Q4 2021 Small Business Growth Index

National’s quarterly report on small business-related economic trends. This report covers small business trends and findings for Q4 2021.

Executive Summary

The National Business Capital Small Business Index Growth Report is a quarterly report on small business-related economic trends. This report covers small business trends and findings for Q4 2021. Research was conducted utilizing open-source intelligence, public databases, and sources such as the Small Business Administration, NAICS Association, U.S. Census Bureau, and other sources.

Insights From Joe Camberato, CEO of National Business Capital

Small Business Insights & Trends

Small Business Administration (SBA) Loans

PPP (Payment Protection Plan)

Unemployment by State

Number of Firms By Industry

Total Amount of Businesses in 2021

Sources

Insights From Joe Camberato, CEO of National Business Capital

Insights From Joe Camberato, CEO of National Business Capital

At National Business Capital, we’re seeing small business confidence reach new heights like never before. Despite a short-lived hiccup at the end of Q4, caused by the Omicron surge, momentum has recovered. January 2022 was one of our busiest months for business financing post-pandemic, it was comparable to pre-pandemic levels.

The overall business financing landscape remains favorable for small businesses. Even though interest rate hikes are on the horizon and it’s becoming slightly more challenging to secure traditional business loans from banks – there has never been a better time to work with fintech lenders and access capital.

Competition in the fintech space remains strong. Lenders are working to attract new clientele and are offering higher funding amounts, longer terms, and lower rates in an effort to secure deals. It’s a great time for small businesses to take advantage of favorable offers.

Nevertheless, small businesses are still facing a variety of challenges – particularly concerning supply chain issues, inflation, and a tight labor market.

When it comes to navigating supply chain issues, it helps to stay ahead. Planning ahead of time can help you avoid delays. Demand was excessively high last year as the economy reopened, but things are expected to cool throughout 2022. Take these factors into consideration to avoid purchasing too much inventory at once. Developments are moving very quickly, so it’s best to reevaluate your needs frequently – on a monthly, or even weekly basis.

Hiring continues to be a challenge, but there are always tools at your disposal. You can make changes to recruiting, advertising, and your company culture. At National Business Capital, we’ve had success in our hiring efforts despite a tight labor market. We recently hosted a webinar for business owners where we shared our insights into hiring – view the webinar here or read the recap here.

“I have a bullish outlook,” explains Joe, “and the business owners we’re speaking to are also quite bullish – which is encouraging. For the challenges ahead, my advice is simple – if you want to have big changes in your business, you need to make big changes. The best business owners are constantly willing to adapt.”

