The coronavirus outbreak continues to wreak havoc across the world, and has now reached 81 countries. Medical authorities are rushing to develop new containment strategies that slow (or stop) the virus from spreading, with limited success. When the virus was largely isolated in China, American manufacturers were suffering from the coronavirus business impact. Now that the virus has started spreading in America, domestic businesses in every industry are starting to feel the effects—and not in a good way.

As the coronavirus spreads, the negative impact on businesses will continue traveling with it. In Washington, currently the epicenter of the American infection, businesses are already reacting. Amazon, which is headquartered in Washington, has instructed employees to begin working from home. But this hysteria won’t just affect tech giants—it will also have a significant impact on small businesses across the state. Many of them, unfortunately, rely on person-to-person contact and can’t easily work from home.

As of today, many small business lenders—which have become the lifeblood for small businesses in Washington and elsewhere seeking capital to finance growth—are reconsidering whether or not to lend in states with an epidemic. Some have stopped lending to Washington-based businesses altogether. If the economy continues to decline, then annual sales numbers could drop with it—and your business may not qualify for the same high financing offers that it once did.

Businesses in need of capital—whether to pursue growth or cover upcoming coronavirus-related expenses—should begin putting the wheels in motion now.

The Coronavirus Business Impact (So Far)

It’s no secret that the coronavirus business impact has taken a toll on the U.S. economy. But how?

For starters, the stock market has suffered. Over the past 2 weeks, the S&P 500 has fluctuated back and forth by 3% or more. This means investors are becoming increasingly uncertain about what the market’s future holds.

The effects aren’t isolated to Wall Street, though—Main Street would take a major hit as well. And the coronavirus business impact for small businesses is only beginning.

For starters, the tourism industry has already taken a major hit. Airlines have, predictably, suffered, with tourists canceling travel plans to avoid exposure to potential germs. But in cities that rely on tourists for economic activity, other businesses are suffering too.

If people continue avoiding travel, then restaurants, many of which earn a significant portion of income from visiting tourists, could suffer as well. The same goes for other areas of tourism, such as tour guide companies, hospitality, and more.

The Future for Small Businesses in Coronavirus Territory

The virus is spreading, and by some accounts, rapidly. What happens if the virus in the U.S. gains the same momentum it had in China?

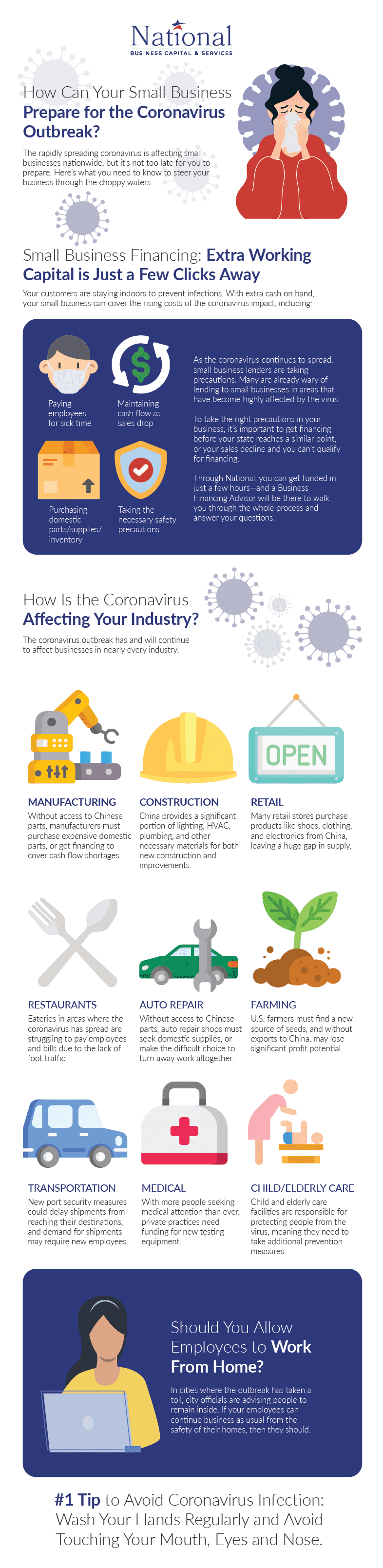

Small business owners will have countless new coronavirus-related expenses, like:

- Paying employees for sick time

- Decrease in customers/demand due to the coronavirus

- Cash flow issues

Regardless of the actual risk, workers will likely begin to stay home due to fears of catching the coronavirus. In turn, small business owners that operate restaurants, auto body shops, contracting companies, and stores will have to take action.

