Equipment Financing

Purchase the equipment your business needs and pay over an extended schedule.

Explore equipment financing options with National Business Capital.

Let's Get Started

How Do You Qualify for Business Equipment Financing?

1+ Year in Business

$500,000+ in Annual Revenue

700+ FICO Score

What Is Equipment Financing?

How Does Equipment Financing Work?

Types of Equipment Financing: Equipment Lease vs. Loan

Equipment Financing Terms: How Long Can I Finance Equipment?

What Are the Benefits of Equipment Financing?

Accelerate Your Success With Financing From National Business Capital

What Is Equipment Financing?

What Is Equipment Financing?

Equipment financing is a loan or lease that allows businesses to purchase equipment without paying the full cost upfront. You can use it to buy various equipment, including vehicles, office furniture, and machinery. And as far as what businesses need equipment financing, any business where growth depends on new equipment with steep upfront costs can benefit, like businesses in:

- Construction

- Specialty Trade

- Wholesale

- Manufacturing

- Retail

- Hospitality

- Software

- Medicine

The equipment is typically used as a type of collateral for the loan, meaning you pledge to give up the equipment if you can no longer repay the loan. Heavy equipment collateral loans are strategic options for companies looking to secure high-valued equipment, often representing a steep financial investment.

How Does Equipment Financing Work?

How Does Equipment Financing Work?

Equipment financing is a standard process similar to many common loan applications. There are several steps to note:

- Choose your equipment so you know specifically what you want to finance and how much it will cost.

- Find a lender and apply. Research and compare different financing options available from banks, credit unions, online lenders, and more.

- Get approved and review terms. Once you’re deemed eligible, carefully examine the financing agreement, including interest rates, repayment terms, and any fees.

- Sign the contract and purchase your equipment. The lender will usually pay the equipment vendor directly when you take possession of the equipment.

- Make regular payments until you pay the equipment off.

The most important step in the equipment funding process is finding a lender who can meet your financing needs. If you work with National Business Capital, you can browse capital options from us and our network of lending partners. Plus, you gain access to dedicated support from our team of expert Business Financing Advisors. That way, you partner with the right lender to help you achieve your growth goals.

💡Plan ahead: Check out our five straightforward tips for getting the best heavy equipment financing rates.