Small Business Insights & Trends

Small Business Insights & Trends

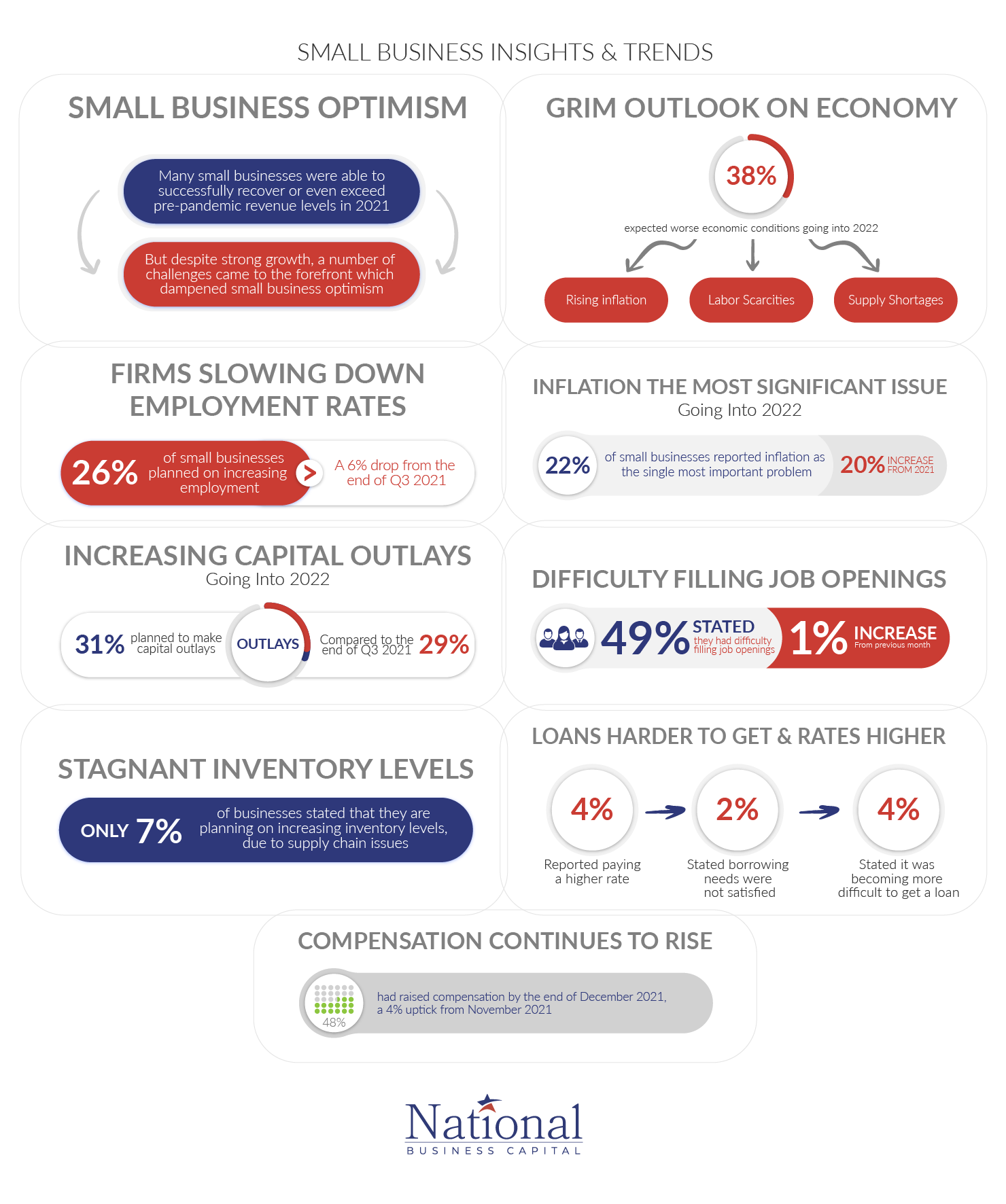

Small Business Optimism

Fueled by a strong economic rebound, rising consumer demand, and ready access to capital, many small businesses were able to successfully recover or even exceed pre-pandemic revenue levels in 2021.

But despite strong growth, a number of challenges came to the forefront. Labor scarcities, rising inflation, and supply shortages continue to dampen small business optimism. Going into 2022, lending markets are now in the midst of a shift, as the Fed considers raising interest rates. Tightening access to capital risks further constraining small business growth.

Firms Slowing Down Employment Rates

Employment rates had been steadily increasing since pandemic lows. But now, momentum appears to be slowing down. Going into January 2022, only 26% of small businesses said they planned on increasing employment, representing a 6% drop from the end of Q3 2021. (1)

Small Businesses Increasing Capital Outlays Going Into 2022

Small businesses are increasingly focusing on capital outlays, or the money spent to maintain, upgrade, acquire, or repair capital assets. At the end of 2021, 31% of small businesses planned to make capital outlays as compared to 29% at the end of Q3 2021. (1)

Stagnant Inventory Levels

The Covid-19 pandemic caused an onset of supply chain disruptions that are still being felt today. Small businesses are continuously feeling the effects, especially when it comes to inventory. Going into the next quarter, only 7% of businesses stated that they are planning on increasing inventory levels. (1)

Small Businesses Have Grim Outlook on Economy

Rising inflation, labor scarcities, and supply shortages continue to weigh on small businesses. In Q4 2021, 38% of small businesses expected worse economic conditions going into 2022 – an increase of 11% from the previous quarter. (1)

Inflation the Most Significant Issue Going Into 2022

Prices are rising faster, and businesses are feeling the heat. At the end of 2021, 22% of small businesses reported inflation as the single most important problem – especially when it comes to operating. This figure represents a 20 percentage point increase in comparison to the beginning of 2021. (2)

