Our monthly construction industry trend report combines the latest industry data with our internal findings from National Business Capital’s award-winning team. With extensive experience in the construction industry since 2007, we are thrilled to share these findings and expand on them through our unique expertise.

Our goal is to provide business leaders and decision-makers with the necessary information and data to make well-informed decisions in their business endeavors.

2024 Election x Construction Industry

As election day rapidly approaches, ConstructionDive.com explored each candidate’s stance on important construction-related issues. We’ve highlighted some of their takeaways:

| Topic | Trump | Harris |

| Supply Chain | Former President Trump has largely advocated for a focus on domestic manufacturing to remove the U.S. reliance on foreign supply chains. He aims to increase tariffs, as he did in his first term, to make American-made products more attractive. | Similarly to her presidential counterpart, Vice President Harris also has her sights set on domestic manufacturing.

She plans to pick up where President Biden’s CHIPS Act and Infrastructure Investment and Jobs Act (IIJA) left off by furthering government initiatives to improve ports, railways, etc. |

| Energy | Focused on domestic fossil fuel production, Trump aims to deregulate federal drilling to promote faster progress. He also plans to peel back Biden-era policies, like the Inflation Reduction Act, which included solar and win product tax credits, among other environmental regulations. | Harris plans to expand on the Inflation Reduction Act and continue promoting clean energy initiatives, following in the footsteps of President Biden. |

| Labor and Workplace | Despite losing union support during his first term, Trump aims to get back on the good side of workers. He sponsored the Teamwork for Employees and Managers Act of 2024, giving retribution-free negotiating power to employees. And, in line with his other policies, he also aims to deregulate the workplace, as he did when scaling back OSHA regulations, to promote tape-less operation. | The Biden-Harris administration’s Infrastructure Investment and Jobs Act and CHIPS Act created an influx in demand for construction work. Harris, notably pro-union, promises to support construction unions with the Protecting the Right to Organize Act and through her collaboration with OSHA, which recently yielded the heat emphasis program. |

See more candidate-specific stances on construction-related issues in Construction Dive’s article.

October 2024 – Former President Trump has set his sights on deregulation and domestic manufacturing, while Vice President Harris aims to continue the government initiatives that have supported the construction industry throughout Biden’s term. While Trump’s pro-business stance has attracted the business community, including big construction players, the Biden-Harris administration’s success with the CHIPS Act hasn’t been forgotten by the industry.

There’s a lot of potential change on the ballot for the construction industry, but we won’t see the effects of new policies in the short term. Construction companies should keep pushing forward, as they’ve done before, to ensure they’re not left behind by the competition.

Impact of Project Delays on Construction Cash Flow

Strong cash flow empowers a growing construction company. Recently, cash flow challenges have persisted across the industry for a number of reasons, mainly because of project delays.

| GCPay Survey: What Are the Most Common Reasons for Project Delays? |

| 1. Labor Shortages 2. Material Shortages 3. Communication Challenges |

October 2024 – A survey by GCPay found that labor and material shortages are the leading factors behind project delays. Project delays, in turn, create cash flow issues for construction companies that limit their operations as well as their ability to grow further.

Labor and material shortages result from trends in the broader economy, while communication challenges persist on a micro level from company to company. Still, inefficient communication can create a web of challenges that impact the entirety of the business. For example, a missed change order can result in extended negotiations and payment delays, which can impede the conclusion of a project while costing the company significantly.

These payment delays impact the general contractor, but they also create prolonged challenges for subcontractors, who are generally paid after the general contractor. Many companies are leveraging ConstrucTech tools to streamline communication and reduce project delays.

Construction x Manufacturing Growth

We routinely examine the relationship between the construction and manufacturing industries. This month, we’ll explore GDP trends across two major manufacturing areas: computer and electronic products, as well as plastics and rubber products.

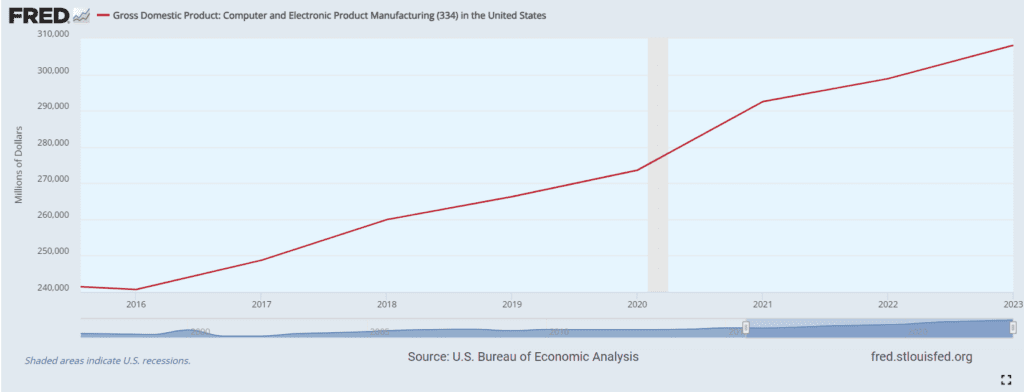

Computer and Electronic Product Manufacturing

Source: Fred Economic Data

October 2024 – Computer and electronic product manufacturing has steadily increased since 2016. This trend, accelerated by the passing of the CHIPS Act in 2022, has increased U.S. electronic manufacturing significantly, leading to the steady rise in GDP outlined by the graph above. With domestic manufacturing becoming a key topic in the upcoming election and both candidates stating similar viewpoints, we expect this trend to continue over the next 4-6 years.

