Business Line of Credit

A business line of credit offers access to capital as needed, where you only pay interest on what you withdraw.

Let's Get Started

Qualifications for a Business Line of Credit

1+ Year in Business

$500,000+ in Annual Revenue

What Is a Business Line of Credit?

How Do Business Lines of Credit Work?

Business Lines of Credit vs. Business Loans

Secured vs. Unsecured Lines of Credit

How To Apply for a Business Line of Credit

How It Works with National Business Capital

What Is a Business Line of Credit?

What Is a Business Line of Credit?

A business line of credit is a type of loan that gives you flexible access to cash on an as-needed basis. It’s often a revolving line of credit, and you can withdraw cash from your total credit limit for any business purpose – and only pay interest on what you use.

More cash will become available as you pay down your balance. Business lines of credit are ideal for small business owners who want to keep ownership and control. They can be used for emergencies or any other business-related purpose.

How Do Business Lines of Credit Work?

How Do Business Lines of Credit Work?

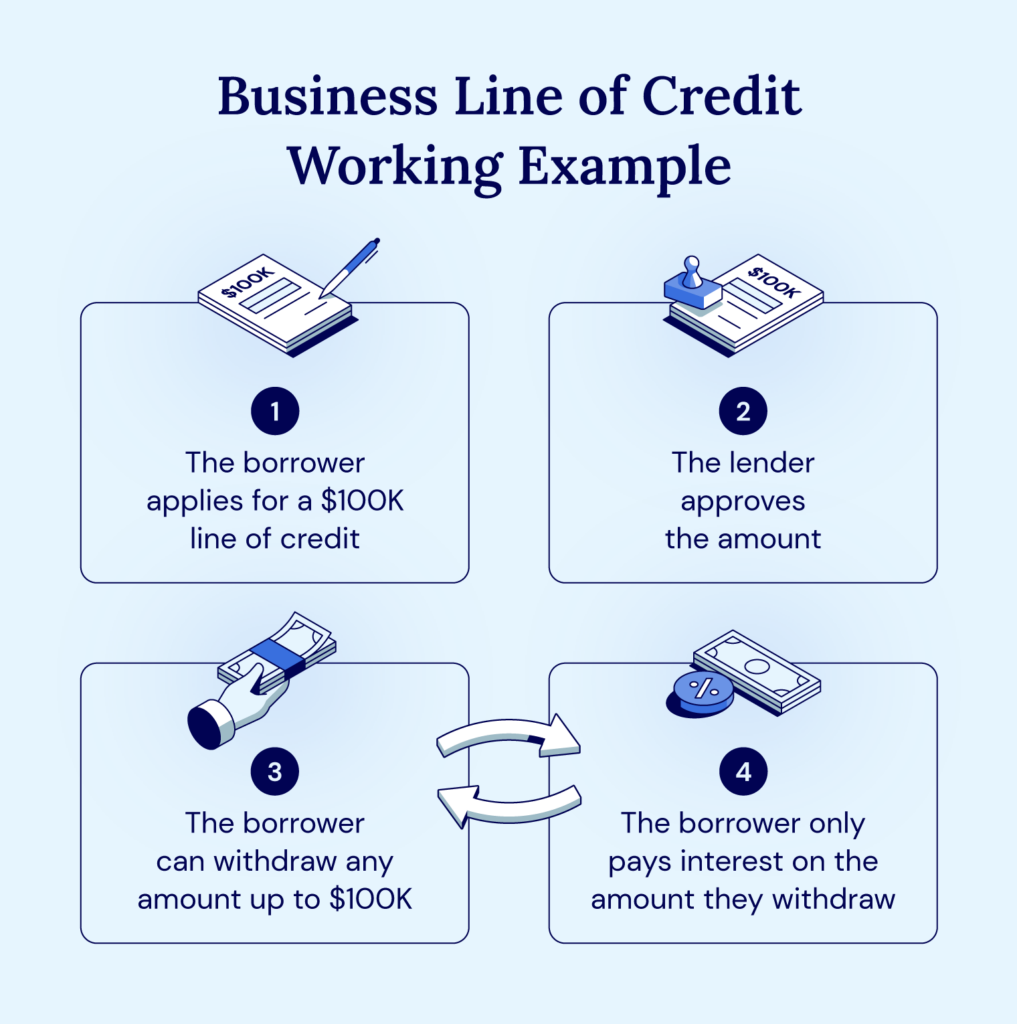

Business lines of credit function more similarly to credit cards than other types of term loans — but you can write off interest on lines of credit come tax season.

You’ll receive a total credit limit after qualifying for a business line of credit. You can transfer any amount you need online from your credit line to your business bank account in any number of installments for fast business financing. You’re also under no obligation to use the full amount.

You can continue to access additional cash as long as unpaid withdrawals stay under the credit limit. Instead of paying interest on the entire credit limit, you’ll only pay interest on what you take.

Before signing an agreement, ask for clear information about any fees, such as non-utilization fees, if you don’t use the credit line. Avoid any agreements without clear, transparent information.