Continued Difficulty Filling Job Openings

Businesses continue to have trouble when it comes to hiring and retaining employees. Thankfully, the problem appears to be climbing at slowing rates. At the end of the 4th quarter, 49% of businesses stated they had difficulty filling job openings. This figure represents a modest increase of 1% from the previous month. (2)

Loans Harder to Get and Rates Higher

As inflationary concerns abound, the Fed is expected to raise rates, dampening the business financing industry. It appears many business owners are already feeling the change. 4% have already reported paying a higher rate on their most recent loan, while 2% stated that all their borrowing needs were not satisfied going into 2022. Another 4% of small business owners also stated that it was becoming more difficult to get a loan in comparison to previous attempts. (2)

Compensation Continues to Rise

Rising inflation levels combined with a tight labor market have pushed businesses to increase employee compensation at record rates. Out of small businesses surveyed, a net 48% had raised compensation by the end of December 2021, representing a 4% uptick from November 2021. (2)

Small Business Administration (SBA) Loans

Small Business Administration (SBA) Loans

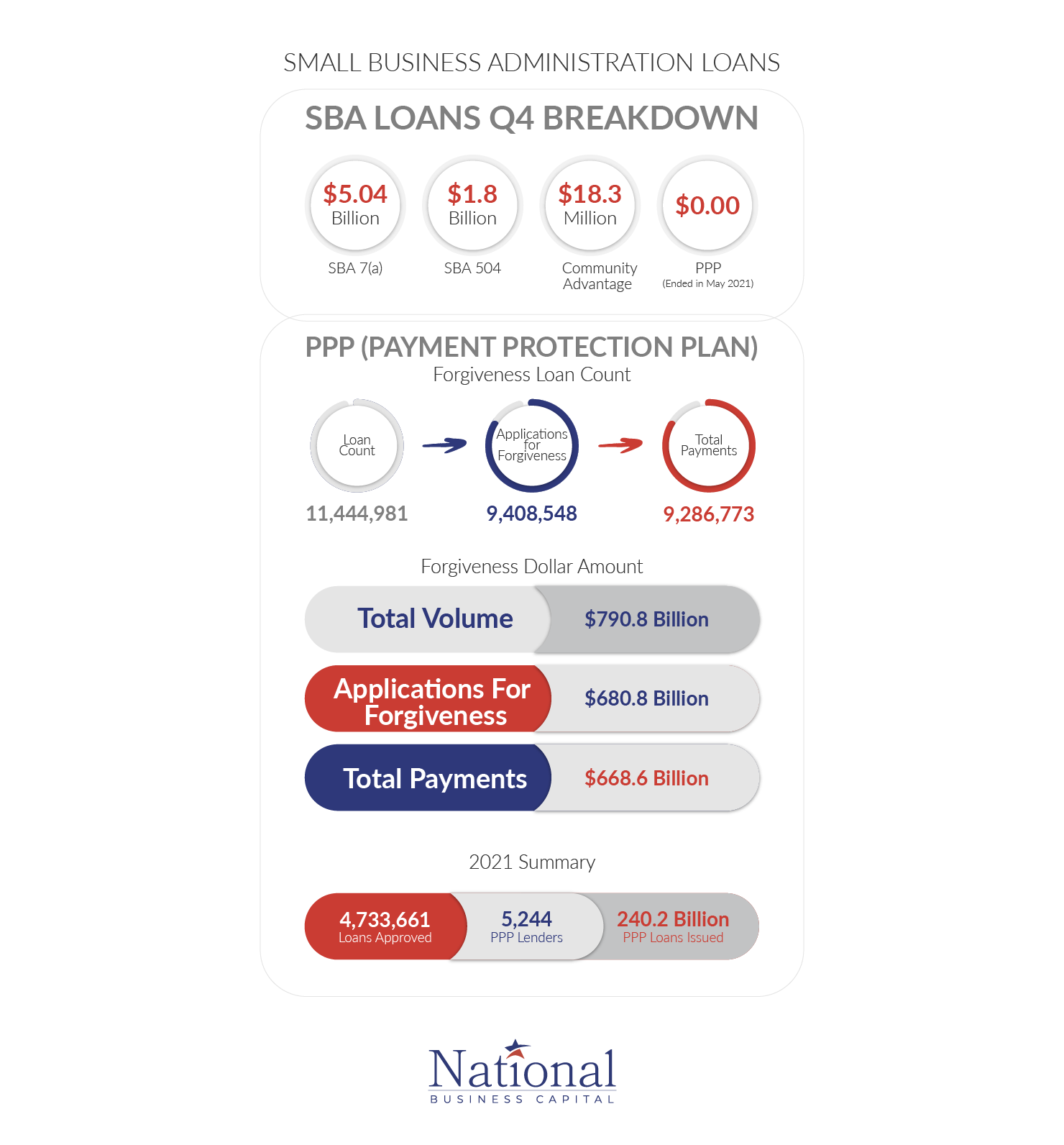

Small Business Administration (SBA) loans are a top financing choice for small businesses. They feature low-interest rates, high funding amounts, long repayment terms, and inherent flexibility.

