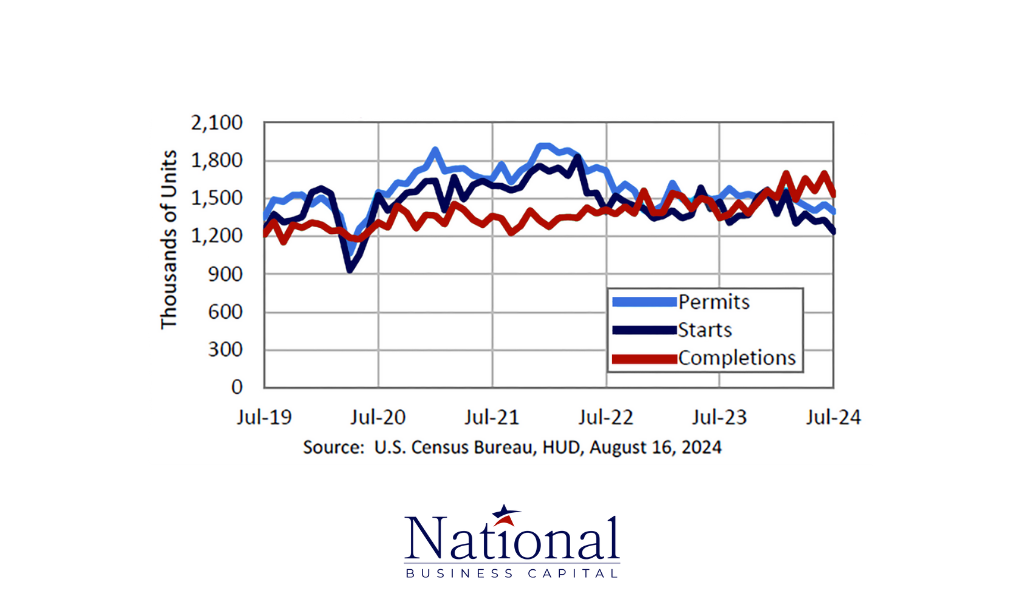

Source: Census.gov

Digging deeper into construction trends, we found that permits, starts, and completions follow the parabolic trend of 2024. With the exception of multifamily home construction spending, all other segments expanded slightly at the beginning of 2024 and contracted toward the mid-way point of the year. This expansion/contraction trend can be found in the same January to July time period of previous years, although 2020–2023 all saw much higher highs than 2024.

It’s an election year. With a lot of change on the ballot, new home permits have likely fallen as the housing market awaits November’s results. However, the lull in permits, coupled with the dampened growth across all residential segments, could also signal a more significant industry-wide contraction caused by higher costs, lower confidence, and a difficult economic environment.

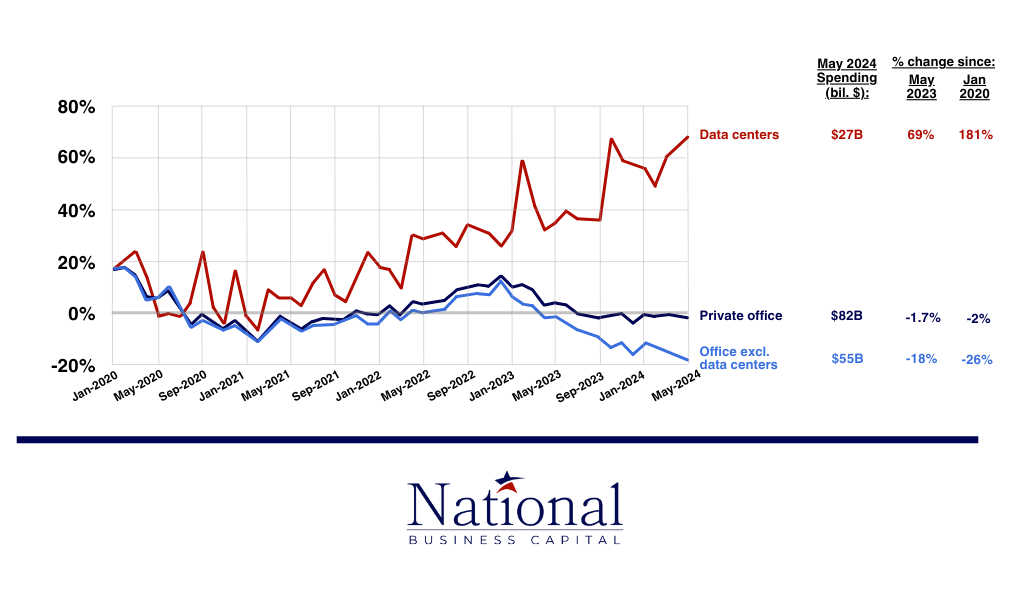

Increased Data Center Spending; Dampened Private Office Construction (2020 – 2024)

As the CHIPS and Science Act continues to push the industry toward data centers and other electronic manufacturing initiatives, understanding spending trends unlocks a unique view of the industry’s focus.

Source: AGC

August 2024 – As we touched on in July’s monthly report, the CHIPS and Science Act has shifted the construction industry’s focus heavily. Data center construction spending has increased ~10% since the beginning of 2024 and 45%+ since the legislation was passed in 2022.