Remember: The best small business line of credit is one that fits your business and where it’s headed. Choose an experienced and trustworthy lender who can help you achieve your business’s goals.

Business Lines of Credit vs. Business Loans

Business Lines of Credit vs. Business Loans

What’s the difference between a line of credit vs. a small business loan? Both give your business the cash you need to grow, but how these products are structured differs.

Business Lines of Credit:

- Can be revolving credit

- Draw funds in any amount you’d like, up to the entire loan amount

- Only pay interest on withdrawn funds

- Typically include higher interest rates and lower closing costs

Business Loans:

- Installment credit

- Funding amounts are generally higher

- Receive the loan in a lump sum deposit

- Pay interest on the entire loan amount

Secured vs. Unsecured Lines of Credit

Secured vs. Unsecured Lines of Credit

A business credit line can be secured or unsecured, depending on whether your lender requires you to put up collateral.

A borrower offers collateral as security to the lender if they default on the loan. For example, if you were to secure your credit line equipment or property, that asset would become the collateral. If you were to default on the loan, the lender has a legal right to seize the collateralized assets to recoup the unpaid amount.

Secured Lines of Credit:

- Backed by collateral

- Higher credit limits

- Lower interest rates

- The lender can seize the collateral if the borrower defaults on payments

Unsecured Lines of Credit:

- Not backed by collateral

- Higher interest rates

- Lower credit limits

- More stringent qualification process

Remember that using your home as collateral for a secured business line of credit is against the line of credit best practices. It risks your personal and business life, so it’s usually not a wise choice.

How To Apply for a Business Line of Credit

How To Apply for a Business Line of Credit

There are slightly different application processes for business lines of credit depending on your lender, the type of line of credit, and more. But the basic application process typically goes like this:

- Gather documentation.

- Submit applications for a few different business lines of credit lenders.

- Review and compare loan terms.

- Select your ideal option.

As for documentation, here’s what you’ll usually need:

- Driver’s license

- Business bank statements (going back at least one year)

- Business credit score

- Financial statements

- Time in business

- Proof of ownership (K1, schedule C, EIN, certificate of corporation, etc.)

- Business tax returns

- Collateral (if secured)

- Cash flow statement

- Business plan

These are the most common application requirements, but it’s not an exhaustive list.

Applying through National Business Capital can simplify this process — you can learn more about your options from our team of expert advisors with only one application.

Banks and credit unions typically have more aggressive and demanding qualifications, so these lenders can be more difficult for applicants with less-than-stellar financial histories. But these aren’t your only options.

National Business Capital focuses on your business performance and opportunity for success over traditional factors like history and credit. Applying and qualifying for the best business line of credit can take some effort, but it’s not complicated or time-consuming with our help.

How It Works with National Business Capital

How It Works with National Business Capital

You’re only a few clicks away from the capital you need to reach your full potential.

Apply Securely

Move through our streamlined application and upload your business documents with zero risk.

Review Your Offers

Compare your offers with expert advice from our team and select the best one for your specific circumstances.

Get Funded

Seize the opportunity to grow your business or confidently tackle a new challenge.

We educate you on the best options available within our platform to ensure you get the best line of credit available.

Lowest Rates, Longest Terms, & Highest Amounts

Line Amount

$100,000 to $10 Million

Revolving

Draw funds on an as-needed basis

Time to Fund

24 to 48 Hours

Frequently Asked Questions

Is It Hard To Get a Business Line of Credit?

If you have a solid financial history, it shouldn’t be difficult to get a business line of credit, especially through a private credit lender or a small business lender. However, getting approved by a bank or credit union is typically more difficult.

Can an LLC Get a Business Line of Credit?

Yes, an LLC can get a business line of credit just as any other business would.

How Does a $100,000 Line of Credit Work?

If you have a $100,000 line of credit, you can borrow any amount up to $100,000 at a time from your lender. For example, if you need to rent a new office space, you could withdraw $25,000 and only owe interest on the $25,000 withdrawn.

Secure the Best Business Line of Credit in 2025

| Bank | Direct Lenders | ||

|---|---|---|---|

Paperwork |

| Bank

| Direct Lenders

|

Application |

| Bank

| Direct Lenders

|

Number of Lenders | 75+ | Bank 1 | Direct Lenders 1 |

Service Level | Business Advisor | Bank Processor | Direct Lenders Programmatic |

Approval Process | Hours/Days | Bank Weeks/Months | Direct Lenders Days/Weeks |

Speed to Funding | Hours/Days | Bank Months | Direct Lenders Days/Weeks |

Collateral Requirements | Not Necessary | Bank Always | Direct Lenders Sometimes Required |

Business Profitability | Not Necessary | Bank Last 2 Years | Direct Lenders Sometimes Required |

Credit Score | No Minimum FICO | Bank 680+FICO | Direct Lenders 600+FICO |

Credit Check | Soft Pull | Bank Hard Pull | Direct Lenders Hard Pull |

Accelerate Your Success

Seize the opportunity to grow your business and gain access to the capital you need.