The outflows of this trend are significant for the construction industry. As more focus is placed on expanding domestic manufacturing, construction firms will be tasked with building the facilities they operate out of. We’ve seen this bolster construction activity in the recent past, and there’s no reason to expect anything different as we move forward.

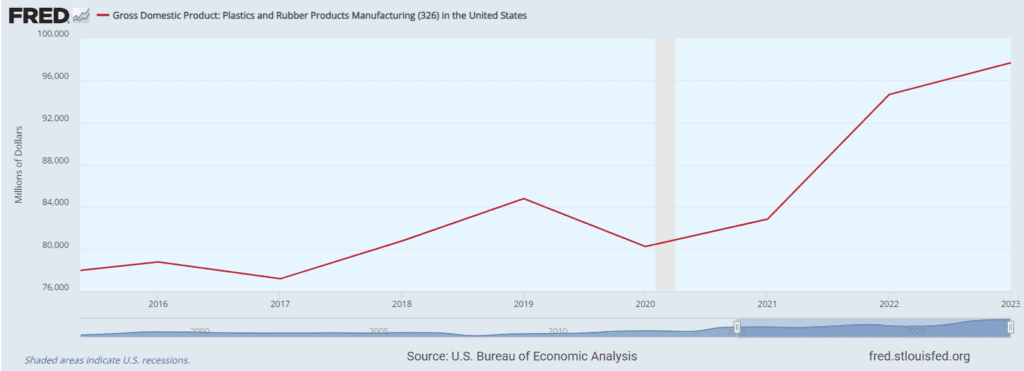

Plastics and Rubber Manufacturing

Source: Fred Economic Data

October 2024 – Although not as steady as computer and electronics manufacturing, plastics and rubber manufacturing has followed a similar upward trend. The dip in GDP around the pandemic was quickly eroded with positive progress, and we’re seeing the trend continue into 2024.

Plastics and rubber products are integral in construction for insulation, piping, windows, and roofing. They’re also key materials in the automotive, packing, and medical industries. As domestic manufacturing ramps up, the prices of these materials should decrease over time as more supply enters the market.

Other Relevant Trends & News

- Electric Power Infrastructure Category Drives Recent Construction Spending Data – ConstructionConnect’s monthly economic report states that spending growth in the electric power infrastructure large dollar category offset other industry spending contractions. This spending contraction was seen most significantly across military, manufacturing, and warehouse construction spending in August 2024.

- Federal Minimum Wage Increases on Jan 1st, 2025 – The EO 14026 minimum wage, given to workers performing work on or in connection with covered contracts, will increase from $17.20 to $17.75. This was established on September 30th within the U.S. Department of Labor’s Wage and Hour Division’s annual update.

- Small Business Administration (SBA) Alters HubZone Program Eligibility – The SBA updated the eligibility terms of their Historically Underutilized Business Zone (HUBZone) program, impacting federal contractors. For more information on the changes, visit the SBA’s website.

National Business Capital’s Construction Recap (October 2024)

Each month, we’ll offer our unique viewpoint on the construction industry’s short to mid-term outlook. Our insights come from a combination of available industry statistics, internal data, and the general sentiment of the construction clients we work with daily.

- Construction Funding Volume Increases Consistently QoQ – As our team continues to focus on supporting the construction industry’s growth and development, our internal funding data yielded 30% overall growth since the beginning of 2024. This has increased steadily quarter-over-quarter and is expected to continue in 2025 as we evolve to better serve the unique needs of our construction clients.

- California, Florida, New York, and Texas Continue to Drive Funding Volume – Consistent with our other reports, specific states continue to drive National Business Capital’s funding volume in the construction industry. It’s no surprise, given the number of construction-related initiatives and proportionate GDP within these states. However, as manufacturing continues to evolve, we expect to see funding volume grow parallel to new initiatives.

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.

Phil Fernandes

Phil Fernandes serves as Chief Operating Officer for National Business Capital. He boasts 15 years of experience in sales and 10+ years of management experience as National’s VP of Financing/Analytics. Phil is also an excellent writer who's completed the Applied Business Analytics executive program at MIT and regularly contributes articles to National Business Capital’s blog.

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.