Businesses must show good credit, two years of business history, and meet the SBA’s size standards in order to qualify for funds.

SBA 7(a) loans

Sba 7(a) loans are one of the SBA’s most popular financing products. SBA 7(a) loans are ideal for financing real estate purchases, short and long-term working capital needs, refinancing business debt, and buying materials, furniture, supplies, and more.

At the end of the 4th quarter of 2021, the SBA approved a total of $5.04 billion in 7(a) loans for the fiscal year. (3)

SBA 504 loans

SBA 504 loans are another popular SBA loan type. They offer long-term, fixed-rate financing up to $5 million in funding amounts for purchasing major assets that promote business growth and job creation. For the fiscal year of 2021, the SBA approved a total of $1.8 billion in 504 loans. (3)

Community Advantage

The SBA’s Community Advantage program aims to provide assistance to small businesses in underserved markets, especially low to moderate-income communities. By the end of the 4th quarter, the SBA granted a total of $18.3 million in Community Advantage loans. (3)

PPP (Payment Protection Plan)

PPP (Payment Protection Plan)

The PPP loans provided critical economic relief for small businesses impacted by the COVID-19 crisis. Although the program ended in May 2021 and PPP loans are no longer issued, many businesses are still taking advantage of the benefits of loan forgiveness. (3)