Types of Equipment Financing: Equipment Lease vs. Loan

Types of Equipment Financing: Equipment Lease vs. Loan

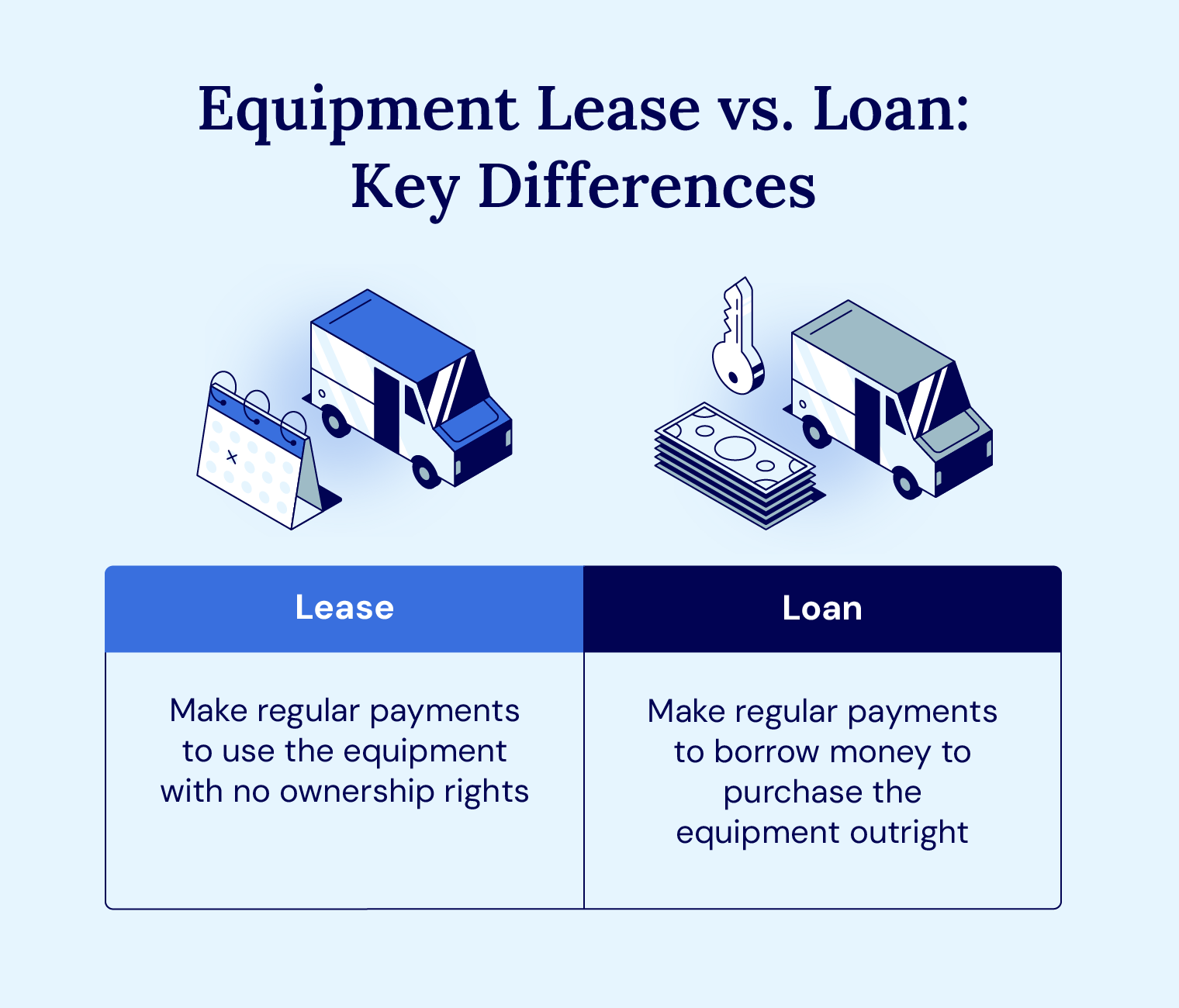

You have two primary options to finance new equipment for your business: leasing and loans. Both provide a way to obtain equipment without a massive upfront investment, but they differ significantly in terms of ownership, payment structure, and tax implications.

- Equipment Lease: This is similar to renting. You make regular payments to use the equipment for a specific period but don’t own it at the end of a lease term.

- Equipment Loan: This is a traditional loan, so you borrow money to finance the equipment purchase outright and make regular payments with interest until you repay the loan.

Business equipment leasing might be a better option for companies that need to upgrade equipment frequently or avoid the risks associated with ownership. An equipment finance loan helps you achieve ownership without the steep cost out of the gate and is an especially good option if you plan to own the equipment for a long time or much of its usable life.

Equipment Financing Terms: How Long Can I Finance Equipment?

Equipment Financing Terms: How Long Can I Finance Equipment?