In some cases, this labor shortage can be solved by simply running on a skeleton crew. It may not be ideal, and could compromise the quality of service or customer experience, but would likely work. Others, though, may not get by as easily.

Many small businesses already operate with a barebones staff by employing only workers essential to the operation. Losing even one or two workers could be enough to put these small businesses out of commission.

To further complicate things, many small businesses competing to hire the best employees offer paid sick time. Naturally, employees with coronavirus symptoms (or simply those afraid to be exposed to the virus) will use that sick time during the throes of the outbreak. Some may attempt to lower this cost by laying off sick workers and hiring healthy ones, but that strategy presents a larger issue. The cost of hiring—and not to mention, training—far exceeds the cost of sick pay.

As a result, you’ll have to juggle the costs of decreased business with a smaller labor force and sick pay.

The best strategy for avoiding a negative coronavirus business impact? Having cash on hand to cover the costs of hurdles down the road.

Will the Coronavirus Affect Your Industry?

Driving the Auto Industry to Domestic Suppliers

Electronics manufacturers are deeply embedded in the Chinese manufacturing game, but they’re not the only ones. Auto manufacturers and repair shops have also historically taken advantage of low-cost parts from overseas.

Now, they can’t.

Like many other prospering American industries, the auto industry is facing significant setbacks due to the coronavirus.

Without access to Chinese parts, auto repair shops may be unable to perform repairs that, previously, might’ve been considered boilerplate. They’ll be forced to find domestic solutions.

In the meantime, though, the coronavirus business impact could hit them quite hard. Unless they have financing to float cash flow in the interim, they’ll have to reduce employee hours, or worse: laying employees off.

Chinatown Restaurants Aren’t Quite Closed

In NYC’s Chinatown, a hub for Chinese restaurants, grocery stores and culture, the coronavirus fears are still alive and well—but not the virus itself.

While there has been no actual trace of the coronavirus in the area, the normally thriving Manhattan district has seen a massive decrease in foot traffic. Due to fears regarding the outbreak’s origin in Wuhan, China, people have become wary of catching the virus in the area.

Some restaurants have been hit quite hard, with sales drops ranging from 20% to a whopping 50%. As a result, restaurants have begun responding by cutting hours, in an effort to avoid layoffs.

But if the outbreak continues, and with it, the lack of foot traffic, then the tide could change.

Restaurants on the Opposite Coast Are Facing an Impact, Too

Restaurants on the opposite side of the country are facing the coronavirus business impact as well. After an Oregon elementary school employee tested positive for the virus, local restaurants began to see a decline in business.

In Lake Oswego, located just south of Portland, an Italian restaurant noticed a significant reduction of foot traffic. Dine-in orders have gone down, and takeout orders up. Overall, business has gone down a noticeable 25%.

With the potential for the coronavirus to continue spreading, cash flow could become even tighter for similar restaurants. In Oregon, state law requires employers to provide up to 40 hours of sick leave to employees.

If business slows to a grinding halt and employees everywhere stay home, then business owners will be forced to pay sick time—and it could consume their supply of working capital.

The Coronavirus Business Impact on Retail

As fears about the coronavirus spreading mount, people are rushing to purchase hand sanitizer, bleach, and other sanitary materials. But that’s not the most important pulse for the suffering retail industry.

Like manufacturers, many retailers purchase cheap products from China. From shoes, to lamps, clothing, computers and beyond, China plays a major role in supplying American retailers. Now that this steady stream of Chinese imports has been cut off, retailers need to get creative in finding new suppliers.