Forgiveness Loan Count

- Total PPP forgiveness loan count: 11,444,981

- Applications for PPP loan forgiveness: 9,408,548

- Total number of payments: 9,286,773

Forgiveness Dollar Amount

- Total volume: $790.8 billion

- Applications for PPP loan forgiveness: $680.8 billion

- Total payments for PPP forgiveness: $668.6 billion

2021 Summary

- Total amount of PPP loans approved: 4,733,661

- Number of PPP lenders: 5,244

- Net dollars amount of PPP loans issued: $240.2 billion

Unemployment by State

Unemployment by State

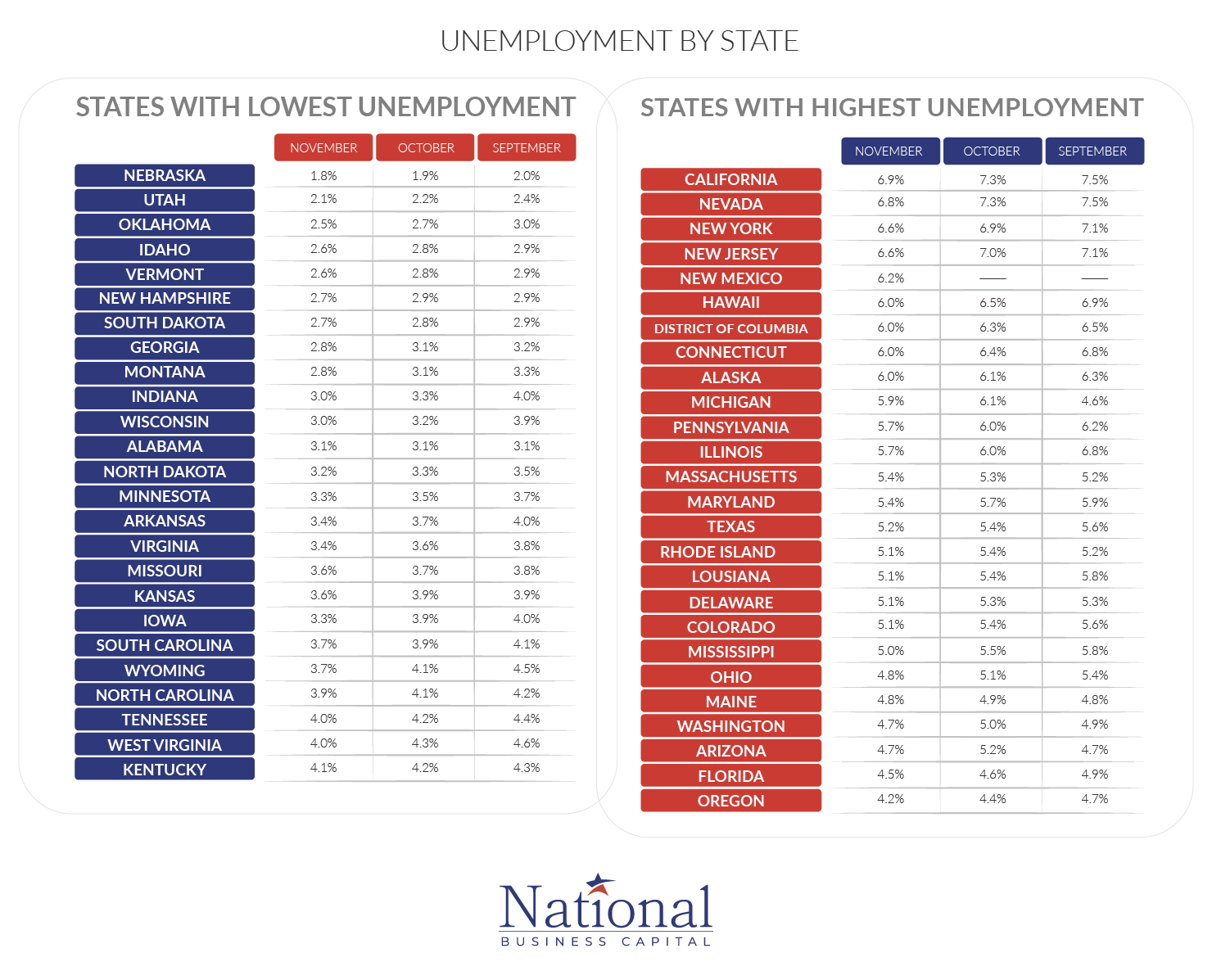

Unemployment rates continue to drop nationwide as Covid-19 infections subside and businesses reopen. In December 2021, the nation’s unemployment rate fell to a pandemic low of 3.9% – representing a 3 percentage point drop from November levels. (4)

Unemployment rates continue to be in a downward trend going into 2022, with many businesses struggling to hire workers. However, the decline is slowing down, suggesting the economy may be nearing full employment.

States With Lowest Unemployment

Nebraska, Utah, Oklahoma, Idaho, and Vermont each reported the lowest levels of unemployment nationwide. Unemployment rates continued on a downward trend throughout Q4. (5) (6)

States With Highest Unemployment

The states with the highest unemployment levels include California, Nevada, New York, New Jersey, and New Mexico. Throughout Q4, unemployment levels in these states continued to drop over time. (5) (6)