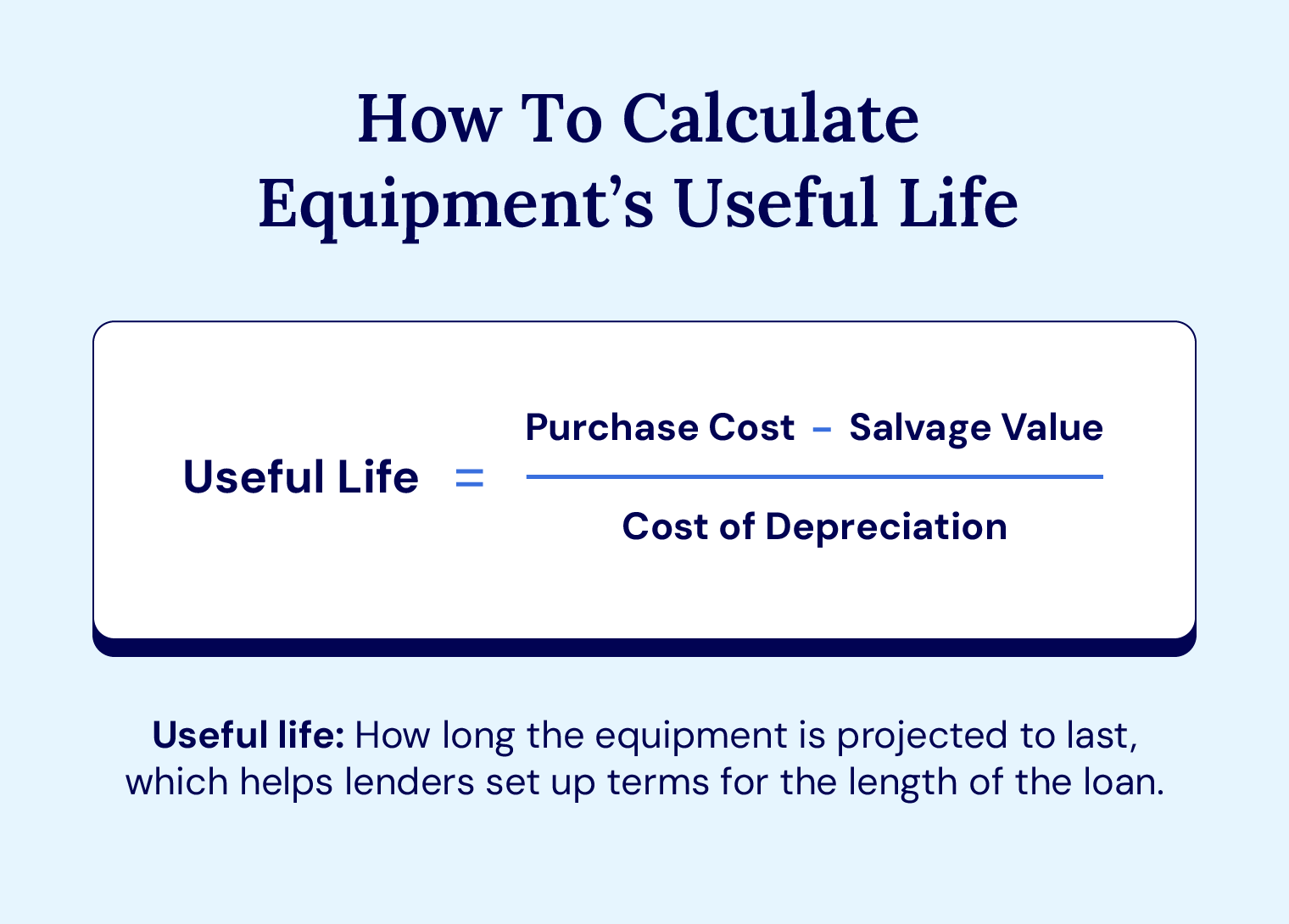

The length of time you can finance equipment varies depending on several factors, including the lender, the type of equipment, and your financial situation. Generally, financing terms range from one to 10 years, with some lenders offering terms as long as 15 years for specific types of equipment.

Repayment terms are often tied to equipment’s useful life, which is how long the asset is expected to last before it’s trashed, sold, or otherwise retired. The repayment term on your business equipment loan is important because it represents how long you’ll be in debt as well as the overall cost of financing.

Longer-term loans feature lower monthly payments but can be more expensive over the loan’s lifetime. Shorter-term loans have higher monthly payments, but you’ll be in debt for less time and save on interest fees overall.

Still, many businesses will select a repayment term based on the monthly payment amount they can afford. Consult with one of our Business Financing Advisors to help you understand which would work best for your scenario.

💡Think long-term: Some industries have specific loan term requirements outside of traditional offerings. According to Matt Presta, Financial Advisor at National Business Capital: “For example, medical practices might look to add an expensive piece of equipment for their growth and want longer terms to pay it off. They should look to find lending partners with specific terms favoring their needs.”

What Are the Benefits of Equipment Financing?

What Are the Benefits of Equipment Financing?

Equipment financing offers many advantages for businesses that need new or updated machinery, vehicles, or technology without depleting their operating capital. Let’s explore some key benefits.