As this spread continues, retailers have a crucial choice to make. Will they purchase more expensive products from domestic suppliers? Or simply accept the consequences and suffer a reduction in sales?

It’s an important choice to make for everyone, including larger chains and local small businesses. For the local players, getting small business financing to cover working capital shortages might make the difference between a wave of layoffs and making it through the difficult times unscathed.

The Coronavirus Business Impact on Construction

To the same tune as manufacturing, the construction industry is also suffering in the wake of the coronavirus outbreak. China has become a major supplier of all materials involved in the building process, including lighting, plumbing components, HVAC equipment, and more.

Construction companies rely on a consistent stream of new jobs, meaning a lack of access to essential parts could pose a problem. While new supplies from domestic sources will surely become available, it may take some time.

In the meantime, construction companies may require a line of credit or other source of funding to continue moving jobs along.

Sowing Seeds of Trouble for Farming & Agriculture

Just because crops are produced in America doesn’t mean their entire life cycle is isolated to the states. Many thriving agriculture and farming companies begin the process by obtaining seeds from China.

A lack of access to these seeds could spell a future of uncertainty for farming and agriculture companies in the states. The coronavirus business impact here could mean that American agriculture and farming companies will have to seek out new sources of seeds.

On the flipside, though, the coronavirus could damage the farming industry in other ways. Following the Phase 1 trade agreement signed by the U.S. and China, China was expected to purchase more agricultural goods from the U.S.

But with the Chinese economy in disarray, experts are skeptical about exactly how much of the bargain they’ll hold up. Some believe it will only be a chunk of the initial estimate, and won’t measure up to the $40 billion increase promised over the next two years.

Child & Elderly Care Facilities

LIke many other viruses, the coronavirus is most dangerous for children and the elderly, who have either developing or weakened immune systems. This means the virus poses a larger threat to elderly and childcare facilities.

In fact, experts are tracing the Seattle (and generally, the U.S.) outbreak back to a suburban nursing home.

To properly prepare for and ward off contact with germs, nursing homes and childcare facilities must put the right protections in place. In order to provide residents and children with the level of care they deserve, you need additional sanitizing and precautionary resources.

Transportation & Shipping Companies Seeking Stability

Transportation companies are also facing a significant impact from the coronavirus outbreak. Ports are instituting new screening procedures, which might delay goods from reaching their final destination. This ultimately adds time to the process for truck drivers.

As demand for particular goods increases, shipping companies might face new obstacles. Extra cash on hand could go a long way, especially in hiring additional drivers to handle the increased workload.

Should You Allow Employees to Work From Home?

As mentioned above, many Washington-based tech giants are permitting employees to work from home. Should your small business do the same?

If your business doesn’t require person-to-person contact and interaction, then you absolutely should. While it won’t prevent your employees from contamination altogether, it will prevent your employees from contracting it from each other.

Get Working Capital to Prepare for the Coronavirus Business Impact

The coronavirus spread may not have reached its peak yet, and it could continue to take a toll on the economy. With financing, you can cover any of the expenses that might emerge.

It’s important to act before the economy (or potentially, your business) takes a turn for the worse. Lenders have already tightened guidelines in Washington. They’re funding businesses in other states, but if things continue moving south, they may adjust guidelines for the worse. Alternatively, if sales take a hit, then you may not qualify for the same offers as you do now in a few months.

With a 75+ lender marketplace, National can help your business obtain the financing it needs to survive the coronavirus outbreak.

After filling out a 60-second application, you can learn your options in minutes and get funded in just a few hours. Even with bad credit, our Business Financing Advisors can help you find viable options through our network.

Get started by applying now!

Disclaimer: The information and insights in this article are provided for informational purposes only, and do not constitute financial, legal, tax, business or personal advice from National Business Capital and the author. Do not rely on this information as advice and please consult with your financial advisor, accountant and/or attorney before making any decisions. If you rely solely on this information it is at your own risk. The information is true and accurate to the best of our knowledge, but there may be errors, omissions, or mistakes.