Number of Firms By Industry

Number of Firms By Industry

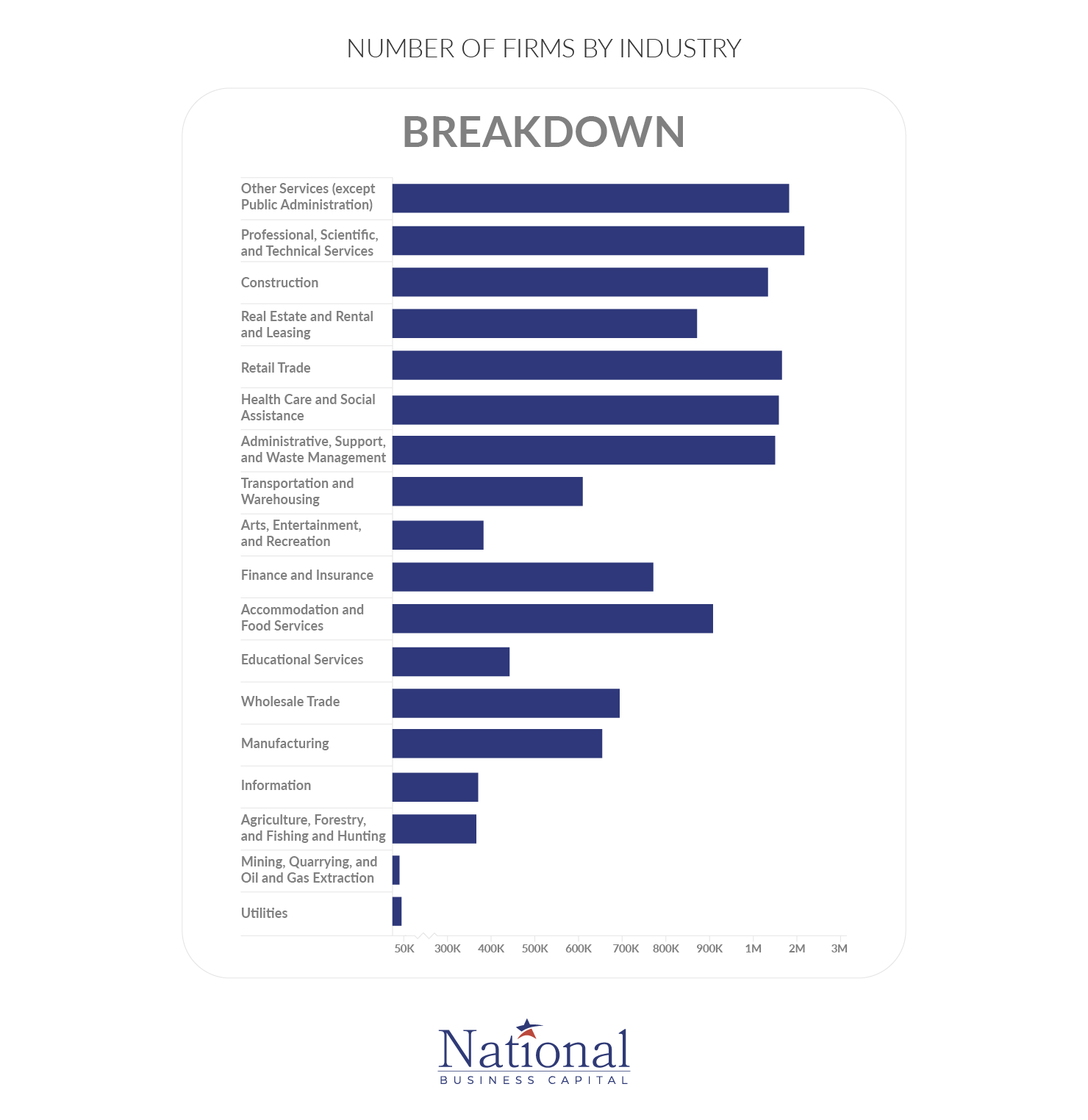

Loosening Covid-19 restrictions, access to capital, and strong consumer demand fueled economic recovery for many industries in 2021. For 2022, the industries poised for growth include technology, professional services, manufacturing, and hospitality. (7)