The government focus, along with a shifting view on the necessity of business offices, has pushed spending away from private offices and other office construction. Commercial real estate, specifically the large corporate offices that paint the skylines of major cities, has seen significant down trends ever since the adoption of “work from home” policies following the pandemic.

These spending trends are likely to continue unless there are any major changes in how we view in-person work and our focus on AI development. Data center spending could decrease as facilities are finalized, as well.

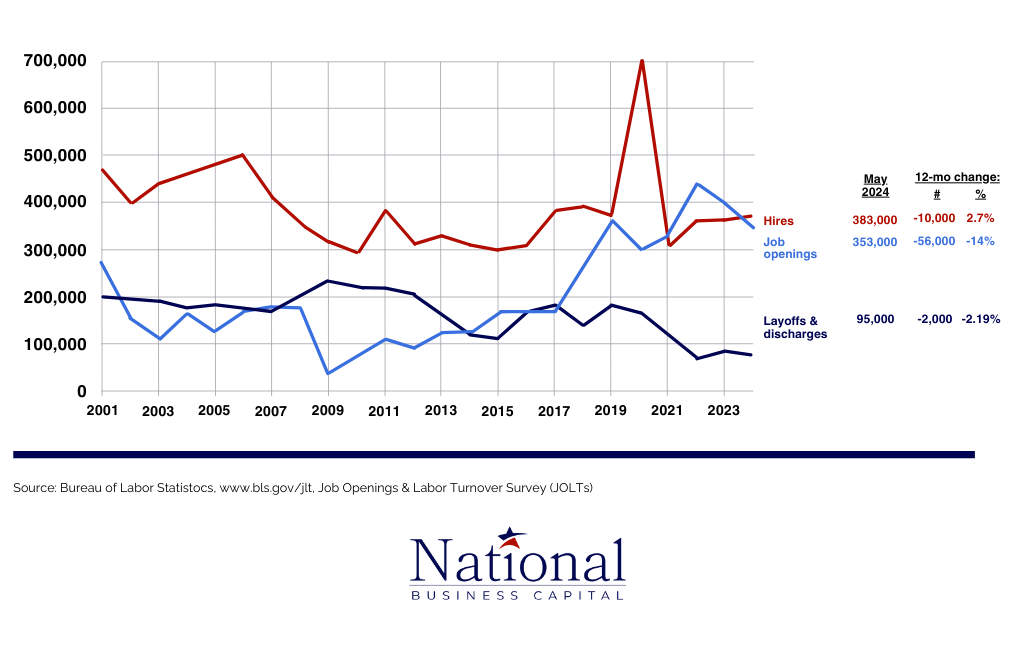

Construction Hiring Trends

Construction hiring trends, including job openings, hires, and layoffs, offer a unique perspective of the industry’s operational capabilities and highlight potential challenges.

Source: AGC

August 2024 – We’ve examined employment trends on a monthly basis. Zooming out on the chart to view employment trends year-over-year offers a much brighter picture of how far we’ve come as a whole.

Focusing on hiring and job opening trends, it’s interesting to see that, at inflection points, the data seem to change direction in one way or another. In 2019, the inflection point resulted in divergent trends, whereas the inflection point in 2021 saw a different result. Considering that we just recently surpassed another inflection point, there might be significant changes in hiring and job opening trends on the horizon.

We hope for a positive relationship where hires and job opportunities grow hand in hand. It will be worrisome if job openings surpass hiring data, as this suggests operational challenges on an industry-wide scale.

Most notably, though, was that construction layoffs and discharges are at their lowest point in more than 20 years. Job openings have risen considerably since 2001, which suggests that the industry itself has expanded rapidly over the last two decades. Hiring trends are a bit different. Hires generally have fallen since 2001 but remained relatively stable, with the exception of a few spikes.

There’s a lot to unpack in terms of construction hiring. In 2024, some firms report struggling with new hires due to a rising labor demand, a lack of skilled/specialized workers, and an aging workforce as a whole. Others haven’t encountered the same challenges, which suggests hiring concerns exist on a case-by-case basis.

National Business Capital’s Construction Recap (August 2024)

Each month, we’ll offer our unique viewpoint on the construction industry’s short to mid-term outlook. Our insights come from a combination of available industry statistics, internal data, and the general sentiment of the construction clients we work with daily.

- Approval Dollars Increased 26.5% from July to August – Approvals for construction companies continue to strengthen. Lenders are more confident in the industry as a whole, which is compounded by stronger applications from company to company. While the industry may have been handling post-pandemic challenges at the beginning of 2024, it’s evident that companies have found their footing and taken off running.

- Construction Funding Volume Increased 21.49% from July to August – On the heels of larger approvals, construction companies are also moving forward with their approvals more confidently. Total funding volume increased 21.49% month over month, driven by higher dollar amount transactions and a more significant number of converted transactions.

- Financials From Construction Companies Are 15% Stronger Since Jan 2024 – Stronger credit, higher revenue, and higher profitability have characterized the applications National Business Capital received in August 2024. Companies are working diligently to drive growth, which is evident across their business metrics.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Phil Fernandes

Phil Fernandes serves as Chief Operating Officer for National Business Capital. He boasts 15 years of experience in sales and 10+ years of management experience as National’s VP of Financing/Analytics. Phil is also an excellent writer who's completed the Applied Business Analytics executive program at MIT and regularly contributes articles to National Business Capital’s blog.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.