Preserves Cash Flow

Instead of making a large upfront purchase, you can spread the cost of the equipment over time through manageable monthly payments. This frees up your working capital for other essential business expenses, such as inventory, marketing, and payroll, allowing for greater financial flexibility and growth opportunities.

Speeds Up Equipment Acquisition

Financing can significantly expedite the process of acquiring new equipment. Rather than saving up for a large purchase, you can obtain the equipment immediately and generate revenue sooner. This can be particularly beneficial in fast-paced industries where having the latest technology provides a competitive edge.

Creates Tax Advantages

You may be eligible for certain tax benefits depending on the type of equipment financing you choose and your local tax laws. Lease payments are often fully deductible as operating expenses, while loans may allow you to depreciate the equipment over time, reducing your tax burden. Under Section 179 of the US tax code, for example, you’re allowed to write off purchases as business expenses up to $1,220,000 for the 2024 tax year. To grasp all of the tax benefits of purchasing equipment, consult with a tax professional.

Simplifies Equipment Lifecycle Management

Equipment financing can simplify the process of managing your equipment lifecycle. Leasing, in particular, allows you to easily upgrade to newer models at the end of the lease term, ensuring you always have access to the latest technology without the hassle of selling or disposing of old equipment.

Accelerate Your Success With Financing From National Business Capital

Accelerate Your Success With Financing From National Business Capital

Equipment financing is a crucial growth step for most businesses that regularly use expensive equipment. Don’t forego expansion or settle for less-than-stellar equipment because of its cost. Opt to finance the purchase over time to reduce your financial burden and risk.

Find a lender that meets your specific needs after speaking with a Financial Advisor at National Business Capital – and apply now to start the process.

How It Works

You’re only a few clicks away from the capital you need to reach your full potential.

-

1.Apply Securely Within Minutes

Move through our streamlined application within minutes and upload your business documents with zero risk.

Apply Now -

2.Review Your Offers

Compare your offers with expert advice from our team and select the best one for your specific circumstances.

-

3.Get Funded

With your money in hand, you can take advantage of opportunities and tackle challenges with confidence.

Frequently Asked Questions

Is It Hard To Get Financed For Equipment?

It’s not very hard to get business equipment financing. In fact, in many cases, getting approved for business equipment financing is easier than other types of loans. All you need to qualify is a FICO score of 600 or higher, at least 1+ years of business history, and at least $500,000 in annual revenue.

How Long Can You Finance Used Equipment?

You’ll typically be able to finance used equipment for one to five years. If the equipment you are purchasing isn’t too expensive, you may be able to get a shorter-term loan.

What Should I Know About How To Choose an Equipment Financing Loan?

There are several types of equipment financing available, so it’s necessary to identify a business’ needs as well as each lender’s eligibility requirements and costs. Evaluate your specific business needs, the loan eligibility requirements, and the cost of financing. For example, equipment loan borrowers generally pay anywhere from 2% to 20%, but there might also be application fees and origination fees that add to the overall cost.

What Is the Typical Term for an Equipment Loan?

Equipment loans are generally longer term. Repayment ranges from three to five years on average, but some lenders offer prepayment discounts, which allow you to shorten your repayment schedule considerably.

10 Reasons Why National Business Capital Offers the Best Small Business Financing

| Bank | Direct Lenders | ||

|---|---|---|---|

Paperwork |

| Bank

| Direct Lenders

|

Application |

| Bank

| Direct Lenders

|

Number of Lenders | 75+ | Bank 1 | Direct Lenders 1 |

Service Level | Business Advisor | Bank Processor | Direct Lenders Programmatic |

Approval Process | Hours/Days | Bank Weeks/Months | Direct Lenders Days/Weeks |

Speed to Funding | Hours/Days | Bank Months | Direct Lenders Days/Weeks |

Collateral Requirements | Not Necessary | Bank Always | Direct Lenders Sometimes Required |

Business Profitability | Not Necessary | Bank Last 2 Years | Direct Lenders Sometimes Required |

Credit Score | No Minimum FICO | Bank 680+ FICO | Direct Lenders 600+ FICO |

Credit Check | Soft Pull | Bank Hard Pull | Direct Lenders Hard Pull |

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.