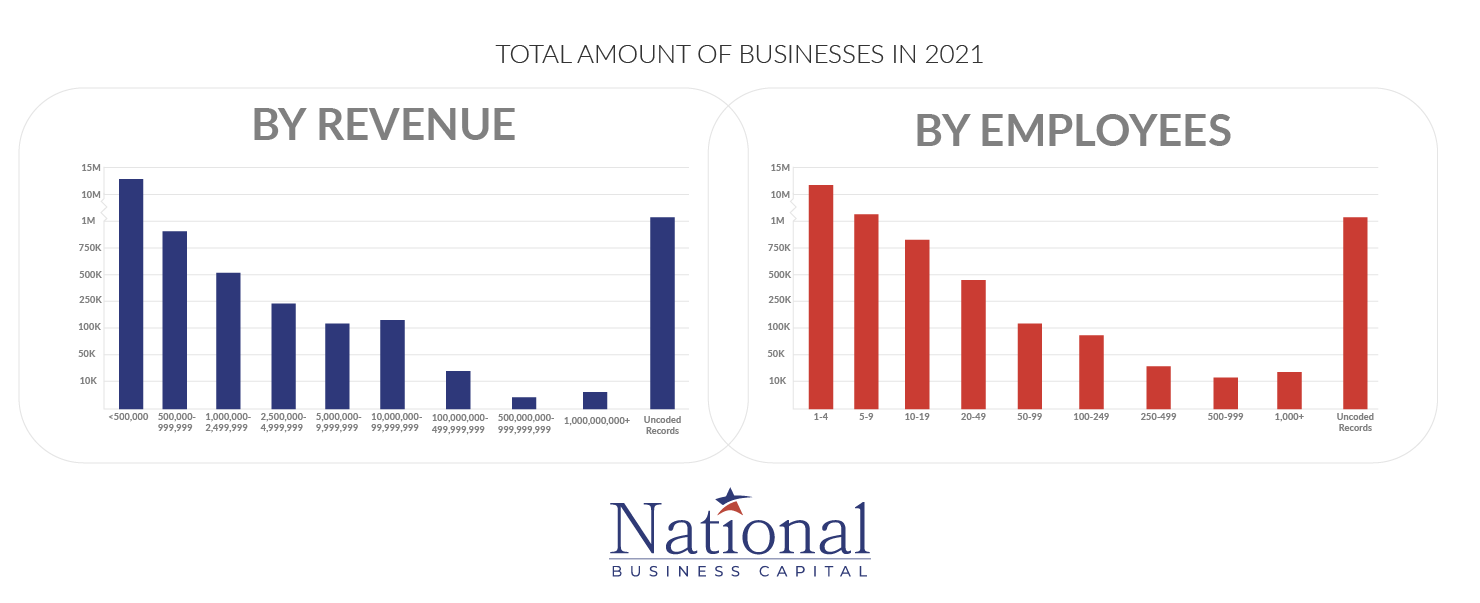

Total Amount of Businesses in 2021

Total Amount of Businesses in 2021

The U.S. economy had a strong recovery throughout 2021. In the final three months of the year, the economy expanded by 1.7% after adjusting for inflation. (8) Despite the uncertainties going into 2022, small businesses are expected to grow at a healthy rate.

Much will depend on how individual entrepreneurs navigate certain challenges, such as rising inflation, higher interest rates, supply chain disruptions, and a tight labor market. Companies that adapt quickly will be in a stronger position than their competitors. Technology and AI tools, strong company culture, and thoughtful planning can help firms succeed in 2022. (7)

Sources

Sources

- https://www.nfib.com/surveys/small-business-economic-trends/

- http://SBA.gov

- https://apnews.com/article/coronavirus-pandemic-business-health-consumer-spending-inflation-97634d0ba6a63c74b79ea10d5540ae28

- https://www.ncsl.org/research/labor-and-employment/state-unemployment-update.aspx

- https://www.bls.gov/web/laus/laumstrk.htm

- https://www.commerce.gov/

National Business Capital

Accelerate your success with frictionless financing and expert advice that breaks down the barriers to growth for every entrepreneur.

Thrive with access to a business lending marketplace that’s built for entrepreneurs, by entrepreneurs. Experience a time-saving machine that cuts approval times from months to hours. Leverage an extensive network of over 75 lenders and teams of expert financing advisors to ensure you’ll always have access to the capital that best fits your business.

Working with NBC, gain a financing partner for the future, ensuring your business has the capital it needs to seize every opportunity and grow without limits.

National Business Capital. Grow to Greatness.

Ready to See Your Options?

Go from application to approval in hours, not days, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.